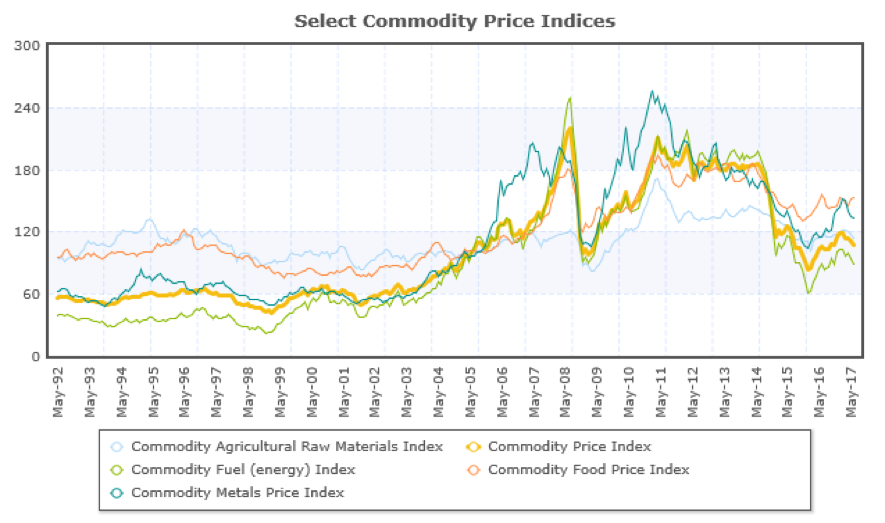

Commodity prices usually follow long cycles. As the graph below shows, commodities enjoyed a good run from the early 1990s to the dawn of the financial crisis and recovered pretty quickly from the crisis, then experienced a downward trajectory for about five years since 2011. However, they have been recovering and we would not be surprised if that recovery continues in the foreseeable future.

Therefore, for an investor interested in greater diversification that will also add an asset class with lower than normal correlation from other asset classes, it may be good to examine the possibility of some exposure to commodities. It is interesting to note that Glencore – one of the largest producers of copper and zinc – just reported profits for the first half of the year of $2.5 billion vs. a $369 million loss for the same period last year. Rio Tinto – another miner – reported gains for the first half of $3.3 billion. Anglo American PLC also reported profits of over $1.3 billion.

The trend for electric cars is driving demand for copper, nickel, cobalt, and zinc, which if coupled with demand for energy storage systems should be good news for these metals as well as the companies involved in their production and processing. However, agricultural commodities are – to a large extent – on an upswing too, while history is on their side as a good hedge against falling stock prices.

It is also our opinion that the strengthening of the commodities market may coincide with the turn in the volatility index, and therefore we would not be surprised if volatility starts rising slowly with some temporary spikes either due to geopolitical rhetoric or due to internal US political dysfunctionalities. Therefore, investors may want to explore options on the VIX as a hedge in a market that could experience rising volatility.

Let me close this commentary with just a brief thought on digital currencies that try to squeeze themselves into the fiat money scenery using cryptography. I believe in competition, including forms of payment, therefore I welcome them. As of recently, they command a market value that exceeds $120 billion. Some of them have more than tripled in value in the last year. Could they be in bubble territory? Of course they could, but that’s not where I am headed. I believe that we may have in our hands a game changer since last week’s announcement that the Chicago Board Options Exchange – the largest US options exchange – is planning to launch options on Bitcoin. The planned Bitcoin futures (as early as the fourth quarter of this year) in relation to options on commodities and volatility might worth looking at in terms of diversification, lower asset class correlation, and hedging.