Corporate buybacks are used to return cash to stockholders. Moreover without committing to higher dividends they boost earnings per share, and anchor the spread of equity dispersion. In times when companies do not expect significant growth and the prospects of internally-funded expansion are not very bright, corporations are expected to revert to corporate buybacks.

However, this time the situation seems to be different. Corporations seem to be “hoarding” the “abundant” cash that sits in their balance sheets. They are hesitant in unfolding plans of organic growth, their capital investment and expansion plans seem to be stagnant, very few are increasing their dividends, and even fewer announce buyback plans, while the trend is to keep the cash, even if the latter results in no returns.

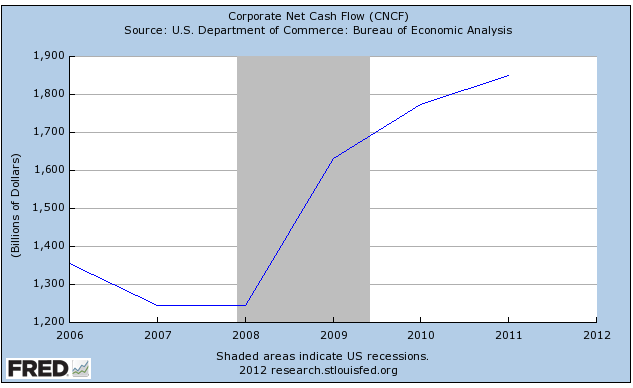

Let’s review the picture of corporate cash in the US, as shown in the figure below:

It is very normal for corporations during crises and recessionary times to accumulate cash in order to avoid funding issues, especially when lending is tight. However, the cash accumulation has exceeded any expectation, especially under anticipations of market normalization. Therefore, even if the growth rate of cash accumulation is no longer exponential, its continuing upward trend may be troubling.

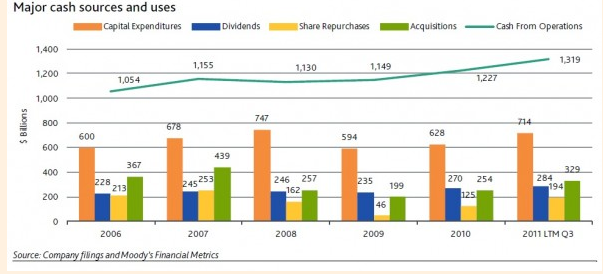

The cash in the balance sheets is used for dividend payout, capital expenditures, buyback of shares, acquisitions, etc., as the graph below demonstrates.

Now, if we took a look at the corporate buyback picture in the EU, we would observe the following: Prior to the 2007-’08 crisis they amounted close to $3.86 billion. This time last year they were about $2.75 billion. Nowadays they are barely $590 million. Why such a dramatic decrease of more than 75% in EU corporate buybacks? What kind of signals do companies send to the markets?

