In Shakespeare’s play titled “Othello” we discover an acrimonious manipulative protagonist in the person of Iago who envisions the downfall of Othello. Iago’s plans are not just convoluted. They are plain evil. Iago’s deceptions grow larger in every act of the play. Othello ends up becoming a victim of his own jealousy when his mind is defeated by Iago’s manipulations. The climax in the story is not the killing of Othello’s wife, it’s the defeat of Othello’s mindset.

In the previous commentary I wrote that I do not anticipate a technical default of the U.S. We are just one day from that technical default (and still believe that it could be avoided), but the damage done on the US credibility may be irreversible. I have heard proclamations that a technical default might be cathartic.

How cathartic could a technical default be when we jeopardize the credibility of the nation that defines the global collateralization process of the credit pyramid, no matter how convoluted and inverted that pyramid is? Financial havoc and chaos cannot produce stability and change. On the contrary, impeding chaotic financial markets will dislocate risks, misallocate capital, exacerbate premiums, and will advance disequilibrium to the point where the very much needed reform may not be feasible (viable and sustainable financial reforms require evolution not revolution). Given the multiple disequilibria our economic system is facing, the perpetual extension of the debt ceiling may not be the optimal thing, but its current needed extension is the only option that can advance a stable disequilibrium until the evolution starts taking shape.

The malfunctions produced by a technical default will cause job losses, will reduce growth prospects, will disintegrate business deals, will increase the cost of capital and thus of doing business, will suppress wealth and incomes, and will jeopardize the essence of the global financial system. Needless to say that such potential dire consequences will be global and will affect rich and poor alike (the poor are usually the ones who pay the higher price).

My fear is that in an environment where the marginal efficiency of QEs (ability to suppress interest rates) has been declining, the central bank will be cornered and its tools will be even more limited to avert the consequences of such a default (especially the effects on the dollar and its supreme position in global finance).

The combination of fiscal and monetary impotence will formulate an environment of high volatility and the latter has the potential of creating destabilizing political and social outcomes ( as an example the US government – to be followed by other governments around the globe – will be forced to cut spending by about 4% which will put the US into recessionary territory).

As it has been reported recently political manipulations have already cost the country significantly in terms of jobs, incomes, and growth. The increase in uncertainty brought by a technical default has the potential of fattening the tails in the distribution of risk which in turn may derail any serious efforts for an evolutionary approach to the needed financial reforms.

A few days ago (on October 10th) we celebrated the bicentennial birth of Giuseppe Verdi, whose opera titled “Othello” was one of his masterpieces that defined his work. With all due respect to the great composer, I think that Bob Dylan’s lyrics in the song titled “Slow Train Coming” are good compliments to the Othello drama of acrimonious manipulations. To some extent Dylan’s words of trying to out-maneuver the devil reminded me of recent “brinkmanship” in Washington D.C. (called by some “the arrogant capital”). Let’s listen to Dylan’s words.

Sometimes I feel so low-down and disgusted

Can’t help but wonder what’s happening to my companions

Are they lost or are they found, have they counted the cost it’ll take to bring down

All their earthly principles they’re gonna have to abandon?

There’s slow, slow train coming up around the bend.Man’s ego is inflated, his laws are outdated, they don’t apply no more

You can’t rely no more to be standing around waiting

In the home of the brave, Jefferson turning over in his grave

Fools glorifying themselves, trying to manipulate Satan

And there’s slow, slow train coming up around the bend.Big-time negotiators, false healers and woman haters

Masters of the bluff and masters of the proposition

But the enemy I see wears a cloak of decency

All non-believers and men stealers talking in the name of religion

And there’s slow, there’s slow train coming up around the bend.

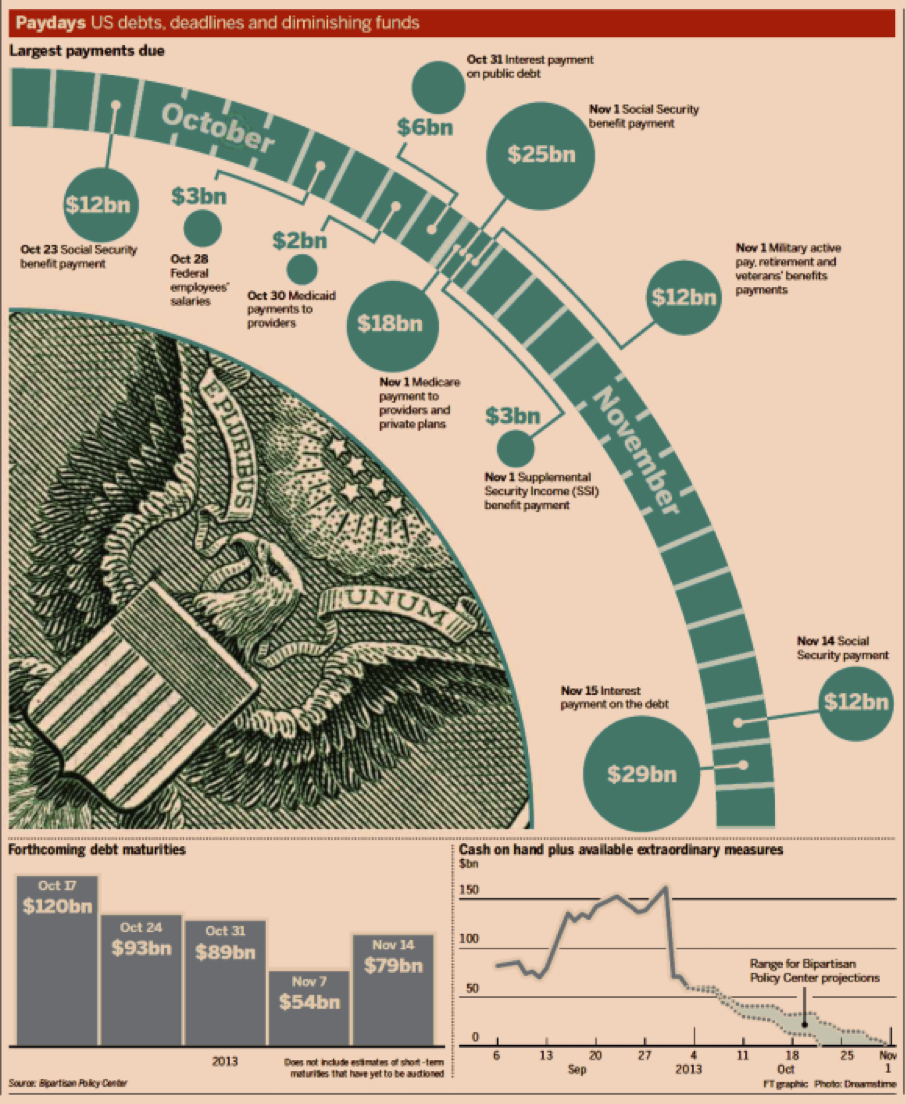

I found the following table – published in the Financial Times – very useful in terms of what is at stake in terms of funds needed in the next couple of weeks.

Let’s watch for the light at the end of the tunnel. It might be the slow train coming…