The Fed cut rates yesterday by 50 bps. It was a move expected but not between meetings of the FOMC. Such a rush sent the wrong signals, generated some panic (“they know something”), misfired, undermined credibility, and limited its ability to act when the next downturn comes.

Initially, when the cut was announced the market reversed its downward trend, but when the dust settled and investors digested the Fed’s subliminal message (or what was perceived as a subliminal message), the market turned not just negative but also deteriorated more than its downward trend before the cut!

We are wondering if the Fed is pushing itself into a corner.

- It is a well-known fact that central banks cannot target rates and money supply at the same time. We are afraid they are falling into this trap.

- Moreover, it seems that Fed officials capitulated to politics and forgot a fundamental lesson: real things affect real variables (e.g. productivity rate affects income & growth); monetary things affect monetary variables (e.g. cutting interest rates could affect – if rates are normal – monetary variables such as money demand). However, rates are not normal nowadays and hence rate cutting cannot have but a temporary – if that – effect.

- Finally, today’s cutting created a feeling of panic. Rates were too low to make a difference.

By doubling down on their Put, Fed officials are targeting the stock market, but the latter is not the economy. So, we are wondering again if at this stage we are facing a trilateral dilemma:

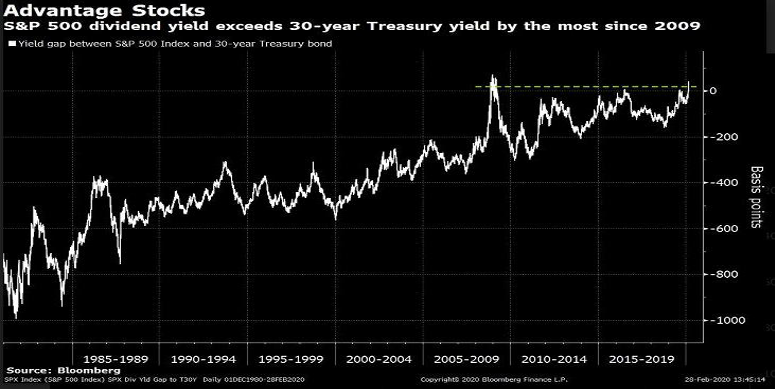

- Could it be that by some measures – such as the low rates – the case can be made to buy stocks (when discounted their fair value increases given the lower rates) as well as given the fact that the S&P 500 yields more than the 30-year Treasury? (See also graph below).

- Could it be that a panic emerges that takes us to a bear market, given that Fed’s action may have misfired?

- Could it be that we are facing something unique that will change our way of life?

We are of the opinion that the direction we are headed is based upon the realization of assumptions made. If the assumption that the number of Covid-19 cases doubles every 7 days, then any complacency is delusional and we would have in our hands a health care crisis (let alone a pandemic) where shortages – including medical shortages – will be part of everyday life. That would result in a recession and a bear market. An exponential growth – which of course at some point will stop being exponential – could have devastating results, especially if we consider the fact that less developed nations won’t be able to respond to the crisis with the effectiveness that more advanced nations can.

If on the other hand, we are facing a normal bell-shaped event, then Covid-19 will be phased out with slower growth and effects which in the short-term may be pretty bad but see a bounce in both economic activity and market reversal in the medium term.

In either case, we believe that having 6-8% of precious metals in a portfolio may be a wise choice. This is because rates are so low and possibly heading lower, as well as due to the fact that the anchor role of precious metals tend to rise in the midst of fear, panic, and volatile markets.

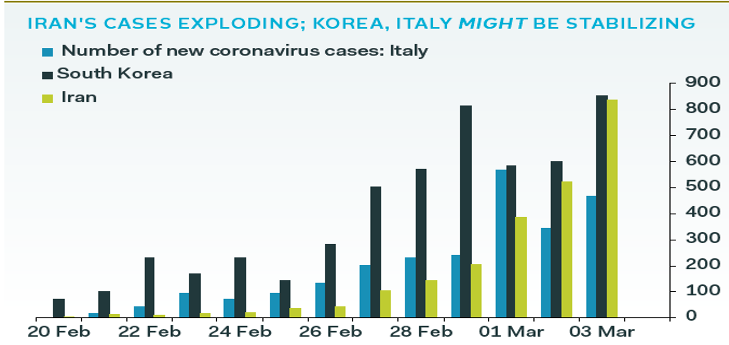

Having said that, when we look at the numbers i.e. growth rate of cases (assuming that we can trust those outside the US and the EU), we have a cautiously less pessimistic view, which may be supporting a case of slower growth (see graph below).

Source: Pantheon Macroeconomics

If that turns out to be the case, then opportunities will arise to buy some good names at lower valuations. Of course, such buys need to be executed with caution and possibly in at least 2-3 tranches.

In conclusion: Cutting rates can neither solve the Covid-19 crisis, nor address its economic consequences. Potentially helicopter money can do a better job (it doesn’t necessarily mean that we support it). Enhancing the portfolios with precious metals is wise. Buying Treasuries at this stage may not be wise (given how low the rates are). Opportunities may be arising and adding good names – while the market goes into reverse mode – might be wise.