Is the uncertainty over? Are the anxieties about trade policy, institutional stability, definitive direction on the economy, earnings, debt, interest rates, the dollar, and valuations over? And if not, how then do we explain the equity markets’ upswing in the last ten days, and how should we allocate assets in this environment?

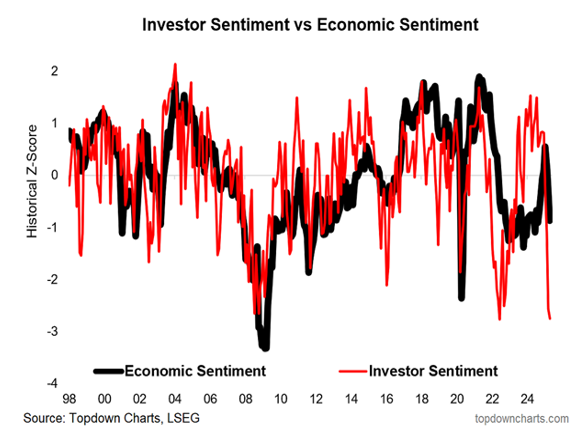

Confidence and sentiment form expectations, and the fact is that neither of them is on their way to recovery, according to the latest data, as shown below.

The market shock of early April was self-inflicted due to the announced tariff policy. Since then, the 90-day pause, the possibility of tariff reversals, some trade talks, the absorption of some tariffs by adopting lower profit margins, the time needed to adjust, and the buildup of inventories, have not allowed the market to see the extent of the inflicted damage or to measure the impact of lower container traffic, already reflected in lower shipment costs.

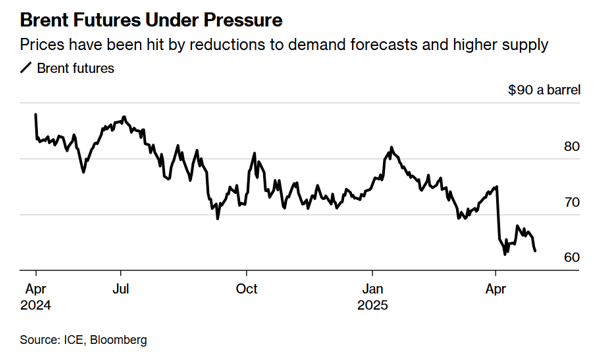

So the fundamentals of uncertainty have not changed, and the combination of an illusionary myopia, as well as the drive to buy at lower prices (trend exhaustion) while liquidity lasts, has uplifted markets’ prospects. However, the restrained market confidence and declining expectations may partially be reflected in the declining oil prices, as shown below.

The GDP decline, as reported last week, can be demystified by looking at the huge negative impact of net exports, the buildup of inventories, and the decline of both private and government consumption, as shown below.

Trend exhaustion (upwards as well as downwards) is at play in this environment, given the fact that there is room for policy manipulation/reversion. Moreover, as the markets search for a direction in the midst of any affirmation regarding a new economic cycle (e.g., moving from growth to recession or vice versa), and with money sitting on the sidelines, our belief is that downward exhaustion reversed the trend and didn’t allow the market to bottom. However, as uncertainty persists and the economy tends to take a turn for the worse, earnings will be negatively impacted within 4-6 months, and the market will reverse again towards a bear stand that will test the lows of the 200-week average.

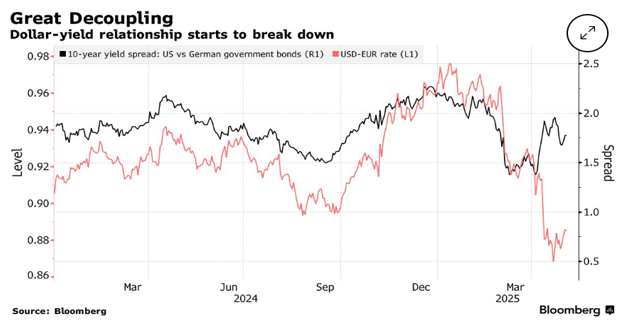

The more worrying sign, in our opinion, is the decoupling of the dollar from the international yield differentials. Normally, rising international yield differentials (where US rates are higher than rates in other major trading blocks) should strengthen the dollar; however, as we see below, that relationship has started breaking down. This implies that the financial system is susceptible to breaking down in a similar fashion, whose prelude we saw on April 9th. Symptoms of this include volatility indexes, margin calls, divergence between Treasury yields and interest rate swaps (implying hesitation to buy Treasuries), and the doom loop arising from the difference in prices between Treasuries and Treasury futures contracts which could undermine financial stability due to the short position in the latter by hedge funds to the tune of $1 trillion.

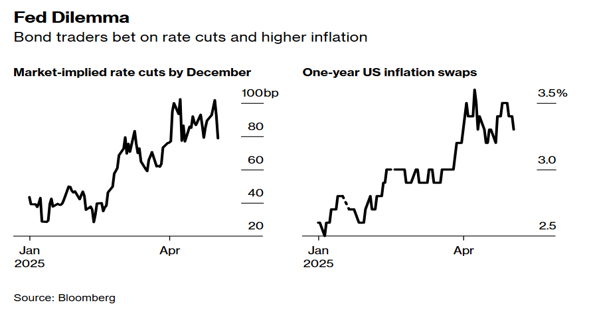

Moreover, given inflationary expectations, the markets are due for a disappointment since they expect three cuts this year (see graphs below) and the non-fulfillment of that expectation will undermine the risk-on attitude, especially when credit spreads start rising again, enhancing the possibility of an upswing exhaustion and retesting low market lows.

Stability (whether political, social, economic, corporate, or financial) requires order. Without the latter, and as Hobbes taught us, there is no basis to distinguish right from wrong, innocence from guilt, enslavement from freedom, and justice from cruelty. As long as there is an institutional vacuum, trend exhaustion is a force of disequilibrium where illusionary forces disguise illogical positions as history driven by reason. When we fail to think tragically, we are doomed to be susceptible to tragedy, as the first five decades of the twentieth century showed us.