John E. Charalambakis, Mohamed Ramzi Roshdi, Nicolas Abdelhak, & Eleni Buss

As we look ahead towards assessing the markets’ outlook for the remainder of 2021, we have split our analysis into sections as discussed below. We begin with an overall macroeconomic assessment and continue with economic, inflationary, monetary, earnings and credit outlooks. We close this mid-year assessment by briefly discussing asset allocation issues, along with investment themes that may play out the rest of the year—and possibly extending to 2022.

Macroeconomic and Asset Allocation Outlook

The key issues that may affect markets’ trajectory are likely to include (but are not necessarily limited to) the following topics:

- Monetary affairs related to the Fed’s possible tapering of bond purchases. We believe that the recent drop in the 10-year Treasury yield is due to the Fed flooding the markets with liquidity. Discussion and consideration of tapering may unsettle the markets;

- Margins of error in the US fiscal packages;

- Covid-19 re-openings and the evolution of variants;

- Cyber warfare against Western infrastructure (including energy and food supply chains) and corporations;

- China’s crackdown on technology companies in combination with the tightening of credit lines and standards in the mainland;

- Saber-rattling in the South China Sea;

- International cooperation and policy coordination;

- Political ramifications of growing income and wealth disparities;

- The meme phenomenon that creates bubble spots and could exacerbate volatility in a downturn; and

- Hybrid work and record job openings in the US as employees leave their jobs at historic rates.

Economic Outlook

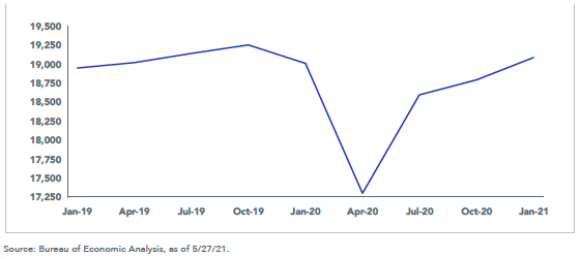

The global economic recovery continues to accelerate despite rising cases in other countries and the “delta variant.” Some regional Federal Reserve banks estimate that Q2 GDP could exceed 9% (on an annualized basis). Economic output is getting closer to pre-pandemic levels as shown below.

| Figure 1: U.S. Real GDP (Billions of Chained 2012 Dollars) |

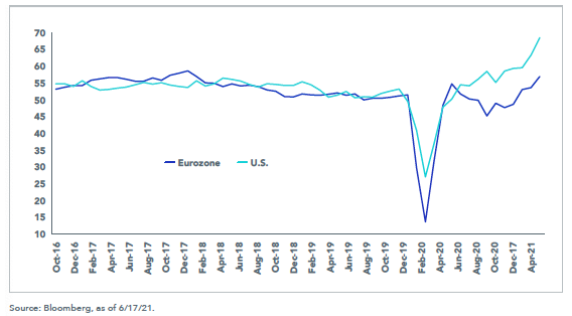

Risks include the scaling back of reopening activities, particularly given that it could push the herd immunity threshold higher. If current trends continue with the openings, solid growth is expected through 2022. The release of pent-up demand is ongoing despite the decline in the May retail sales report. Savings are up, especially for people who have maintained their jobs— they were not spending money and stimuli checks advanced their savings. The US is expected to be outpaced by economic growth outside the US in the next several months and over the course of 2022. Global manufacturing is accelerating and will remain above 50, marking expansions as shown below.

It is likely that supply chain disruption will still prevail by the time of Christmas shopping. However, manufacturing output is still rising and that may contain inflationary pressures. However, the high demand could make for slim pickings and continued shortages.

Figure 2: U.S. and Eurozone PMIs

Inflation Outlook

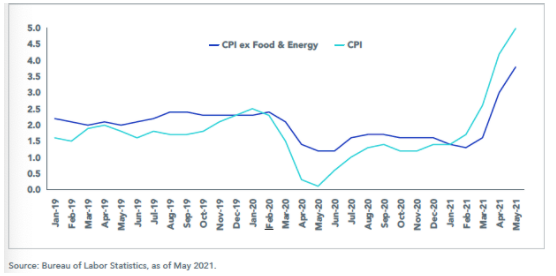

We have all become familiar lately with the recent CPI reports and headlines implying that price pressures may be reaching new recent highs. The figure below is indicative of the inflationary risks that could unsettle financial markets, corporate plans, and government spending.

Figure 3: U.S. CPI & CPI ex-Food & Energy (YOY Rate % Change)

The pop in inflation puts us in relatively unknown territory. The debate remains centered around if this is temporary or longer-lasting. The determining factor may be the growth rate in wages, which could dictate whether the observed trend is more broad-based. There might be a shift in bargaining power where workers are demanding higher compensation—and being rewarded it. Recent regulatory decrees point to that direction. Workers’ confidence is high, the combination of this with the instability of job openings may provide substance to inflation’s staying power. Additional signals from the commodities sector (oil, lumber, gold) point to a landscape where price pressures may continue in the foreseeable future.

