Looking back to 2019, we don’t think that it would be a stretch to claim that lower rates and the dovish approach by the Fed lifted up valuations and played a very significant role in the spectacular rise in equities (not that debt markets did not also perform well). Earnings also contributed to the gains, but not as much.

Therefore, given the Fed’s determination to stay pretty much where it is now, to assess the equity markets we turn our attention to earnings potential. We present below four graphs regarding earnings expectations from three sources, aggregated together.

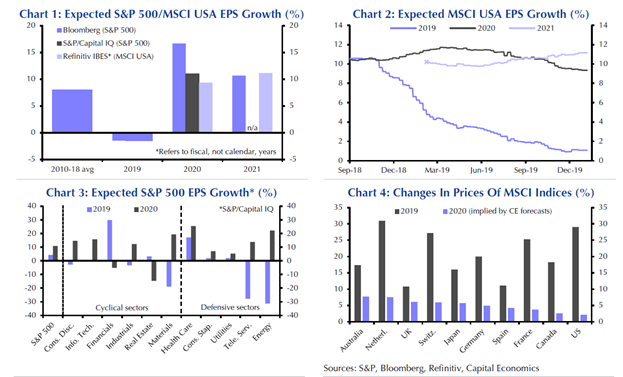

Overall, 2019 was characterized by poor earnings growth, as can be seen in chart 1. On the contrary growth for 2020 and 2021 is expected to be a healthy 10%, as shown in chart 2. Furthermore, such growth in earnings seems to be across the board covering almost all sectors, as chart 3 indicates. So while economic growth is expected to bottom out soon, we have some reservations if corporate investments, share buybacks, margins, and earnings can replace the monetary momentum, especially if earnings disappoint, and/or long term rates start rising. Hence, our assessment/outlook published at the end of December for decent but not extraordinary stock market gains, in the first part of 2020.

Having said that, and as a closing note please take a look at chart 4 above. It shows that non-US equity markets may perform better than the US ones. You may recall, we have been discussing this lately along with the flow of funds, especially to the Eurozone which concedentally also may uplift the Euro. Given the probability that the ECB may proceed with more quantitative easing, as well as lower valuations in the EU than the US, we would not be surprised if some EU markets’s returns exceed those of the US in 2020.