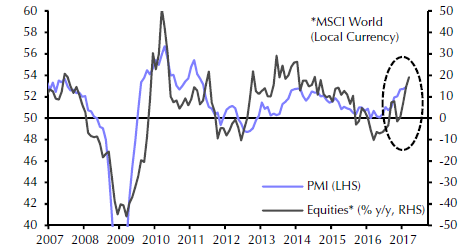

Over the course of the last few months, we observe that not only developed markets have been enjoying good returns, but also emerging markets rise along with them. As the following graph shows the Global PMI Index (signifying manufacturing activity) is close to its three-year high, which if combined with upbeat business surveys and rising consumer confidence, may lead someone to the conclusion that spending is about to increase substantially.

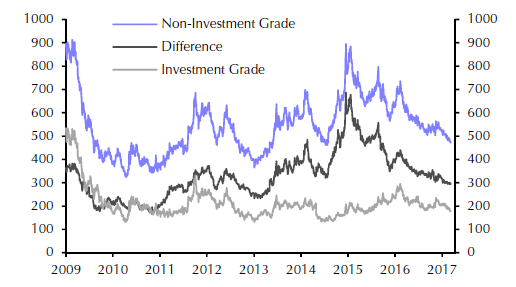

As those lines are being drafted, the expectation is for the Fed to raise rates during this week’s meeting. As the Fed raises rates, the risk-free component of a bond portfolio rises too, and therefore the “search for yield” adventure may start taking a back seat. If that is to happen, then we anticipate that the credit spreads between emerging markets’ financial instruments and developed economies yields to start widening. Furthermore, our working assumption is that emerging markets spreads have been underestimating the pace of future Fed tightening.

Therefore, we expect that in the near future, the credit spreads in emerging markets to start rising, as the search for yield declines given Fed’s tightening. Hence, we anticipate that the convergence we have seen in the last few months to convert into a divergence at the same time that the EU launches its multi-speed integration platform which will allow its developed members to diverge faster from its slower growing members. In this reversal we anticipate that emerging markets corporate bonds to suffer a lot more than emerging markets sovereign bonds, and therefore caution is needed.

The figure below shows the investment grade (gray line) and the non-investment grade yields (blue line) yields in emerging markets. The difference i.e. the spread is shown by the black line. As it is clear, the spreads are dropping, but as stated above, we expect this to be reversed.

As such reversal takes place, we anticipate emerging markets to start experiencing some tremors and possibly capital outflows, which may force local central banks to tighten monetary policy which in turn may reduce economic activity. Under such circumstances, unless developed markets investors’ appetite is revived for emerging markets, we would not be surprised if by the second half of this year a risk-on approach is observed for developed markets but a risk-off approach for emerging markets.

After all it could be that the open/close debate (regarding globalization) finds its own channel to implement a divergence that down the road could backfire for all.