The latest report of the BIS (Bank of International Settlements, a.k.a. the central bank of the world’s central banks) is very clear as to the future of further monetary stimulus when it declares: “But despite all the monetary accommodation, economic growth remains lackluster, and job creation has yet to gain firm traction…Monetary stimulus alone cannot provide the answer because the roots of the problem are not monetary.” In the same report BIS urges central banks to stop quantitative easing measures and calls for a focus on things that can really stimulate growth, such as productivity.

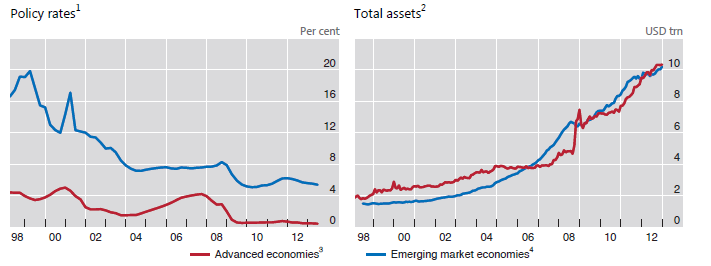

A major concern according to the report is the distortions created by the accumulation of financial assets among the world’s central banks. As the following figure shows (taken from that report), in just five years the balance sheets of central banks (among both developed and developing nations) has more than doubled.

This accumulation of bonds (i.e. third party liabilities) can destabilize the central banks themselves when interest rates start rising significantly, because their balance sheets will suffer due to the drop in the bond prices. If central banks become unstable, then the whole fiat currency system will suffer, planting the seeds of a destruction that would devastate the globe. Moreover, financial flows among developed and developing nations create distortions in currency exchange rates and create bubbles due to credit over-extension. Therefore, the need arises to stop these distortions and reduce those risks.

In that direction, the pre-announcement by the Fed of the QE suspension comes as a logical option, since the risks accumulate at an exponential rate. Even the central bank of China has chosen to follow the recipe and thus the recent turmoil in Chinese markets. The result of such a move has a triple effect, namely:

First, it sends a signal of normalization. Anytime that interest rates project an upward trend chances are – assuming of no major inflationary threat – that the economy is moving to a higher growth path (again, it could be illusionary as we recently wrote).

Second, the higher yields in developed markets move funds away from developing nations – and thus reduce the risk of bubbles bursting there – to developed ones, and thus these new funding sources mitigate the tendency of higher interest rates, while portraying a picture of stability and growth which translates into higher potential for the markets.

Third, it enhances the image of the fiat currency system and its return to normalization, while the higher yields depress – among other reasons as we recently wrote in our May 21st commentary – precious metals’ prices, which allow institutional players and central banks to accumulate them at low prices. Such accumulation mitigate the risks in their balance sheets and will allow them to breathe easier when they are called upon to deploy the power of hard assets during dark hours, when paper assets are questioned and real hard assets could be the only game in town.

While we still think that this dark hour may be two to three years away, we also believe that it may be prudent to start accumulating precious metals soon at these low levels, irrespectively of its temporary downward trend and the possibility of moving sideways in the near future. At this point gold could start be treated like cash even for those who do not believe that gold is cash. We simply do not invest in cash, because cash is simply cash.