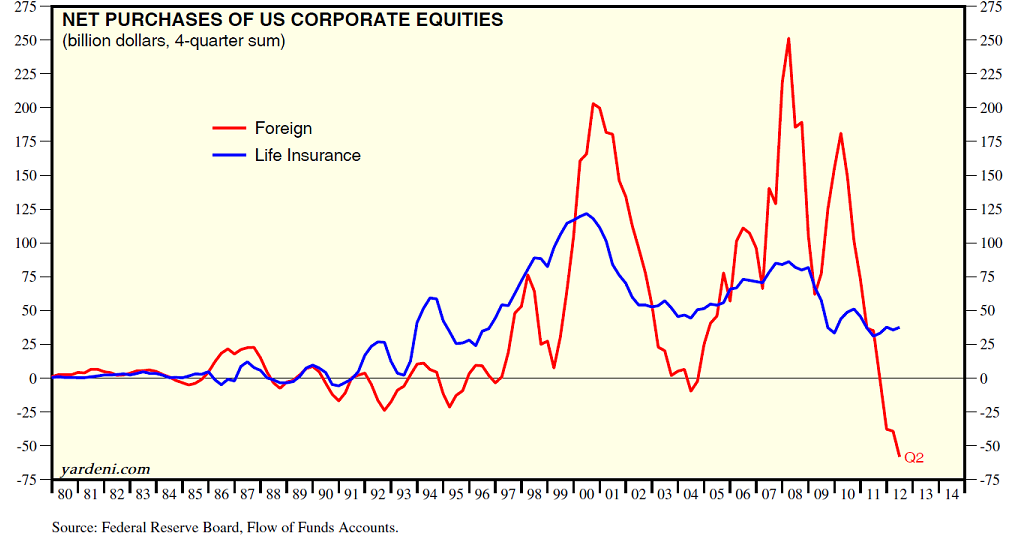

Part of the answer to the above question might be given by taking a look at the net purchases of US equities by foreign and domestic institutional investors.

As the graph above shows, we are entering a period of a downward trend that may be solidified in the near future. If that takes place, then the overall risks in the economy will be shifted and even gain momentum, and such a shift could create tectonic movements in the markets. The symptom may be the fear of the US fiscal cliff; however the cause is uncertainty of growth, of sales, and of sustainable incomes in the midst of too much debt. If we add to that list the unhealthy EU banks’ balance sheets, and the forces of disintegration in the EU, then we have a cocktail whose main ingredient is “give me cash and forget about anything else”.

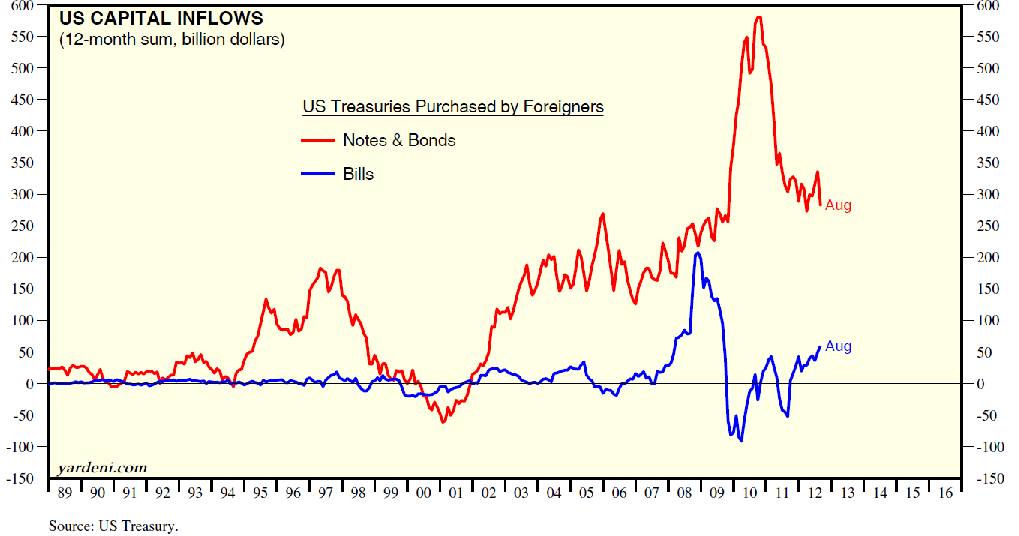

The shift to cash for precautionary and preservation reasons is exemplified by forces of deleveraging and will be amplified by suspicion over bonds. Let’s not forget that we have already started seeing less and less foreign interest in US bonds, as the graph below shows.

The declining appetite for paper liabilities is seeking a partner for its tango, which in turn may be found in a predictable event such as a Spanish full bailout, or another Greek financial tremor.

No matter who that tango partner may be, the message that is conveyed by the analysis above implies an increase in market volatility and risk. Such increases will shift the center of financial gravity to lower valuations, where the cash can de deployed for acquisitions of assets that have experienced an internal devaluation. In the meantime hedging portfolios might be a good tactic to follow.