In this week’s commentary we employ lots of graphs, which in our humble opinion, tell us an unfolding story that might be full of challenges but also portfolio opportunities.

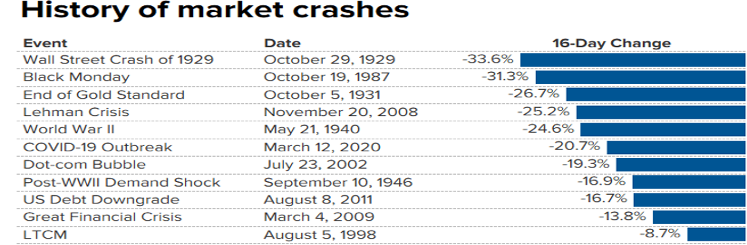

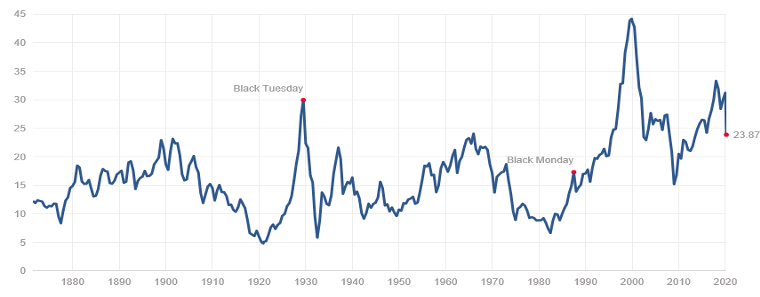

So, first a quick refresher of market crashes.

Then, a helicopter view of the different sectors in the equity markets over the last month. This is a sea of red where well-known companies have lost a significant portion of their value.

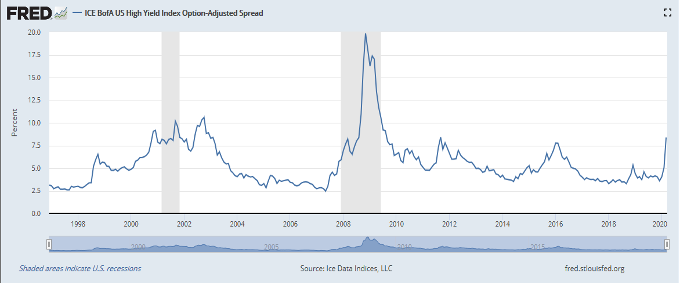

The record level of volatility is amplified by the fact that we live in a sea of corporate debt which has risen to almost $75 trillion. Such enormous amounts of debt cannot act as a buffer to absorb shocks. On the contrary it could become the trigger of financial ruptures. As concerns rise, so do the spreads between high yield bonds and Treasuries (see graph below). As noted earlier, rising spreads could become a cornerstone of financial stress and inflict an enormous amount of pain in the economy. So, while we believe that the Fed acted unwisely when it cut rates twice (between meetings), we believe that actions taken to relieve pressures in the credit markets were proper and needed.

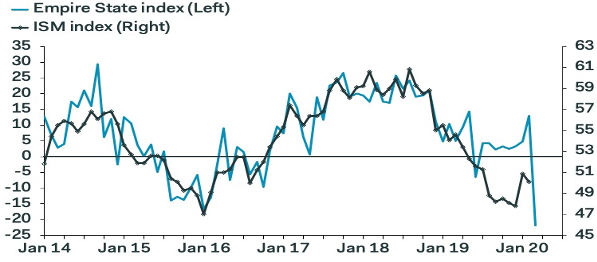

As we have been writing to our clients, we believe that the chances of recession are very high. We estimate them at close to 80%. On the other hand, we do not believe that credit markets will freeze. The fact is that the data do not reflect yet the consequences of the Covid-19 and the impact will be seen in Q2. However, initial data released on Monday (see figure below) shows a major blow to manufacturing activity which certainly will be amplified by the forthcoming collapse in demand and which in turn will reduce the supply side even more, leading the economy into a vicious cycle.

