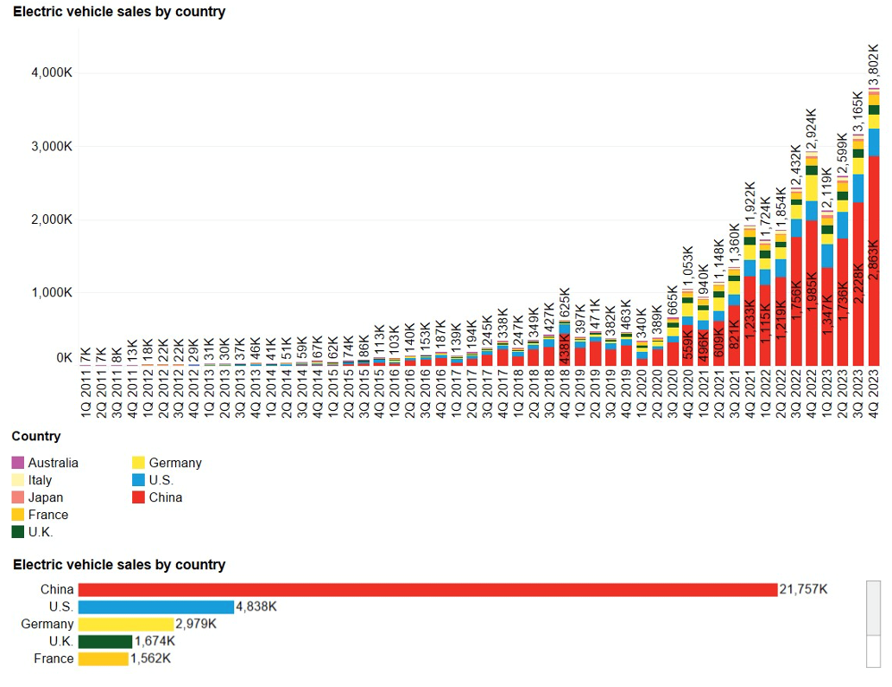

As the global automotive industry accelerates toward a cleaner, more sustainable future, the electric vehicle (EV) market has been significantly elevated and demands exploration. It is a fact that EVs reduce greenhouse gas emissions when compared to traditional vehicles. Sales of EVs reached nearly 14 million in 2023. Their trajectory is EVs changing the auto industry, assuming that the needed infrastructure will catch up with that trajectory. As countries vie for a leading position in the market, governments are supporting/subsidizing their own domestic markets, which in turn gives rise to higher trade tensions. Decisions on infrastructure investment, tariffs, and supply chain management are critical.

Source: Bloomberg

As stated above, last year, global EV sales rose to nearly 14 million, with 95% of those in China, Europe, and the US. This brought the total number of EVs on the road to 40 million. The year-on-year increase in EV sales between 2022 and 2023 was a significant 3.5 million.

During 2023, weekly new registrations exceeded 250,000, surpassing the entire annual total from 2018. EVs accounted for around 18% of all cars sold in 2023. This is an incredible change when we consider that back in 2018, they comprised only 2% of cars sold. To put it into perspective, the global EV market in 2023 was valued at over $500 billion.

EV Revenue Forecast by Major Countries

Source: Statista

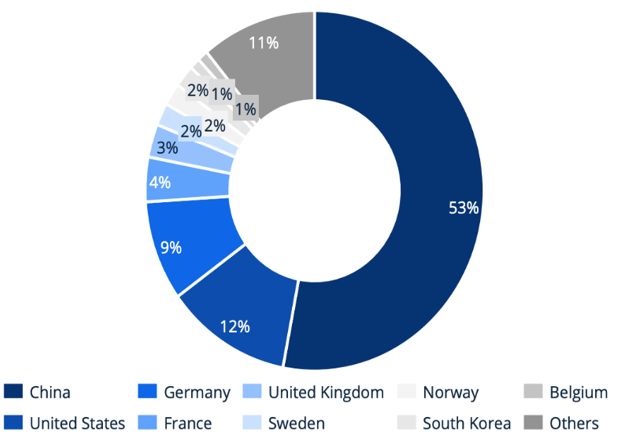

China is a titanic leader in the EV market. It boasts the world’s largest market for the vehicles and was responsible for around two-thirds of global EV production in 2023 and has the capacity to produce over 30 million EVs annually. Importantly, China also leads in EV exports, with most shipments headed to Europe and other countries in the Asia-Pacific region.

However, there are other fast-growing EV markets emerging in Asia that could absorb demand for Chinese EVs or become competitors. For example, Thailand has implemented subsidy policies and its industry has received significant investments from Chinese EV producers. Thai EV production is expanding its production capacity at a significant pace. Indonesia, as Southeast Asia’s largest economy, has been steadily ramping up its production capabilities too. The country’s well-established metals and minerals industry positions it to become a major source for nickel – a crucial component for EV battery production – which in turn will allow its domestic production to enjoy significant reductions in manufacturing costs.

