The best thing that the US has to export is the USD. From that perspective, it is the strategic advantage of the US to create those conditions necessary for the demand of its currency. The phrase “take it or leave it” originates with Thomas Hobson from Cambridge, England when he was giving his customers only one choice regarding the horse they could take from his stables. The relative strength of currencies should reflect the fundamental dynamics of the issuing country. It is my belief that we are headed into a period which will be characterized by significant gains for the US dollar (the upcoming newsletter will elaborate more on the issue), or to put it in another way: the weakness of others will be perceived as the strength of the still fiat USD. Moreover, and maybe equally important is the fact that the USD is an instrument of foreign policy and as such it needs to show its strength in order to ascertain its role in the games of power, foreign reserves, collateralization and credit creation.

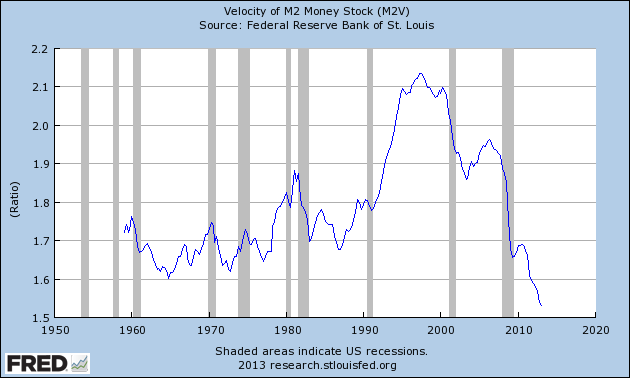

The US economy is operating below full capacity and that weakness is partially reflected in the velocity of money as shown below.

It is my estimate that a triple event will be observed in the next several months: First, capital will fly to the US markets. Second, the “dead” reserves produced by the Fed through the different rounds of QEs will start be translated into loans and credit facilities, stabilizing and possibly reversing the downward trend of the velocity of money, while boosting growth and the equities market (bond markets are anticipated to experience capital losses). Third, as the above phenomena are unfolded the USD will strengthen while other currencies will lose ground relative to the US dollar.

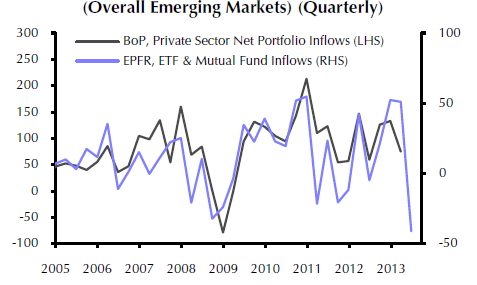

It is interesting to note that the latest data regarding net capital inflows into emerging markets reveal a sharply negative turn in the second quarter of this year (see graph below). We anticipate this trend to continue, and believe that the created expectations about higher US returns will push those funds to the US markets, keeping the cost of financing low.

The USD’s strength is based on its supply and demand in the international markets. As demand for the US markets increase the USD will strengthen. In addition, the US has very little to gain by cheapening its currency (even if exports go from 14% of GDP to 15%), while it has a lot to gain from a stronger dollar such as in energy costs. The growth in the financial industry and the underlying collateral holes signify demand for the denominating currency. Hence the increase in the Fed’s balance sheet needs to be seen from that perspective too, i.e. demand for the denominated currency of all those financial instruments.

The recent oil price increases (especially for the WTI and not so much for the Brent) could also be interpreted as the need to circulate more dollars. Moreover, and as noted above the different rounds of the QEs should also be seen with the lenses of expanding the Fed’s balance sheet in order to create reserves that could be converted into money supply (outside the US) as an instrument of trade, foreign policy, and a means of re-affirming the global position of the international reserve currency while satisfying the demand for it especially with the trillions of questionable instruments denominated in USD.

Where does this leave the Euro (the other major reserve currency)? Allow me to ask a not so rhetorical question: Will the Euro be around in 3-4 years?