What happens if you put new wine into old wineskins? Simply, the old wineskin will burst during the process of fermentation and then a mess will be created, value will be destroyed, and productive resources will be wasted.

Societies have been experimenting with fiat money for centuries. Fiat money (paper money that has no intrinsic value) leads to the accumulation of liabilities, the issuance of IOUs/Promissory Notes/Bonds, the latter are used as collateral in the credit creation process, which in turn elevates other paper asset prices, which furthermore are used as collateral for additional credit issuance, and the proliferation of the rehypothecation process leads to securitizing the bubbles into tradable instruments which somehow can be justified to trade at 30/40 times their EBITDA. And when someone asks “how does this all end?”, the answer may be found by looking into the history of finance which teaches us that all bubbles burst and the worst of them burst through the engine of finance a.k.a. war. Nowadays, the latter can take different forms (trade, finance, technology, cyber, etc.) without of course excluding the possibility of an arms conflict.

By no means should the statements above, or previous arguments for a sound monetary system, be perceived as a crying wolf argument or as a goldbug proposition. The world has evolved so much that a pure gold-standard financial system – which from a historical standpoint never took place – will suffer such a contraction where depression would prevail. However, from that extreme to swing to the other extreme where anything goes and the whole system is based on pure fiat, there is a lot of room for a golden medium position that can anchor economies and their financial system.

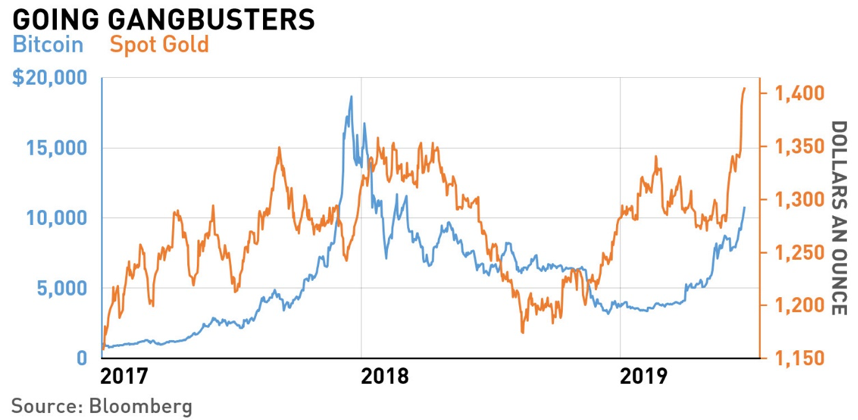

The absence of an anchor with intrinsic value has led societies to invent monies and forms of payments which in parallel to other forms of fiat can fascinate crowds and create additional bubbles which could go through cyclical phases of bubbles, as we have witnessed with Bitcoin and similar cryptocurrencies.

About a week ago, Facebook announced that they are getting into the business of digital currencies. Obviously, they are jealous of Alipay in China. Their cryptocurrency will be called Libra and was proclaimed as a bubble-free crypto because its value will be determined by other fiat paper currencies! I believe that we can all understand the logic of a tech giant wanting to control the means of payments.

While I support competition – a cornerstone to wealth creation and to society’s wellbeing – I cannot see how a pyramid of fiat currencies advances competition, let alone solves the quest for a stable store of value. Facebook’s announcement gave wings to Bitcoin to fly to a price of over $13K. Obviously the memory of its epic bubble bursting not long ago seems to be forgotten, let alone the fact that it is an inefficient (given that it processes less than half of a percent of the transactions that Visa processes), and costly form of payment.

How in the world rational investors could believe that in a sea of problems (Middle East rising tensions, trade and tech wars, Chinese and EU tremors, let alone debt, derivatives, and unfunded liabilities, to name just a few) pseudocurrencies can become anchors of stability, is beyond belief.

Artificially imposed scarcity can raise prices and can create illusions of wealth and a paper paradise. The systemic risks imposed by the cryptos are such that the Financial Stability Board has begun issuing warnings. Moreover, market power by the big tech – especially when they are involved in payment systems – distorts market dynamics and oligopolizes industries. The oligopolization of the payment system in an anarchic form could create havoc and a meltdown. Moreover, the gross negligence and irresponsibility that Facebook has exhibited has already inflicted significant damage and pain to democracies around the world.

Let’s close by returning to the definition of sound money. Sound money is reliable money that advances and reflects stability. Sound money is a trustworthy unit of account. Sound money enhances institutions and democracy. Sound money helps producers, consumers, and investors to make rational decisions. Sound money is honest money that is not manufactured at will or artificially restricted by arbitrary rules. Sound money is money that reflects fundamental movements and serves as a store of value. Sound money is no one’s liability.

