Welcome to our monthly newsletter, Carbon Market News Roundup, the goal of which is to introduce our audience to a new asset class market in the making: the carbon market. Our previous issues, along with the rest of our commentaries, may be read here.

In the last issue, we looked at challenges facing green investing and carbon removal strategies, a new International Maritime Organization (IMO) plan to charge fees on shipping emissions, and the effects of climate change on energy demand. In this issue, we examine the latest developments in the EU ETS, the simplification of the CBAM rollout, news from emerging compliance markets, and some key structural shifts in the voluntary carbon market.

EU ETS & CBAM Updates

EU, UK strike initial agreement in ETS linking talks

Carbon Pulse

EU carbon market emissions drop 5% in 2024, on track for 2030 target

Susanna Twidale, Reuters

Russia targets EU carbon policies in WTO showdown

Eklavya Gupte, S&P Global

EU Lawmakers Agree to Exempt 90% of Companies from CBAM Import Carbon Tax

Mark Segal, ESG Today

European carbon prices stayed stable in May after a strong start to the year. On May 19, reports that the EU and UK agreed to pursue a future linking of their carbon markets sent UKA prices up ~6% and widened the UKA–EUA spread, though implementation details remain unclear. Meanwhile EUAs hovered in the low-€70s.

Source: Trading Economics

For example, a mid-week EU auction on May 27 cleared 3.246 m allowances at €71.51. Brokers noted that selling pressure from futures funds kept EUAs under pressure, and EUA futures saw only “slim gains” on May 28 as long positions supported prices. Overall emissions in the ETS fell 5% in 2024 (driven by a 12% power‐sector cut) and are now ~50% below 2005 levels, putting the bloc on track for its 2030 target.

Crucially, the Commission’s May Total Number of Allowances in Circulation (TNAC) update signaled further market tightening. It announced that an additional 275.5 million EUAs will be withdrawn into the Market Stability Reserve (MSR) from September 2025 for one year. This came after TNAC data showed a surplus high enough to trigger record MSR withdrawals. By locking away these permits, the EU aims to bolster the carbon price signal. Market participants also noted that wider geopolitical news (e.g. US trade tariffs) had eased late May EUA selling, keeping prices around the €70 mark.

Legislatively, the big news was the EU–UK link initiative. Beyond price moves, the administrations agreed in principle to join their ETSs (and mutually exempt from each other’s border carbon charges).

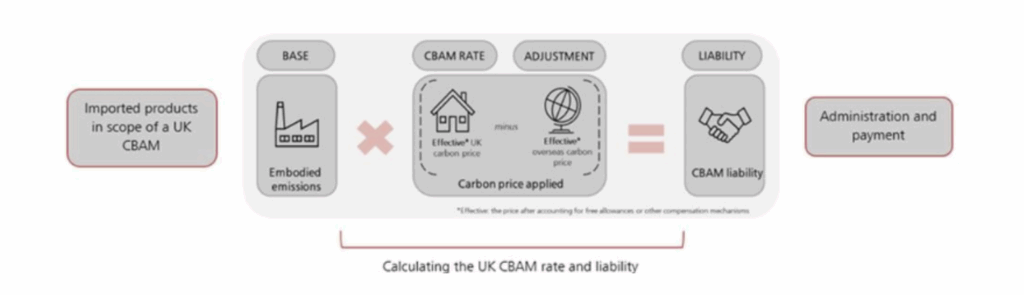

Overview of the UK CBAM Process; Source: GOV.UK

Analysts say a formal link could align UK prices nearer the EU level, affecting business costs and avoiding double-fees. The UK also confirmed plans to launch its own CBAM in 2027 to mirror Brussels’ 2026 import charge for goods (steel, cement, etc.). No other major EU ETS policy changes occurred in May, aside from normal auctioning. Future EU ETS reform (e.g. the new ETS2 for transport/heating) will start in 2027.

The EU Carbon Border Adjustment Mechanism (CBAM) is a regulatory tool designed to prevent carbon leakage—the risk of businesses relocating production to countries with weaker climate policies to avoid carbon costs. CBAM applies a carbon price to certain imports based on their embedded emissions, ensuring they face comparable costs to EU-produced goods under the EU Emissions Trading System (ETS).

The EU is pressing ahead with CBAM implementation and simplification. On April 1 the Commission opened the declarant registry, allowing importers and their agents to apply (from Mar 31) for authorized CBAM declarant status. This was a key step in the 2023–25 transitional phase: only authorized declarants can report and eventually surrender certificates. Importers exceeding de minimis levels have been urged to register early.

More dramatically, on May 27th, EU member states approved a Council negotiating position to simplify CBAM rules. They backed the Commission’s Omnibus I proposal introducing a 50‑tonne annual de minimis threshold. Under this change, about 90% of importers – mainly SMEs – will be exempted, while still covering roughly 99% of carbon embedded in imports. The Council’s general approach also aims to ease reporting (streamlining emissions calculations, verification and liability processes). Simultaneously, on May 22 MEPs overwhelmingly endorsed these simplifications, marking Parliament’s negotiating position. Both institutions will now hash out the final text, aiming to adopt the rules before end-2025.