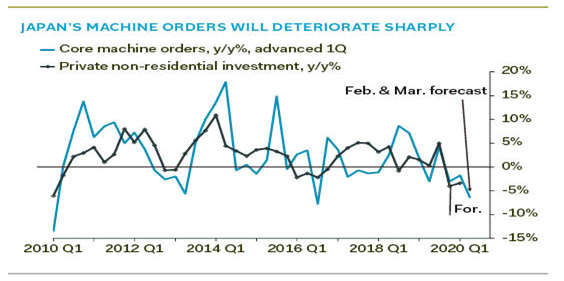

Needless to say, this is a global phenomenon and we present below estimates of Japanese capital investments which show the forthcoming contraction. China is also expected to have close to zero growth in Q1 and European economies are probably already in recession.

Here are some estimates regarding the Chinese economy:

• Chinese retail sales plummeted more than 20%.

• China’s industrial production dropped by more than 15% YTD.

• Chinese fixed asset investment has declined by close to 30% YTD.

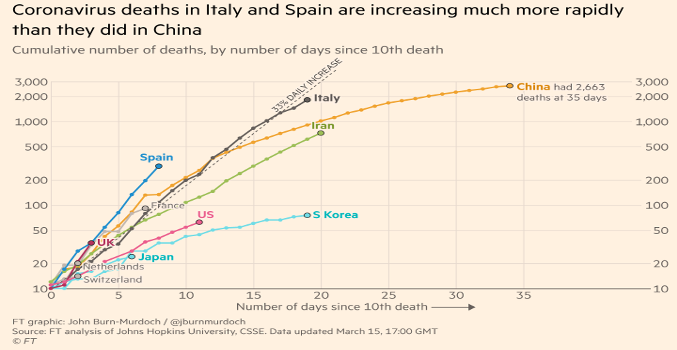

Europe now has become the epicenter of the crisis (see below); however the lack of proper preparation in the US may make the US the epicenter too. The good news of course is that when restrictions are imposed, the growth rate of infections decreases. Of course that does not cure the virus.

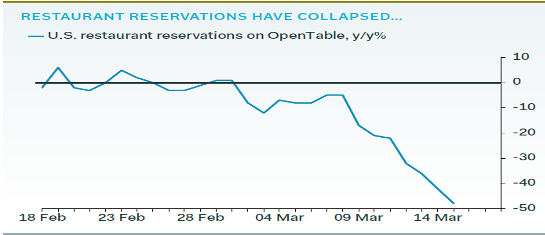

The impact on demand may also been seen below. Not necessarily the most important statistic but indicative enough of the impact on demand for services.

The unstable situation is reflected in the different sectors of the economy. Well-known firms within particular sectors have lost close to 50% (if not more) of their value in the last month. Certainly, we should consider that the pandemic that triggered the bear market, became also the stepping-stone of more reasonable valuations. We present below the CAPE (Cyclically Adjusted Price-Earnings) ratio which as of last evening stood close to 24. It is still overvalued relative to the historical average of 16. However, if we consider zero interest rates around the world, then the adjusted CAPE requires another drop in the equity markets of about 10%. Therefore, we believe that the worst is not over yet. Assuming that a drop of another 10% materializes (over a few sessions and in the course of several days which will include also sessions with gains), then capitulation may bring stabilization and the turning point which a priori demands government competency in containing the pandemic, addressing supply needs, and ensuring that proper buffers are in place, until a vaccine is found.

The fact that almost all asset classes lose ground (certainly not by the same percentage) signifies investors’ fears at a time when war of words (between Saudi Arabia and Russia and not only) achieve the inflammation of a wall of worries that is being constructed by an amalgam of unpreparedness, overvaluations, market inefficiencies, over indebtedness, and in some cases pure incompetence.

In late January we sent an email to our clients informing them that we will be more conservative and raise cash. On February 6, we posted a commentary explaining some of the reasons that made us believe that a correction would be forthcoming. Each account ended having between 20-45% in cash. As the market moves towards capitulation and eventually stabilization opportunities will arise to deploy that capital either with outright buys or by selling Puts.

Allow me please to close with the same message we have been conveying to our clients: The sun will rise again. The crisis opens up a window of opportunities to enhance portfolios with solid companies at significantly lower valuations, and that timing will come. Don’t jump from the train as we go through a dark tunnel.