In this week’s commentary, we opted to discuss electric vehicles (EVs). We are of the opinion that EVs present good opportunities for investment consideration. Such investments could look into at least two segments, namely the manufacturers and the materials that are pivotal for EVs production. We also need to state that such investment consideration should have at least a 5-8 year time horizon.

Here are our thoughts then:

- Traditional manufacturers (US, EU, and Asian) do not necessarily have major competitive disadvantages to Tesla. On the contrary, while we should be crediting Tesla for its innovations, we should also take into account that the traditional manufacturers are not facing any major engineering challenge, and as they are now getting into the field they actually possess some strategic advantages over Tesla, such as distribution networks, massive operating and service facilities, financial resources, production expertise, etc.

- Governments around the world will enhance incentives for the adoption of EVs and they will also strengthen regulations regarding emission standards for traditional vehicles. Those actions will advance the adoption schedule of EVs.

- Innovations like EVs require a catalyst in order to build critical mass. We believe that Tesla’s Model 3 will be that catalyst.

- Traditional – combustion engine – vehicles will not disappear quickly. After all, improvements in efficiency and pollution emissions, but most importantly size (e.g. the need/want for bigger cars which require much larger batteries without significant increases in the range they cover) will allow them to hold on to a significant part of the market for at least ten-fifteen years after the critical mass in developed market has been established. In addition, the fact that vendors are losing money for every EV they are selling is a disincentive for dealers/vendors. Furthermore, we need to take into account that massive charging infrastructure will be needed, and thus the phase-out of traditional cars will take some time. As for developing markets, the lower car and gas prices will also contribute to the remaining demand for traditional vehicles. On top of this accelerated depreciation for EVs will enhance the value of traditional vehicles.

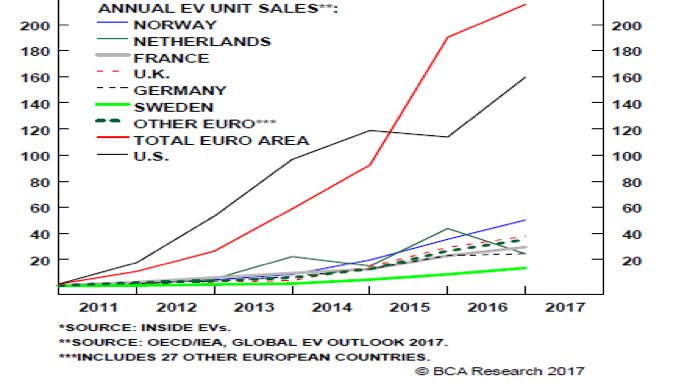

- We expect that EV sales in the EU will continue to be greater than sales in the US, as has been the practice (see graph below). This is due to distances traveled, population density, and attitudes regarding climate change.

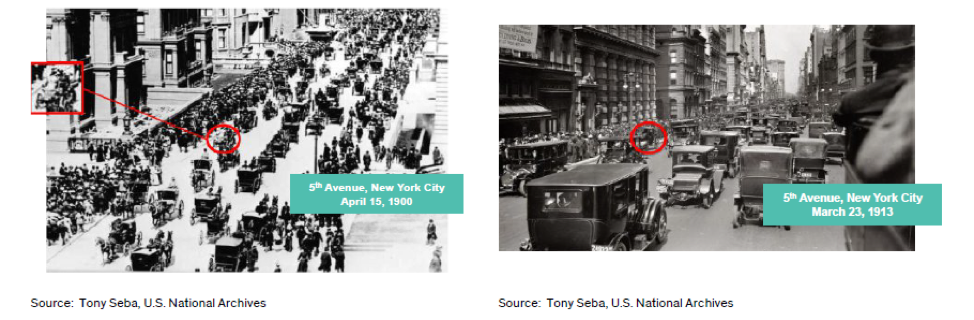

- As far as adoption rate is concerned we would let the following two photographs tell the story. Once the catalyst (Ford’s Model T) emerged, penetration became triumphant. In the left picture below one needs to put significant effort to identify a car. On the contrary, we need significant effort to identify a horse in the right picture shown below.

Having said the above, we believe that an automobile/transportation revolution is in the works supported by major technological/battery improvements, consumer preferences, government incentives/regulation, a catalyst that will generate critical mass, and economies of scale (especially for traditional manufacturers), all of which seem to suggest that it would be prudent for investors to be examining the possibility of obtaining exposure in the inputs (and those who produce them) that will be used in EVs. Such inputs include copper, lithium, zinc, nickel, etc. Such an exposure may turn out to be more profitable than exposure to the manufacturers of EVs.