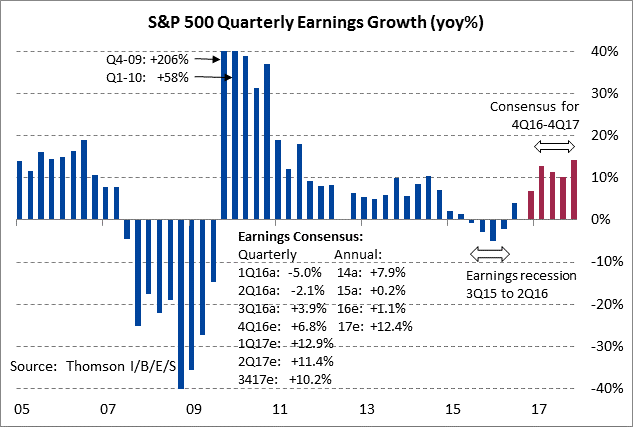

More than 65% of companies that have reported earnings in the last few days have beaten estimates, which is a little bit higher than the long-term average. So and as the graph below shows, it seems that the earnings recession is over and that corporate profits are in healthy territory, hence the equity markets’ levels. If that is sustained, then we could say that small and mid caps might continue performing better than large cap entities.

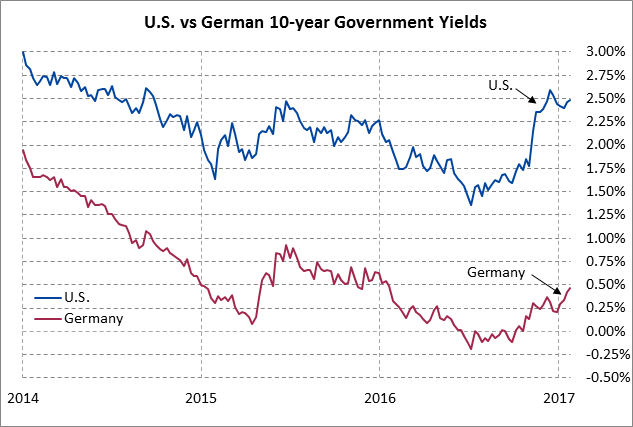

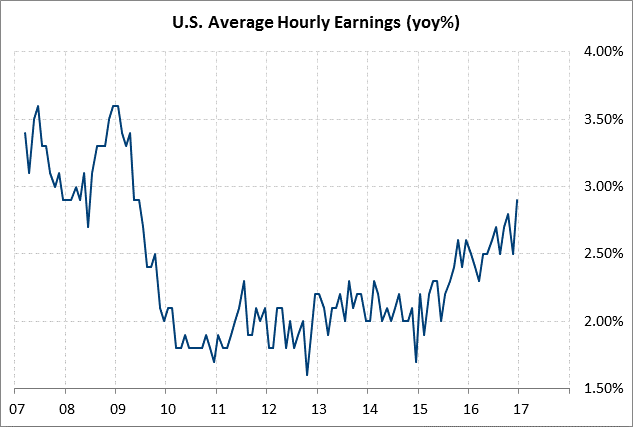

Of course, we cannot ignore the fact that only 49% of corporations reported higher sales, vs. 59% which is the long-term average. However, this is not so concerning –as least for now – for two reasons: First, it shows pricing power which is healthy. Second, sales are expected to rise as incomes are rising too. The last facts can be demonstrated through the rising yields that reflect the turning of the page related to deflationary fears, and the rising hourly wages (both of which can be seen below).

As consumer confidence remains strong, and as income rise, sales volumes should increase also. Of course, as the PCE deflator exhibit healthy upswing trend, the pressure on the Fed will be maintained to raise short term rates next month, which is a healthy thing. The combination of these factors, along with the production estimates point to a possibly earnings growth for 2017 between 9-11%.

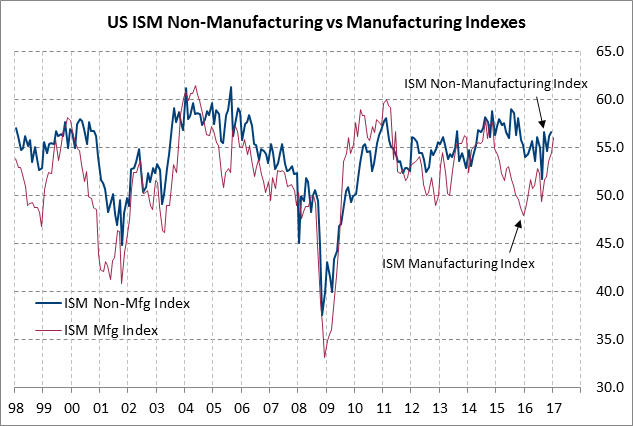

Speaking of manufacturing activity, the larger than expected ISM number released last week (see graph below) bodes and blends well with the other positive news (increase labor force participation rate, higher than expected number of jobs created).

Could the equities market then experience new highs? The current US economic expansion is 91 months old, making it the fourth longest in economic history. Could it last longer driving the market to even higher levels? The answer is yes, it could for three basic reasons: First, the financial crisis was deep and the recovery has not been as strong as expected. Second, the unorthodox monetary measures by the Fed uplifted the markets (rather than the main driver which is corporate profitability). Third, if growth and profitability grow (as it seems they do currently) then, the normalization of policies – absent erratic and unpredictable moves – should be conducive to an elevated market.