Three weeks ago, we wrote about the factors propelling the energy transition. For this week’s commentary, we will detail the energy challenges facing Europe in particular.

Despite being the world’s second-smallest continent, Europe boasts the world’s third-largest and third-richest population, making it a key market in the global economy. Leaders of the European Union’s member states are looking to leverage Europe’s market power to decouple the bloc from dependence on Russia. In order to do so, Europe will need to significantly diversify its energy supply, reducing its reliance on imports by building infrastructure at home.

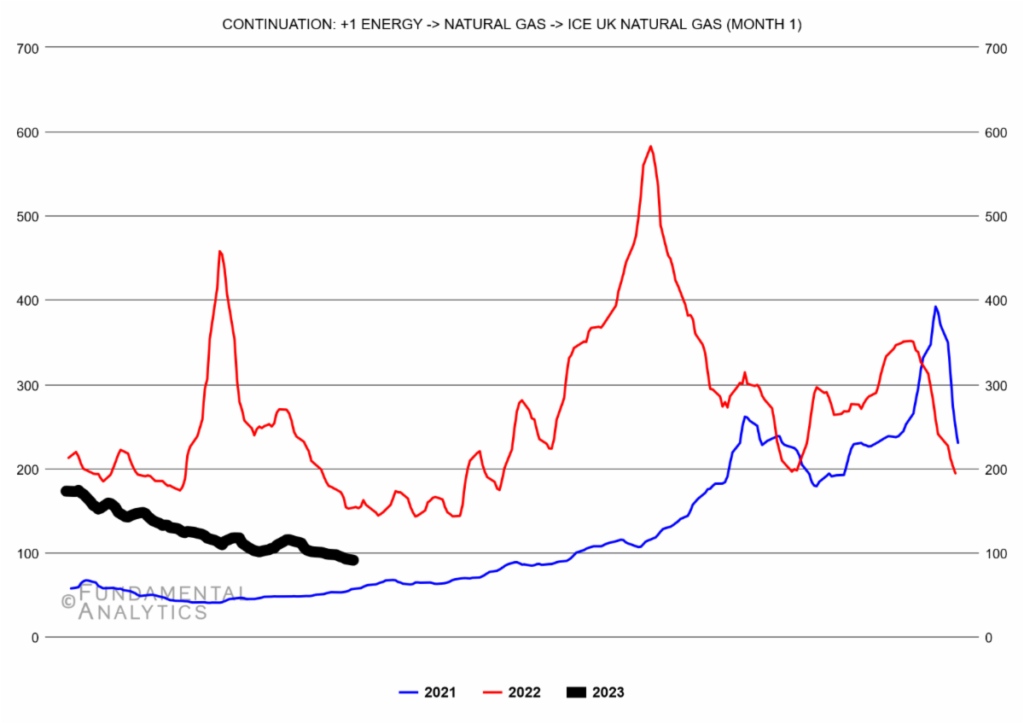

Already, Europe has begun to decrease its dependence on Russian energy, galvanized by Russian President Vladimir Putin’s invasion of Ukraine. In the aftermath of the invasion, Western economies drastically reduced their Russian imports, especially of energy products, which sent the prices of natural gas, crude oil, and several other commodities skyrocketing. The price of natural gas in the United Kingdom (UK) alone more than doubled in the wake of the invasion.

Since then, prices have stabilized, but the volatility seen in the intermittent months has cast a shadow over Europe’s ability to meet its energy needs. While European leaders had been discussing the continent’s dependence on its easternmost nation for fossil fuels for some time, the sudden shock brought that idea into sharp focus. There were concerns that gas rationing could bring European industry screeching to a halt. Thankfully, that possibility never materialized, thanks in no small part to the bloc’s massive pivot to liquified natural gas (LNG) imports and a milder-than-expected winter.

LNG represents a significant step towards reduced dependence due to its flexible infrastructure. The liquefaction process allows natural gas to be transported from any global supplier to regasification terminals in Europe via tankers, whereas the traditional pipelines lock in a single source of natural gas to be sent along a fixed route. By making the source and import point of energy modular, Europe’s energy infrastructure can be tailored to better accept imports from friendlier exporters, such as the US.

