With very little doubt the good earnings growth has uplifted and sustained stocks to high levels. At the same time, good economic growth has uplifted consumer and business confidence levels and has advanced spending. The main question at this point is that if such advances can be sustained in the future given market valuations, geopolitical gyrations, trade tensions, and currency misalignments.

Before we proceed with our analysis regarding the earnings trajectory we should state our concerns about the rising tensions between the White House and the investigation led by Special Counsel Robert Mueller. While it is unlikely that an indictment will be issued, if the Special Counsel’s report indicates that obstruction of justice has taken place along with additional wrongdoings, then such report will go to Congress for action and/or a grand jury will be convened. That spells significant political turmoil which has the potential to shake up the market.

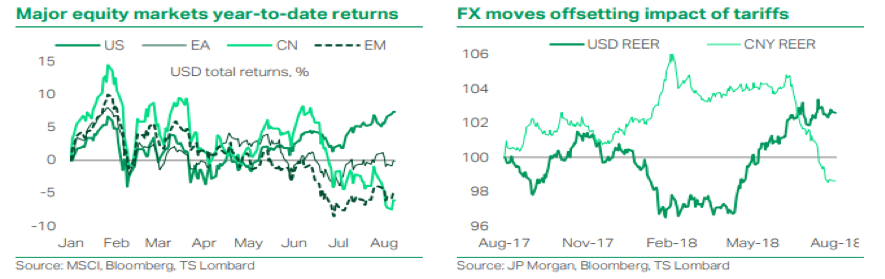

The first graph below shows us that it is only the US markets that have experienced positive returns this year, while European (EA), Chinese (CN), and Emerging Markets (EM) are all in negative territory for the year. At the same time, the Chinese markets’ significant decline of over 20% along with the trade tensions have forced Chinese authorities to design strategies that could offset those developments as well as the declining growth rate. Such strategy is reflected in the depreciation of the renminbi, as shown below.

We should also note that the Chinese response to such developments could be asymmetrical in the form of retaliatory tariffs, currency devaluation, bilateral agreements, bond dumping, investment restrictions, retaliatory actions against US companies operating in China, and other measures.

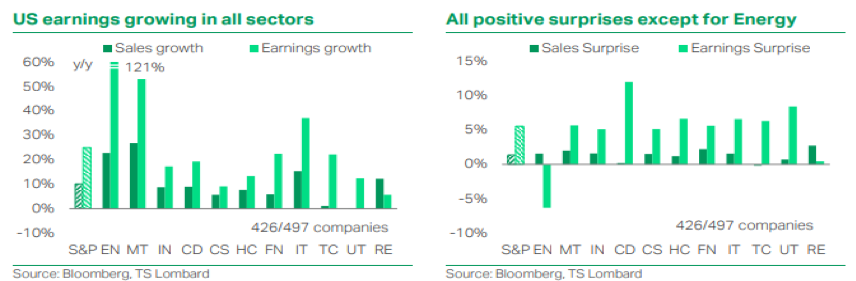

Now, regarding earnings future growth we should first look at the facts of the second quarter and review the circumstances that led to such positive news. As the graph below shows, we observed positive surprises in US earnings in almost all sectors, with revenue growing about 12% and earnings growing about 25% year-on-year.

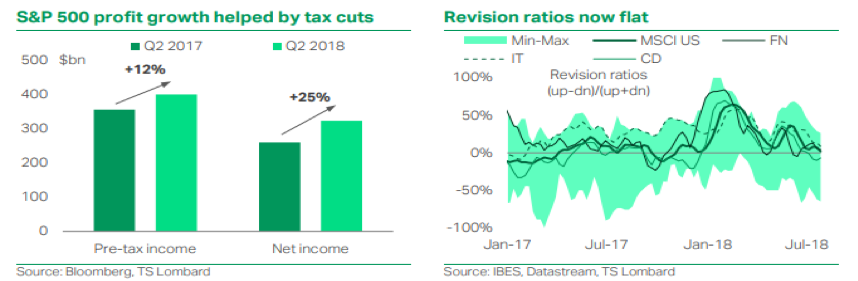

However, when we take into account the effect on earnings from the tax cut, we could say that such impressive earnings numbers are probably not sustainable. Furthermore, forward guidance issued by corporations has been indicating a slowdown in earnings and the upward/downward revisions as shown in the following graph point to a significant drop in future earnings.

More specifically, EPS growth is expected to slow down from 18% in 2018 to about 11% in 2019.

Given the above, we are of the opinion that the US equity markets may be mildly overbought under conditions of credit tightening along with all the other events mentioned above. However, if the Fed surprises the markets and does not raise rates (or allows such suspicion to percolate) in December or next March, then we would not be surprised – other things being equal – if we see another market rally.