Composite models that assess the risk of a recession in the next 12 months indicate that the probability of a recession happening in the next 12 months has fallen slightly. However, such reading in our humble opinion is mistaken due to a false positive signal related to the term premium on bonds, and therefore our opinion is that the probability of recession has actually increased but remains below 35%. However, before we explain the sentence above allow us to take you back to 1953 when Vercors (the pseudonym for Jean Bruller who worked in the French Resistance) published his novel titled “You Shall Know Them”, which is an attack on racism as the latter was unfolding.

Here is what the novel is about: In the 1950s a team of British scientists set out for New Guinea hoping to discover an unknown great ape fossil. By sheer chance they come upon an entire colony which they call ‘Tropis’. These are monkeys that bury their dead. Moreover, the Tropis seem to speak a rudimentary language. Hence the obvious question: Where do they sit on the imaginary ladder between animals and humans? The answer to this question becomes urgent when an unscrupulous businessman plans to domesticate the Tropis in order to make slaves of them. The hero of the novel gets a female Tropi pregnant and decides to kill the child once it is born in an attempt to force the law to make a decision. A legal case gets underway which grips the world’s press. The most eminent specialists are summoned from biologists, to philosophers, and theologians. At last the judge’s wife comes up with the decisive criterion: If the Tropis bury their dead, they must be human since this ritual indicates a metaphysical awareness of reality.

The animal is one with nature; whereas humans and nature make two, hence distance from nature is one of the most important criteria. Distance from nature enables humans to engage with the history of culture and not be mere hostages of nature. This distance enables us to interrogate reality, to transform the world, to engage in debates, to invent ideals, and to distinguish between good and evil. From that point on, the dominant ethical system of Immanuel Kant came into being.

If distance from nature is a key criterion, then in the investment world distance from natural equilibria could also serve as a key criterion for decision-making process in portfolio construction, hedging, and necessary adjustments. Take for example the credit spreads: We all know that rising spreads between junk bonds and Treasuries and/or between junk bonds and investment-grade bonds is a clear signal of trouble down the road. Similarly, deviations from natural interest rates (even when the latter are adjusted for extraordinary circumstances) signify trouble down the road.

Furthermore, outrageous CAPE ratios which are far from the historical average reflect bubbles which always burst. Moreover, valuations of new IPOs – let alone of unicorns – that are out of this world simply imply that the new normal is not normal at all. Of course, negative interest rates and the $15 trillion worth of bonds with negative yields – which guarantee that the investor will lose money if the bonds are held to maturity – are prime examples of significant distance from nature.

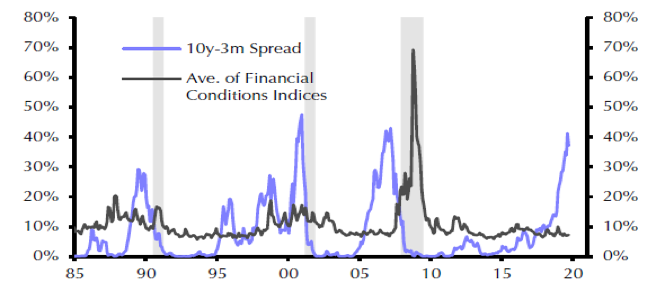

There is no metaphysical reality in the markets, but the distance we are creating from natural equilibria (including permanently rising deficits and the urge to monetize them) is becoming more dangerous as time passes. Not experiencing a mild recession and especially being fearful of that also signifies rising distance from the natural order of things. Therefore, the markets seem to rejoice when they hear that the chances of recession are dropping when the latter is nothing but a false positive signal. Specifically, the models rely heavily on the difference between the yield of the 10-year Treasury Bond and that of the 3-month Treasury Bill. The accompanying implied adjustment to the inverted yield curve (which by itself is abnormal) is the positive false signal, especially when we take into account other recent news such as lower consumer spending and declining capital expenditure along with declining business confidence.

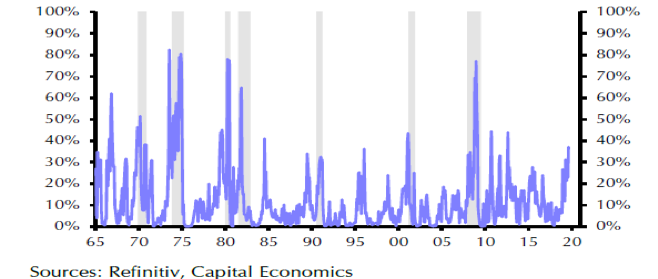

We believe that the probability of recession is rising as shown by the two graphs below. The first shows the spread between the 10-Year Treasury and the 3-month TB, and the second estimates probability of recession based on ISM new orders.

Source: Capital Economics

In closing, allow us also to emphasize that there is another pretty troubling indicator which also enhances the probability of recession: While all the emphasis has been on the damage inflicted on the goods traded due to the trade war, little emphasis and attention has been placed on the declining exports of services. Services account for over 30% of US exports and their decline is a deviation from the natural order which is a rising surplus in traded exports. This decline is approaching the decline we experienced during the financial crisis.

Happy hedging!