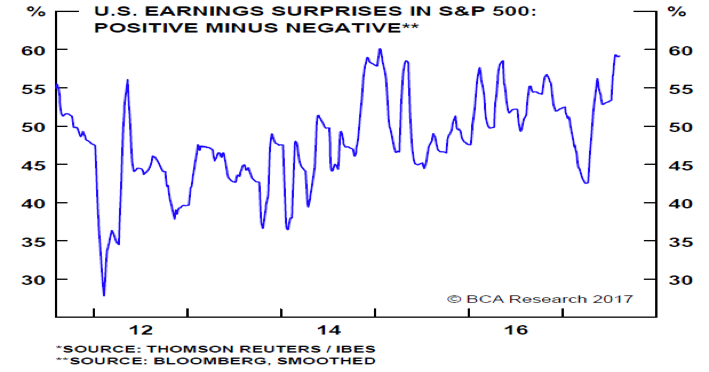

Over the course of the past several months we have reiterated the point that good growth earnings provide market justification for further rises in the equities market. We continue supporting that thesis and we still hold the view that future earnings for the next two-to-three reporting cycles could show healthy growth in the neighborhood of 9-12%. As the first graph below shows, the earnings surprises also follow an upswing, and as long as this continues the overall market could still enjoy an upward trend.

What could then possibly derail this trajectory? We are of the opinion that geopolitical rhetoric related to North Korea cannot alone derail this trajectory. However, political instability centered on the White House, as well as the potential inability to pass tax reforms in the next 5-6 months, in combination with the Fed’s tightening (in terms of shrinking its balance sheet and also rising rates), could derail this upward trajectory.

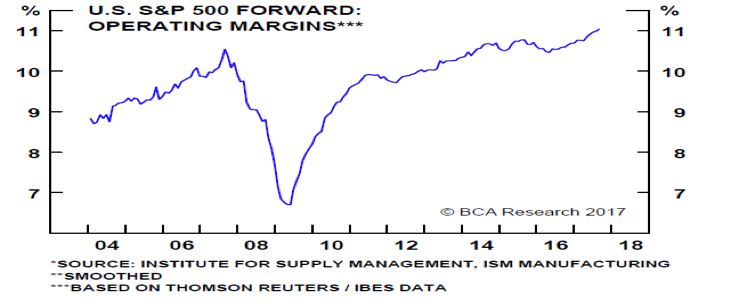

What encourages us is the fact that earnings which actually perform the heavy lifting remain solid, given that profit margins remain healthy. As the next graph demonstrates, profit margins are on an upswing, but to that we also need to add that overall sales growth is expected to be healthy, and we expect higher earnings from financials, tech companies, most of the industrials, and possibly the energy sector.

How then should we protect a portfolio at this time, given that some clouds may start gathering in the investment horizon? Our view is that as long as volatility insurance is cheap (VIX) it might worth looking into this (either directly or through options), and we would also consider slowly increasing the exposure to tangible real assets (such as precious metals) which have intrinsic value.