We live in an environment where the markets strive to remember, but forgetting might be preferable as it brings relief. It’s the twilight zone where the voice of silence carries a laughter that makes you cry. You want to take a deeper look but are terrified of what might be revealed. The 20/20 vision is blinding the horizon. While seeking truth, the feeding of lies and illusions feels uplifting. It’s the environment where joy converts to grief, where wholeness is nothing but brokenness.

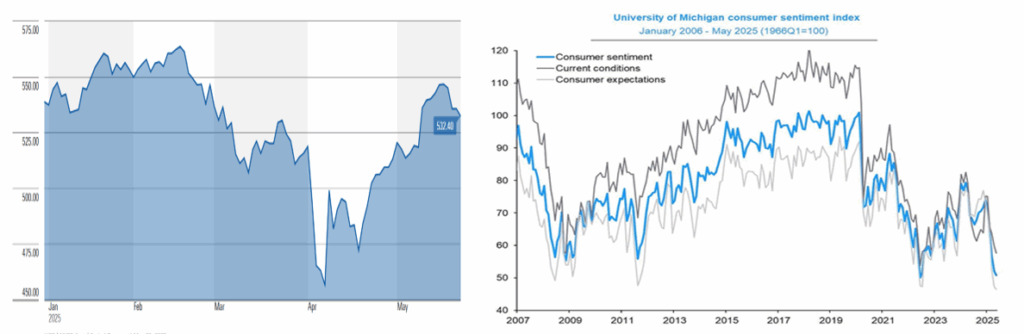

Welcome to market oxidation where victory (market recovery following the drop of +12%, see left panel below reflecting the S&P 500) feels like defeat due to corrosion (declining confidence and sentiment, as shown in the right panel), and where someone must consult Euripides (the master of mixing realism and illusion) before designing and executing an investment and trading strategy.

In his play titled Alcestis, Euripides inaugurated a new kind of performance where tragedy meets comic reality. In that play, King Admetus seems scandalously unheroic and comic as he wants his wife Alcestis to take his place when Thanatos (death) arrives. Alcestis agrees to sacrifice herself, but when Thanatos arrives, Heracles (Hercules) rescues her and reunites the tragic Alcestis with her comic husband Admetus. Admetus’ kingdom was corroded, and going forward, oxidation made it irrelevant.

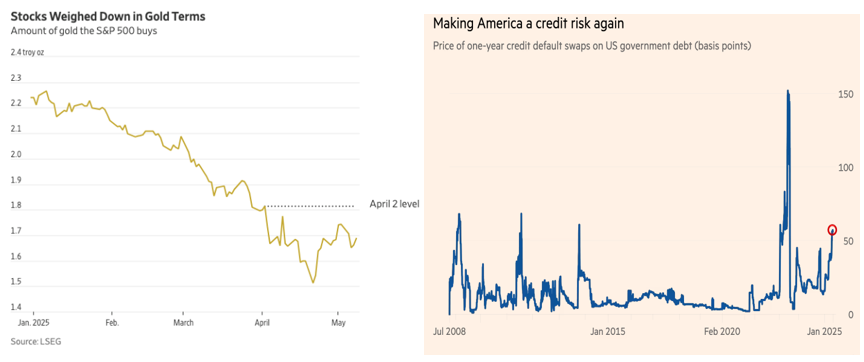

In the last few days, S&P Global’s Capital IQ model revealed that credit markets are currently pricing 6 notches of downgrades for US sovereign credit ratings, from Aa1 to BBB+. That’s tragic, but it makes you wonder if smiling is the proper response when you hear lawmakers arguing that by adding to the deficits, the debt burden will be reduced. Who is Alcestis, and who is Admetus in our trajectory? We need Euripides to straddle the line between what is theatrically compelling and what is believable.

The degradation of standards (from education to ethics and professional competence) accompanied by overextension of credit have thrown the markets into a position of an unstable state that desires to be loved but also feared, as thriving innovations illuminate delusions and speculations, while macro and idiosyncratic fundamentals spell out caution, and red flags are raised. Oxidation corroded the moral authority of Admetus, and market oxidation corrodes the foundation of value in the markets.

