When the EU started feeling the heat in its periphery, and fearing damages to its core, it established the EFSF (European Financial Stability Fund). We have expressed elsewhere some of our concerns regarding its establishment. In this commentary – which will be better articulated in the forthcoming September newsletter – we take the position that given the pressures on EU banks and EU paper/bonds of major countries, the fragility of the rescue packages, and the lack of cohesiveness among EU partners, we are afraid that the trajectory of the Euro will be similar to that of the Gold Pool established in early 1961 in order to save the Bretton Woods system of dollar convertibility into gold.

We know that once that Gold Pool system – that acted like a cartel – started feeling the heat, it collapsed within two years after sustained sales of gold commenced. Hence, we believe that the price of shorting the Euro is pretty cheap nowadays, as the following figure shows.

Between the mid 1930s and mid 1940s, the US accumulated almost 70% of the total global gold reserves. Hence, it could support a system of dollar convertibility into gold. The dollar could proclaim that it was as good as gold (a.k.a. those who have the gold make the rules, but this is not the golden rule).

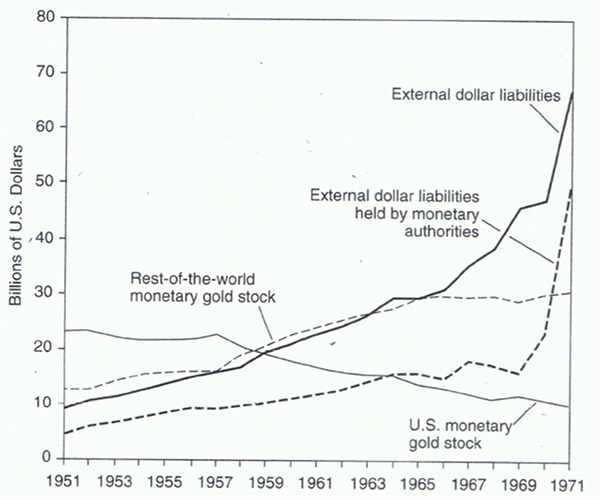

However, in the 1950s it accumulated a lot of liabilities and circulated a lot of dollars abroad. Its gold reserves started depleting. As the following graph shows by the late 1950s the demands to convert US dollars abroad into gold increased significantly.

Source: IMF, International Financial Statistics

Questions arose as to the US ability to support the $35/ounce gold price. Speculation emerged that the dollar will be devalued against the gold, and hence those holding dollars would have experienced losses. The US proposed the Gold Pool as a collective rescue-parachute, which was adopted in 1961 by the United Kingdom, Germany, France, Belgium, Italy, Switzerland, and the Netherlands. The goal was collective action (buying and selling of gold reserves in order to stabilize gold prices,) that would advance the common interests of the participants and hence reduce risks and costs, while sustaining the international monetary structure. The system proved to be unsustainable, especially when General Charles de Gaulle in France decided not to support it anymore.

Since the EU crisis erupted in late 2009, the EU and the ECB have been trying to create new institutions such as the EFSF, issue guarantees in the hundreds of billions of dollars, and design rescue packages, in order to save countries and banks. They have created new mechanisms and the ECB in just one month (July) spent more than 50 billion dollars (€35 billion) buying the paper of Italy and Spain. On July 21st, they decided on a new rescue package for Greece totaling close to $150 billion. Now, some EU member countries demand hard collateral in order to contribute to the pool.

We are of the opinion that the EU besides lacking visionary and dynamic leadership, it also lacks a common conceptual framework which is a precondition for collective action. In addition, the enforcement mechanisms are too weak, while slowing growth, undercapitalized banks, lack of transparency, and the accumulation of debt obligations with very little prospect in the horizon create a dynamically unstable environment for the Euro.

Ode to those who taught us about the trajectory of fiat money!