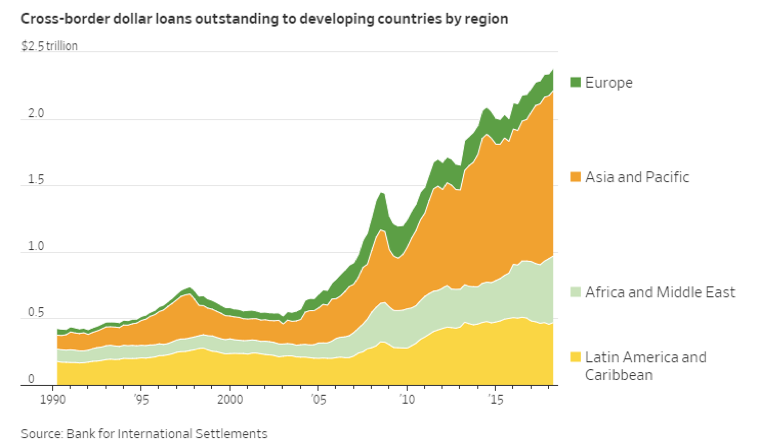

Over the course of the last few days, emerging markets currencies have been experiencing tremors due to contagion fears originating in the Turkish lira. As the first graph below shows, emerging market dollar-denominated debt has more than doubled in the last ten years. Easy money policies and quantitative easing allowed those economies to borrow dollars very cheaply. Now that the Fed is in a tightening cycle and dollar shortages start making their presence in the markets felt (to a very limited extent), fears of further dollar shortages are generating some limited anxiety in the markets in the form of contagion fear.

The fact is that the turmoil is not limited only to the Turkish lira but has been extended to the Indian rupee, the Mexican and Argentinian pesos, the Russian ruble, the Indonesian rupiah, the South African rand and other emerging countries currencies. Even the euro dropped by 2.5%. The situation does not exactly resemble the 1997 emerging markets currency crisis, given that this time emerging markets have more foreign reserves. However, those banks – and especially trade finance companies – that have exposure to the markets that have been affected the most (such as Turkey) will be affected negatively (by no means would that imply an existential threat to any major EU bank), which may lead to asset shifting and limited sales in order to cover losing positions.

As the dollar strengthens it becomes more expensive to service the dollar-denominated debt, but on top of this the emerging dollar shortage may carry more weight and be a greater factor in the depreciation of those currencies. As rates increase and dollar shortages surface, refinancing those debts (in some cases they represent over 50% of the local GDP) becomes a more expensive and challenging exercise. Furthermore, as capital inflows are reduced, and capital outflows grow, emerging countries may be facing significant pressures that will force them to raise domestic rates (Argentina raised its rates from 40% to 45%) which may make borrowing unaffordable and refinancing working capital prohibitive; the combination of the above may lead emerging economies into a recession.

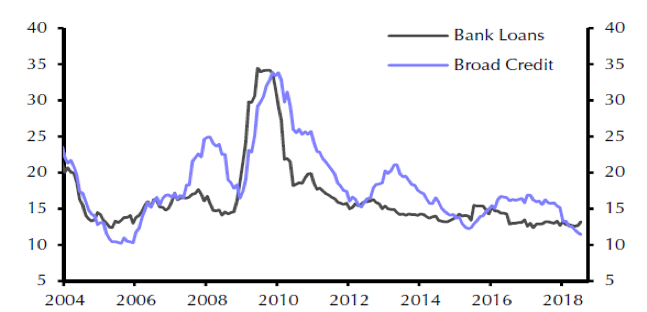

All these developments may be taking place at a time when the Chinese economy is experiencing a double hit, namely US tariffs and slower growth. A symptom of that is that a semi-military company missed its debt payments last week, generating concerns regarding the massive debt load that Chinese and semi-governmental institutions carry. If liquidity in China keeps tightening (as shown in the figure below), then we cannot exclude a repricing of Chinese bonds which could open Pandora’s box regarding global debt.

Bank and Broad Credit Growth in China

Source: Capital Economics

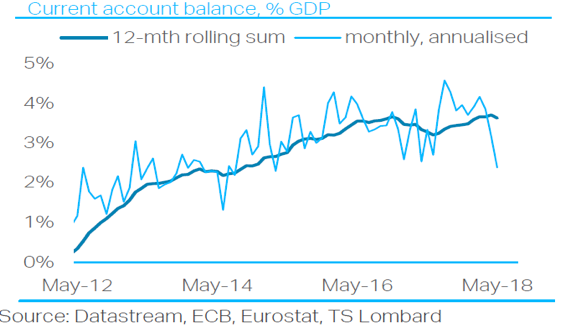

In the meantime, the EU current account surplus has been cut almost in half in the last 10 months, as shown below. The cause for this is mainly slower growth (partially due to slower Chinese demand); however, concerns are rising due to capital outflows (portfolio managers acquiring foreign – mainly US – assets, while direct investments into the EU are slowing down). The combination of the two along with concerns regarding Chinese demand and US tariffs is pressuring the Euro downwards.

Allow us to close with a non-conventional thought: Most analysts believe that the flattening of the yield curve (declining difference between the 10 and 2-year Treasuries) will ultimately lead to an inverted yield curve which will be the predecessor to recession. Our thinking is that dollar shortages and continuing QEs by the ECB and the Japanese central bank are pushing investors toward US assets which in turn reduces the premium required to hold long-term US assets. As that premium decreases and pressures build up internationally, the Fed may slow down its tightening cycle which may, in turn, give a further boost to the risk-on cycle for equities.