In the Homeric account of the virtues, the exercise of virtue should exhibit qualities that sustain the social order and advance excellence in some well-marked area of social practice. To excel means that someone excels at war like Achilles, or sustains a household like Penelope does. Nestor shows us how to excel in providing counsel, and Homer himself excels in telling a tale. When Aristotle speaks of excellence, he refers to a person excelling in some kind of human activity (geometry, flute-playing, or war). I am afraid that the cryptos advance a pseudocurrency that cannot excel in the Homeric account of virtues.

Cryptocurrencies and Pseudocurrencies Meet Homer: The Tale of New Wine in Old Wineskins Continues

Author : John E. Charalambakis

Date : June 27, 2019

What happens if you put new wine into old wineskins? Simply, the old wineskin will burst during the process of fermentation and then a mess will be created, value will be destroyed, and productive resources will be wasted.

Societies have been experimenting with fiat money for centuries. Fiat money (paper money that has no intrinsic value) leads to the accumulation of liabilities, the issuance of IOUs/Promissory Notes/Bonds, the latter are used as collateral in the credit creation process, which in turn elevates other paper asset prices, which furthermore are used as collateral for additional credit issuance, and the proliferation of the rehypothecation process leads to securitizing the bubbles into tradable instruments which somehow can be justified to trade at 30/40 times their EBITDA. And when someone asks “how does this all end?”, the answer may be found by looking into the history of finance which teaches us that all bubbles burst and the worst of them burst through the engine of finance a.k.a. war. Nowadays, the latter can take different forms (trade, finance, technology, cyber, etc.) without of course excluding the possibility of an arms conflict.

By no means should the statements above, or previous arguments for a sound monetary system, be perceived as a crying wolf argument or as a goldbug proposition. The world has evolved so much that a pure gold-standard financial system – which from a historical standpoint never took place – will suffer such a contraction where depression would prevail. However, from that extreme to swing to the other extreme where anything goes and the whole system is based on pure fiat, there is a lot of room for a golden medium position that can anchor economies and their financial system.

The absence of an anchor with intrinsic value has led societies to invent monies and forms of payments which in parallel to other forms of fiat can fascinate crowds and create additional bubbles which could go through cyclical phases of bubbles, as we have witnessed with Bitcoin and similar cryptocurrencies.

About a week ago, Facebook announced that they are getting into the business of digital currencies. Obviously, they are jealous of Alipay in China. Their cryptocurrency will be called Libra and was proclaimed as a bubble-free crypto because its value will be determined by other fiat paper currencies! I believe that we can all understand the logic of a tech giant wanting to control the means of payments.

While I support competition – a cornerstone to wealth creation and to society’s wellbeing – I cannot see how a pyramid of fiat currencies advances competition, let alone solves the quest for a stable store of value. Facebook’s announcement gave wings to Bitcoin to fly to a price of over $13K. Obviously the memory of its epic bubble bursting not long ago seems to be forgotten, let alone the fact that it is an inefficient (given that it processes less than half of a percent of the transactions that Visa processes), and costly form of payment.

How in the world rational investors could believe that in a sea of problems (Middle East rising tensions, trade and tech wars, Chinese and EU tremors, let alone debt, derivatives, and unfunded liabilities, to name just a few) pseudocurrencies can become anchors of stability, is beyond belief.

Artificially imposed scarcity can raise prices and can create illusions of wealth and a paper paradise. The systemic risks imposed by the cryptos are such that the Financial Stability Board has begun issuing warnings. Moreover, market power by the big tech – especially when they are involved in payment systems – distorts market dynamics and oligopolizes industries. The oligopolization of the payment system in an anarchic form could create havoc and a meltdown. Moreover, the gross negligence and irresponsibility that Facebook has exhibited has already inflicted significant damage and pain to democracies around the world.

Let’s close by returning to the definition of sound money. Sound money is reliable money that advances and reflects stability. Sound money is a trustworthy unit of account. Sound money enhances institutions and democracy. Sound money helps producers, consumers, and investors to make rational decisions. Sound money is honest money that is not manufactured at will or artificially restricted by arbitrary rules. Sound money is money that reflects fundamental movements and serves as a store of value. Sound money is no one’s liability.

In the Homeric account of the virtues, the exercise of virtue should exhibit qualities that sustain the social order and advance excellence in some well-marked area of social practice. To excel means that someone excels at war like Achilles, or sustains a household like Penelope does. Nestor shows us how to excel in providing counsel, and Homer himself excels in telling a tale. When Aristotle speaks of excellence, he refers to a person excelling in some kind of human activity (geometry, flute-playing, or war). I am afraid that the cryptos advance a pseudocurrency that cannot excel in the Homeric account of virtues.