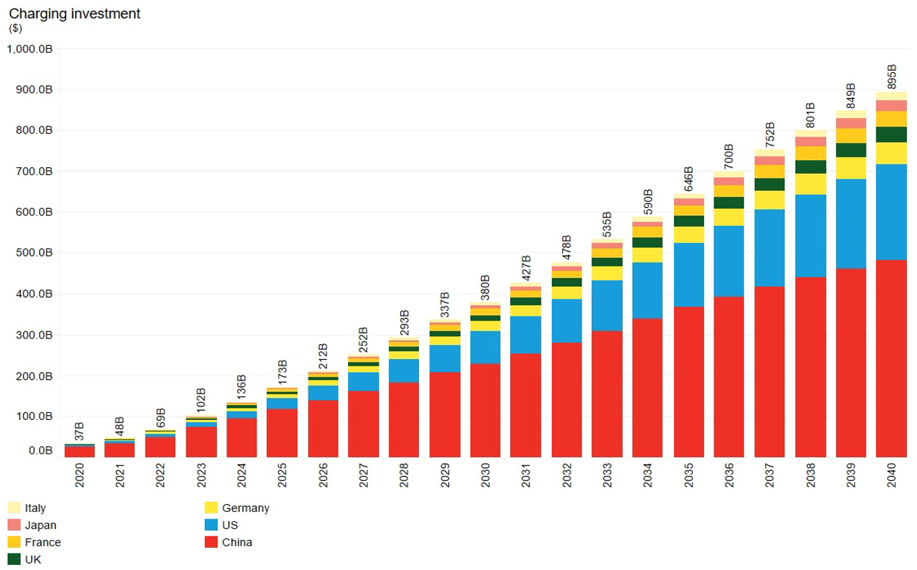

In Europe, EVs accounted for an impressive 21% of all new light-duty vehicle (LDV) registrations in 2023. Tesla and Volkswagen models led the charge, but an influx of cheaper Chinese models has significantly heightened trade tensions, which will be touched upon later in this commentary. European companies are investing heavily in EV charging infrastructure, with Italy planning over 21,000 operational charging stations by 2026.

The US EV market, the second largest after China, has faced bumps in the road. Tesla announced that it would lay off 10% of employees, and major automakers such as Ford are scaling back operations, planning to fill the gap with hybrid vehicles instead of pure electrics. Despite this, new EV registrations in 2023 were 40% higher than in 2022, fueled by price cuts on popular models like the Tesla Model Y and revised qualifications for the IRA’s Clean Vehicle Tax Credit. EV sales accounted for around 10% of total vehicles last year, and projections expect this to rise to 24% this year when including hybrids.

The Biden administration’s plan to install 500,000 public charging stations by 2030 is critically important for supporting the growing number of EVs on the road and alleviating range anxiety among consumers.

Source: Bloomberg

Key Growth Factors

Several factors are driving the expansion of the EV market:

- Increased environmental awareness among consumers, including growing concerns about climate change and air pollution, drives heightened consumer interest in cleaner transportation options.

- Governments worldwide are promoting EV adoption. Stricter emissions regulations and incentives including tax credits, rebates, and reduced registration fees, all encourage consumers to buy electric.

- Improvements in battery energy density, charging speed, and cost have made EVs more practical and appealing.

- Manufacturing costs are declining due to a combination of price reductions, government incentives, and economies of scale, leading to prices being more competitive compared to traditional vehicles.

- Generous government subsidies, especially in China, allow EV manufacturers to undercut prices and make their vehicles more attractive to consumers. Around 60% of the EVs sold in China are now cheaper than traditional vehicles.

Challenges

Nevertheless, the EV market does face hurdles in both the economic and geopolitical realms.

For example, the rapid growth in EV demand has fueled investments in battery manufacturing. However, this increase in supply has led to a dramatic oversupply, where committed and current battery plants already meet EV production volumes through 2030. This oversupply could drive high-cost producers out of the market, and many battery manufacturers face the risk of operating below capacity, potentially resulting in financial strain, market exits, and a volatile environment.

Additionally, concerns have arisen over China’s “dumping” of EVs into the EU market, which is the destination of 36% of Chinese EV exports (a share that exceeds the combined exports of the next five largest markets). Because of the subsidies Chinese companies receive, they can undercut European automakers who can’t compete with the state-funded enterprises. The EU has initiated an anti-subsidy investigation and has agreed to talks with Chinese officials to address their concerns. Meanwhile, the Biden administration has quadrupled tariffs on EVs from China, setting the tariff rate at 100%. Despite China’s dominance, the US currently buys very few EVs from China.

Outlook

According to the International Energy Agency (IEA), by 2030, around one-third of cars in China and over one-fifth of cars in US and Europe will be electric. Outside of China, EVs are expected to reach cost parity with traditional vehicles by 2030 as new technology and economies of scale kick in. Overall, the estimated compound annual growth rate (CAGR) for the EV market between 2018 and 2028 stands at 23.2%.

The future of electric vehicles is promising despite the challenges mentioned above. They play a crucial role in the decarbonization of transportation, improving air quality and contributing to a cleaner environment. In the geopolitical realm, only time will tell how competition between Chinese manufacturers and others will play out.