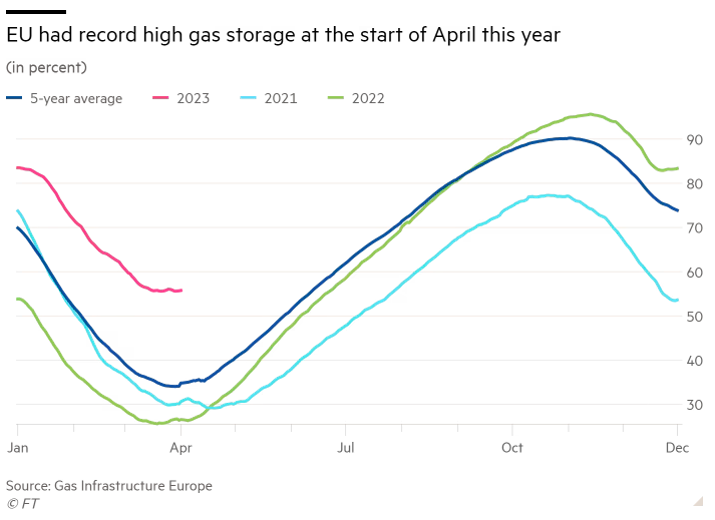

And import Europe did. With supplies from Russia effectively cut out of the energy mix following the sabotage of the Nord Stream I and II pipelines in September 2022, Europe began stockpiling LNG, with storage nearly reaching its maximum capacity in late 2022. In some areas, a lack of onshore storage facilities led to tankers being used as storage for a time. Even with storage near full, experts warned that the stockpile would quickly be depleted, and without sufficient volumes to replenish it, Europeans would be in for a deadly winter. Thankfully, that forecast proved false as a milder-than-expected winter kept heating demand low.

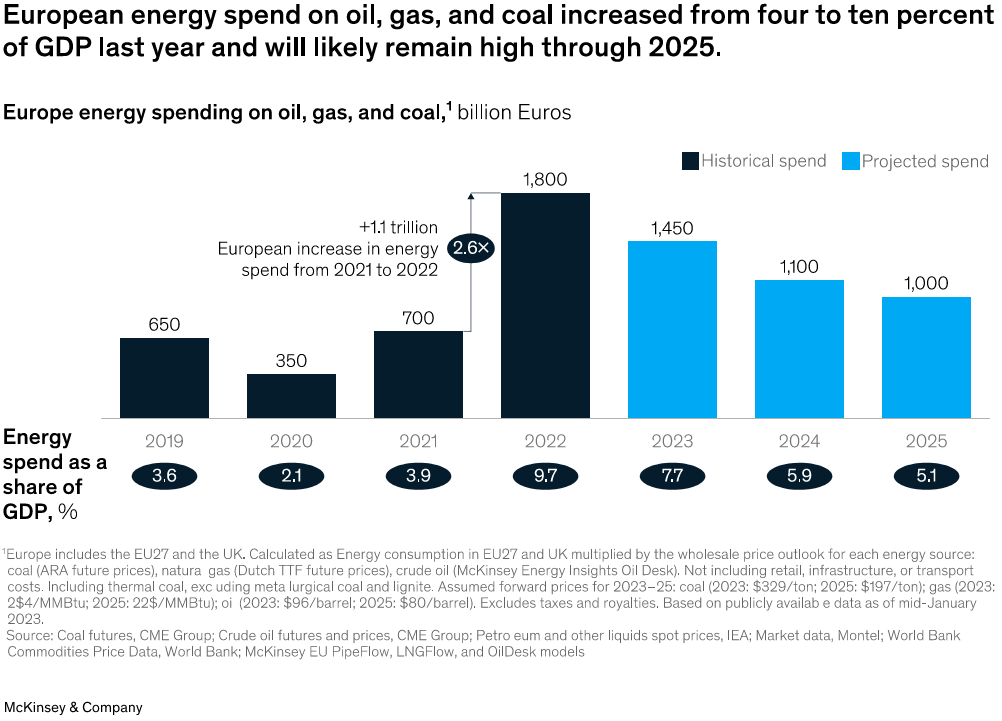

Even with Europe’s swift pivot to LNG, the shock to prices meant that Europe had to more than double its expenditures on energy (measured as a fraction of GDP) to meet demand. McKinsey anticipates that this level of spending will continue for the next few years as Europe continues to pursue energy independence.