The S&P 500’s performance vs. gold is one of those cautionary signals the market is sending. Since Liberation Day, the index buys about 15% fewer ounces than at its February peak. With consumer prices threatened by sustained levies and inventory pressures, and economic growth projections downgraded, the risk remains that this rally overshoots the fundamentals and gives way to renewed volatility. The graphs below are indicative of gold smiles in times of rising indebtedness that force long-term rates in an upward trajectory.

In Medea, Euripides describes the oxidation that takes place when grief and rage dissolve into a mythic act of revenge and hate. Medea was the daughter of King Aeetes of Colchis in the Caucasus. For the sake of helping Jason get possession of the Golden Fleece, she abandoned her father and murdered her brother. Once Jason seized the Golden Fleece, she accompanied him in Corinth, became Jason’s wife, bore him two sons, and arranged the death of his rival uncle Pelis (King of Iolcus). However, Jason desired to marry the Corinthian King’s daughter (Creusa) and started ostracizing Medea as a foreigner who didn’t belong in the Corinthian kingdom. The Corinthian King Creon ordered Medea’s expulsion and banishment. While Medea is offered refuge in Athens by the Athenian king, she secretly stayed in Corinth and succeeded in assassinating King Creon, his daughter Creusa, and also killed her own two children. Vengeance against Jason became poisonous and indiscriminate hate. At the end of the play, her grandfather Helios (the Sun-god) rescues Medea while Jason is left vainly lamenting her cruelty.

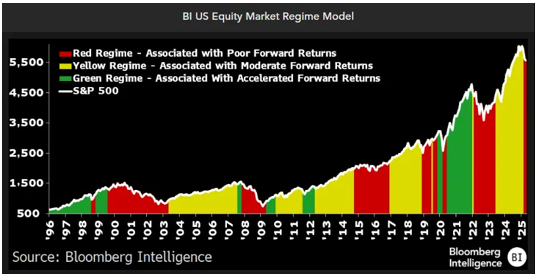

Medea’s oxidation could resemble the market theme of overvaluation where the passion for new tech is transformed via dramatic internal conflicts, in a play where Jason’s smug, snobbish and ungrateful behavior weaponizes Medea’s savagery (we have seen that play in the late 1990s and early 2000s when Nasdaq lost more than 50% of its value). Bloomberg’s Intelligence Unit has a proprietary equity model that turned red (see below), signifying that a Medea risk is rising, threatening a moderate forward return to a state of losses and poor performance.

Medea’s transformative oxidation continues as a theme in Euripides’s play titled Bacchae, where a rational order is overwhelmed by Dionysian delusionary frenzy (any resemblance or implication for cryptos is just coincidental). Unfortunate choices are undermining global stability and the role of the dollar. Accelerated de-dollarization driven by policy shocks and structural shifts could raise long-term U.S. borrowing costs by 50–100 basis points above current levels and erode the dollar’s role. The potential further decline of the dollar, triggered by erratic U.S. policies and global investor anxiety, risks destabilizing not only the U.S. economy but also the broader global financial system through rising inflation, reduced investment, and declining trust in American institutions.

The Bacchants were Asian Maenad women (the chorus in the play) who were attendants of the god Dionysus (Bacchus), who decided to return from Asia to his native Thebes. Agave – the mother of King Pentheus – and her sisters had initially refused to recognize Dionysus’s divinity. However, the frenzy around him overwhelmed them, and Agave led a whole group to become faithful devotees of Dionysus, dedicating themselves to his worship at Mount Cithaeron. King Pentheus’ calls for reason went unheeded, and amid the frenzy surrounding Dionysus’s worship, even his imprisonment turned on its head. Pentheus is persuaded by Dionysus to visit Mount Cithaeron, where his mother, Agave in her madness, led the Maenads to the killing of her son, King Pentheus, whom they perceived to be a lion.