Figure 4: U.S. Job Quitters as % of Total Job Leavers

Monetary Policy

It is an indisputable fact that the growth rate of monetary aggregates (such as M2, M3, M4 with the latter two unofficially measured) has slowed down significantly from the same periods last year. This might support the notion that prices may be more temporary, however, the growth rate is still higher than the economy’s long-term sustainable rate of economic growth, which makes the continuous liquidity infusions problematic. The June FOMC meeting contained a more aggressive tilt than markets were expecting, hinting that the Fed may be closer than we think to an exit strategy. Members are not in agreement on when the tapering will begin, but it is a hot subject. Timelines have already been moved up, but some members believe that it should still be sooner.

Now, as far as cryptocurrencies are concerned, the Fed’s recent flagging of crypto prices as a “national financial risk” follows the Chinese crackdown on crypto mining and outright bans in markets like India, suggesting continued volatility in cryptocurrency markets despite the recent adoption of crypto reserves by some corporations, the introduction of crypto desks by several banks, and efforts to launch a US-based bitcoin ETF by multiple asset managers.

Earnings and Dividends

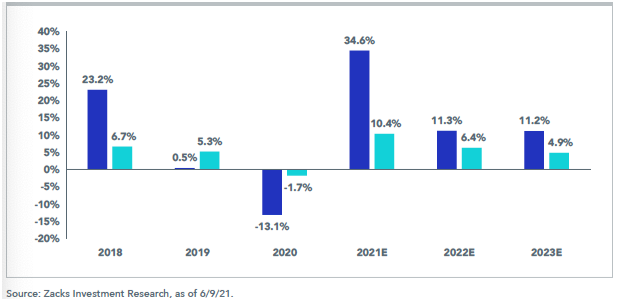

Earnings are expected to be very strong in Q2. It feels like a miracle that the S&P earnings only declined by 13.1% in 2020, but the real miracle could be that the snapback is expected to be in the mid-30% year-over-year growth range. Investors are beginning to think that earnings will eventually grow to more than $200 in 2022, or earlier.

Figure 5: S&P 500 Earnings & Revenue Growth Rate

There are estimates from reputable and trustworthy sources which are pinning earnings at $190 for 2021 and $210 in 2022. That puts the S&P 500 at nearly 20x next year’s earnings. Since foreign markets took a harder hit from the pandemic, overseas markets might reach earnings growth larger than the S&P 500.

Rates and Credit Outlook

Recent trading in the UST 10-year yield highlights how the market had already priced in the pre-June FOMC macro/Fed policy setting. For the rest of the year, the UST will be taking its signs from shifts in the Fed’s thinking regarding tapering and interest rates. The UST 10-year Treasury is expected to keep the uptrend and attack the 2% threshold in H2 2021. Real yields are vulnerable to the upside.

The improvement of fundamentals will uphold corporate bond market valuations, despite previously tight levels. While default and downgrade rates will continue to fall, upgrades and downgrades are steadying out this year. Focus is needed on credit selection with an emphasis on investment-grade bonds. Exposure in lower-quality bonds should be limited, especially when the same coupons could be achieved with quality preferred stocks.

Compared to US high yield corporate bonds, the ones offered by emerging markets may carry greater credit risk in a time of turmoil. They may also carry exchange rate risk. The US corporate bonds have reached new lows where EM bonds have stayed above their 3-year lows. Continued economic recovery also increases value in the opportunity of adding non-core securitized credit to established agency mortgage-backed positions.

Asset Allocation Guidelines

We believe that holding some cash of at least 5-6% (to be deployed during a potential downturn) is a wise choice. In addition, some exposure to precious metals would be wise as a portfolio anchor and protection hedge against inflation. Overweighting equities relative to fixed income should be a safe bet (especially if no downturn takes place between August and October), while buying more European equities may pay more than buying US equities. When it comes to US equities, we believe being exposed to a mix of quality growth names, cyclical, and value equities should prove tactically beneficial.

With uncertainties surrounding propagation of new variants, combined with rising geopolitical tensions, potential higher volatility, hybrid work trends, and growing interest rate risk, it would be possible to add a few quality growth stocks, especially in areas like digitalization and cybersecurity that are still in their nascent enterprise stage. More than ever, selectivity is key.

It is important to remember that technology plays an important role in influencing production, and thus discerning quality tech-oriented holdings should give a boost to portfolios.

Value-oriented holdings should also continue doing well as demand will remain strong, and recovery momentum will continue to sustain the expansion from corporate earnings. The infrastructure bill will also offer another boost to growth to the U.S., but the impact will be more gradual as spending rolls out over multiple years.

We certainly believe that remaining underweight in duration and possibly also in credit risk, are wise choices.