Unfortunately for Europe, LNG cannot be the silver bullet to its energy problem. Europe has few sources of traditional energy, hence its reliance on Russia in the first place. While diversifying its energy import portfolio will reduce Europe’s risk of a bad actor leveraging energy supplies as a political tool, it does not eliminate the problem as there are still a limited number of available suppliers. With few natural energy resources of its own, Europe will have to look to its renewables sector to build its path to true energy independence.

As in equity investing, when risk is a factor, diversification is the key to stable success. During the high point of the crisis, Germany permitted two coal plants to increase operations to meet electricity demand. The move was all the more ironic due to Germany’s commitment to shutter its remaining nuclear plants earlier that year, despite nuclear energy’s proven capability as a clean and reliable energy source. Still, the crisis surrounding Russia’s takeover of the Zaporizhzhia nuclear power plant shows that over-reliance on any single source of energy, no matter how stable it may seem now, is a dangerous game to play.

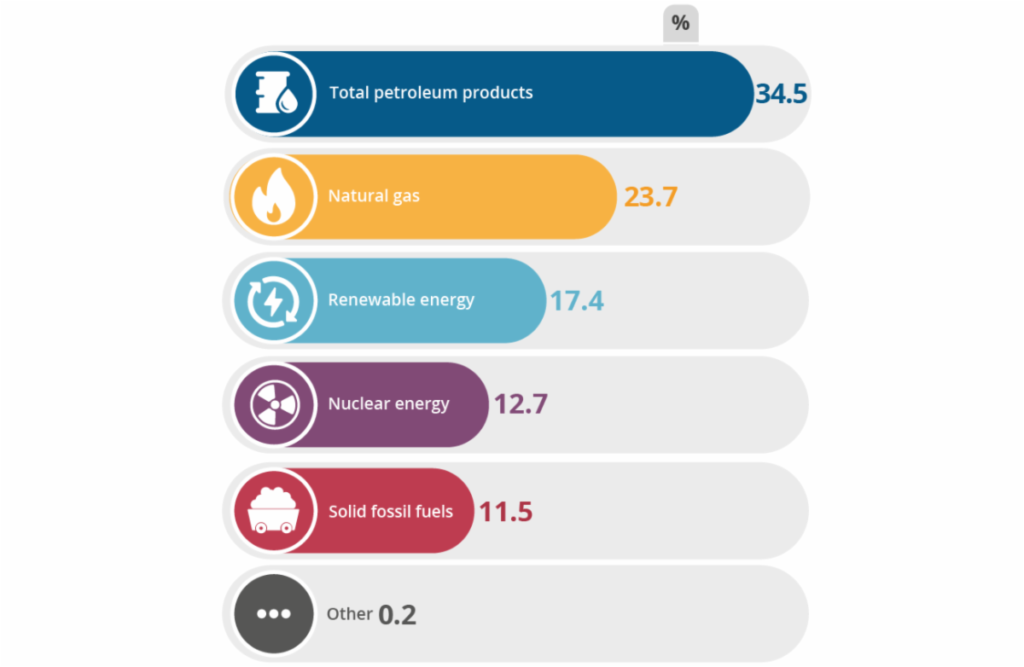

Europe still has a long way to go in ensuring its people have access to cheap, clean, and de-risked energy. Prices remain elevated and are only likely to climb unless new, cheaper sources of energy are brought online quickly. Nearly 70% of Europe’s energy still comes from fossil fuels; though carbon management legislation will help manage the risk, the impact of these emissions will be difficult to mitigate without a serious reduction in traditional energy’s share of the energy mix. Within the renewables sector, half of Europe’s renewable energy comes from wind and solar energy, which are notoriously unreliable as primary energy sources for the grid. Even with Europe’s successes in securing supplies of natural gas, passing landmark climate legislation, and building renewable energy infrastructure, the path toward energy independence remains long and difficult. But the people of Europe have faced adversity throughout their long history, and they have always emerged stronger for it. Let us hope they will do so again.