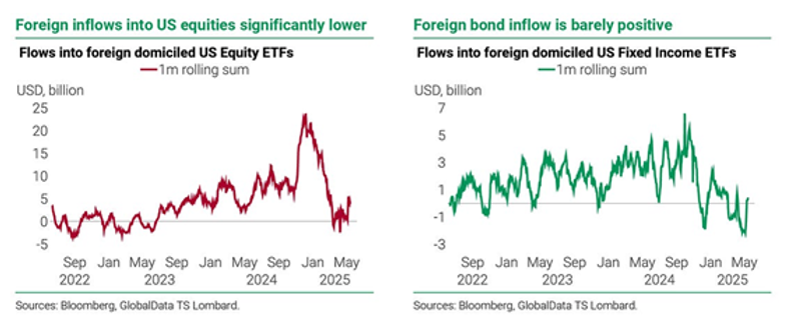

The ongoing shift away from U.S. dollar-denominated assets (see graph below) by large institutional investors, such as pension funds, could signal the start of a significant, long-term reallocation of global capital that could have major implications for the U.S. dollar, equity, and bond markets.

The reversal of a decades-long trend of strong inflows into U.S. assets could signal a broader, structural shift in global capital flows. Notably, European pension funds, such as those in Denmark and Finland, have reduced their U.S. equity holdings in favor of European stocks, marking the largest purchase of European shares since 2018. The potential for sustained capital outflows from the U.S. could pressure the dollar further. If European investors were to hedge $2.5 trillion in currency risk on their U.S. assets, this could further weaken the dollar. Who is the Dionysus who leads that dance?

Asia’s adoption of non-dollar transaction networks threatens to displace the dollar’s role in approximately 14% of daily foreign-exchange turnover, potentially triggering up to a $2.5 trillion wave of dollar divestment over the next several years. Banks and brokers across Asia report a 30–50% year-to-date increase in client requests for currency derivatives and hedges that bypass the dollar, and instead are routing trades through the euro, yuan, Hong Kong dollar, and Emirati dirham.

Euripides is not a prophet. He simply knows that Dionysus is devilish, representing an incomprehensible delusion that the people chose to worship. Ignoring the orgiastic forces is at the peril of someone’s temporal prospects, however, the adoption of lies and delusions dissolves the bonds of society and undermines the functioning of the polis’ institutions. King Pentheus refused to come to terms with the irrational. Dionysus offered ecstatic irresponsibility, and those who bought into that illusion deceived themselves and betrayed their destiny and the destiny of myriads of others.

The power play between tragedy and comic characters reinforces the power of each opposite pole and reflects the current market experience where fundamental forces dance around illusory shocks of policy and policy pivots. The affront of illusions risks corroding sentiment and oxidizing investors’ confidence in a similar way to Euripides’ characters losing themselves in the frenzy of divine trickery. Just as Euripides demands that theater must weave believable human struggle with its necessary theatrical artifice, markets under current conditions require investors to navigate between real (data‑driven) analysis and the illusions of headline‑grabbing proclamations. Success lay in finding the “golden medium” between overreacting to every tweet (illusion) and dismissing the undercurrents of policy shifts (realism)—a balance as delicate and dynamic as any Euripides’ tragedy.

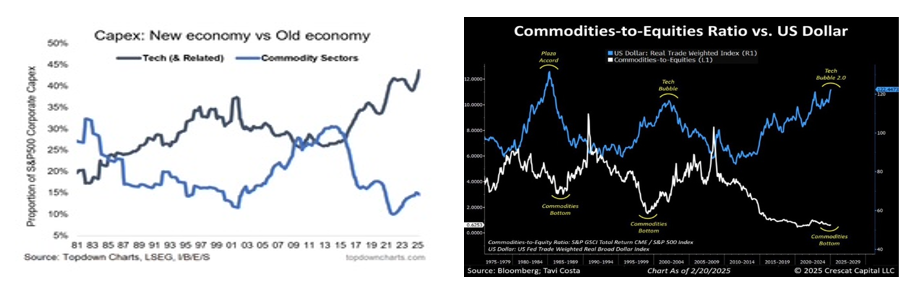

As I was about to put in the closing sentence, I saw Euripides (the most tragic of poets according to Aristotle) standing at the trading pit, pointing out the following two graphs:

“We are all for the new tech and capital investments in the emerging technologies, but where are the materials to build the data centers as well as the other necessary structures, and how are you going to wire the new products and services if you run out of the necessary ingredients, let alone allow your system to navigate the new waters without an anchor?” Euripides asked and then shouted: “How does all this relate to my play Iphigenia in Tauris?