In our August 10th commentary we touched on the parallels between T.S. Eliot’s poem Waste Land and the rehypothecation of assets/bonds (a dangerous endeavor that could undermine financial stability). Furthermore, the subliminal statecraft messages derived from T.S. Eliot’s Waste Land could easily have been seen a few days later as Kabul fell to the Taliban. Waste Land’s lamentation reminds me of shouting at the wind, wondering what has gone wrong.

White bodies naked on the low damp ground

And bones cast in a little low dry garret,

Rattled by the rat’s foot only, year to year.

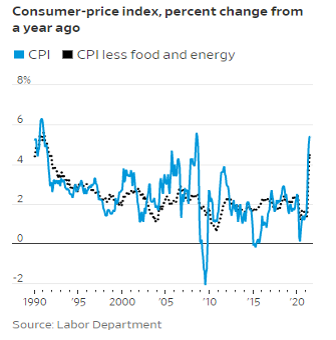

So, as we observe new market highs – elevated by rehypothecation of assets – we should remember that such rehypothecation is a major factor in lowering the cost of capital (interest rates). Thus, while rehypothecation assists in the lubrication of our financial system, the higher collateral velocity could uplift prices which itself becomes another source of financial instability.

After the frosty silence in the gardens

After the agony in stony places

The shouting and the crying

Prison and palace and reverberation

Of thunder of spring over distant mountains

He who was living is now dead

We who were living are now dying

With a little patience

However, the emerging issue is the efficient arbitrage of funding operations in the face of geopolitical realities where China desires to take the lead in the circulation and use of CBDCs (Central Bank Digital Currency). Following the financial crisis of 2008-’09, the amount of good, available collateral dropped significantly, and consequently collateral velocity declined. Quantitative Easing (QE), and/or increases in the monetary base, is not a substitute for collateral operations. By 2016, it was estimated that we needed an additional infusion of at least $5 trillion in prime collateral.

Anticipating the waves of demand for liquidity and credit in the new era of global transformation (climate change, pandemic, infrastructure, geopolitical statecraft), we would not be surprised if the needed collateral – especially when we take into account the need to dominate in e-payments using CBDCs (a.k.a. Project Hamilton in the US) and the implied need to increase the relevant velocity – exceeds the previous estimate by a multiple of 2.

T.S. Eliot saw cracks in the old, antiquated world that emerged following World War I, and in that emerging era of credit creation (1920s) he foretold of growing pains and fallen cities that would soon be consumed by the unreal chess game of the masters.

What is that sound high in the air

Murmur of maternal lamentation

Who are those hooded hordes swarming

Over endless plains, stumbling in cracked earth

Ringed by the flat horizon only

What is the city over the mountains

Cracks and reforms and bursts in the violet air

Falling towers

Jerusalem Athens Alexandria

Vienna London

Unreal

As I was contemplating of the forces that will ultimately underwrite the fundamentals of the new era, I bumped into a gentleman by the name of Mr. Lacinyc, who insisted that I recall the modern roots of the Afghanistan adventure and in particular the role that Nur Mohammed Taraki played in the late 1970s while next door in Iran a theocratic regime was taking hold. Furthermore, Mr. Lacinyc insisted that I re-read a poem by Andreas Gryphius, penned in 1648 at the end of the Thirty Years’ War.

The towers stand in flames

The Church is overturned

The town hall lies in ruins

The stalwarts are hacked to bits

The maidens are deflowered

And everywhere we look

Fire, plague and death

Press the heart and soul.

“Who is the best to plant seeds of instability?” Mr. Lacinyc asked. Before I even had the chance to think about the question, a Machiavellian voice echoed in the conversation: “Hello Mr. Lacinyc, how do you spell your name backwards?”