CBAM rollout continued in practice: importers have been filing quarterly reports under the transition. Industry sources in May noted many companies were still unprepared (e.g. only ~20% of EU steel importers aware of CBAM) but duties will intensify. Russia formally lodged a WTO complaint (May 19) claiming the EU’s CBAM (and ETS) are discriminatory trade barriers. The EU defends CBAM as needed to prevent carbon leakage. Overall, by late May the world is gearing up for CBAM’s full phase-in in 2026 (when certificates must be bought to cover embedded CO₂), and the EU is focused on making that transition smoother.

Emerging Compliance Market Updates

Why Japan’s Emerging Carbon Market Could Reshape Global Trading

Phil De Luna, Forbes

China’s Carbon Markets Surge: CCER Revival and ETS Expansion

Yan Qin, ClearBlue Markets

Turkey’s Emissions Trading System and CBAM: The Futures of Turkey’s Carbon Market

Goldstein Carbon

India to launch its own carbon market by 2026

DGB Group

Brazil prepares to launch South America’s first carbon market

Anne C. Mulkern, E&E News

Emerging carbon compliance markets in Turkey, China, India, Brazil, and Japan are rapidly evolving as these countries develop regulatory frameworks to meet their climate goals and align with global carbon trading mechanisms. Turkey is preparing to launch a pilot Emissions Trading System (ETS) by 2026-2027, supported by a pending climate law that will institutionalize carbon market governance and ensure compliance with the EU’s Carbon Border Adjustment Mechanism (CBAM), critical for its exporters. This system will initially allocate allowances for free and use revenues to fund green transition projects, marking Turkey’s entry into regulated carbon trading.

China’s carbon market remains the largest globally and continues to expand in 2025, with the revival of the China Certified Emission Reduction (CCER) voluntary credit program complementing its national ETS. The market allows compliance entities to offset a portion of their emissions with CCERs, primarily from renewable energy projects, while the government is broadening the ETS coverage to more sectors. China’s state-led approach maintains tight control but aims to integrate international carbon market mechanisms under Article 6 of the Paris Agreement, enhancing market liquidity and credibility

India is on track to launch its carbon market by mid-2026, targeting 4 key sectors with a compliance market alongside a voluntary market to support non-obligated entities. The government is expected to finalize policy guidance in 2025, positioning India as a significant emerging market given its status as the world’s third-largest emitter. India’s carbon market builds on existing energy efficiency programs and aims to align with global standards, while also playing a leadership role in Article 6 negotiations that could influence other developing countries.

Brazil has formalized its regulated carbon market through Law 15.042/2024, establishing the Brazilian System of Greenhouse Gas Emissions Trade (SBCE) to meet ambitious emission reduction targets of 59-67% below 2005 levels by 2035. This cap-and-trade system will cover multiple sectors and is overseen by an inter-ministerial committee, complementing a robust voluntary carbon market. Brazil’s approach reflects a strong commitment to climate action ahead of hosting COP30, where it aims to showcase leadership in carbon market development.

Japan is transitioning its voluntary GX-League emissions trading system into a compliance ETS by 2026, with auctions planned from 2033 to strengthen price signals and market participation. Japan has signed numerous bilateral agreements to source Article 6.2 carbon credits, aiming to implement international carbon market rules agreed at COP29. While its current voluntary ETS has weak demand due to the absence of mandatory targets, the planned compliance system reflects Japan’s strategy to integrate domestic and international carbon markets and support its net-zero ambitions.

Voluntary Carbon Market Developments

Demand Holdings Steady as Turnover Stabilizes

Ecosystem Marketplace

Jennifer L, Carbon Credits

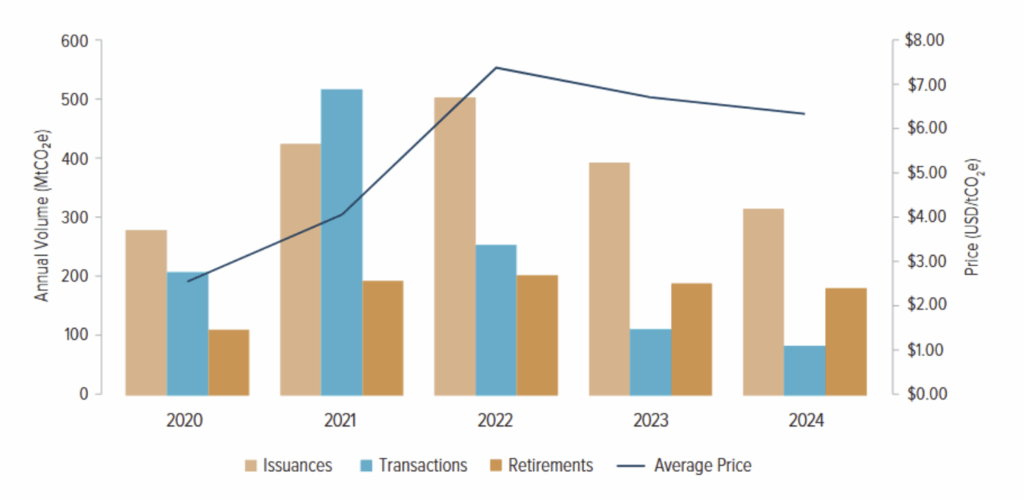

In the voluntary market, major trends were more structural than headline-grabbing. A new Forest Trends State of VCM report highlights that 2024 transaction volumes collapsed by ~25%, as the market rebalances towards quality and scarcity. Importantly, credit prices fell only modestly (~5.5%), and retirements (actual retirements by companies) remained steady around 182 Mt in 2024, indicating resilient demand despite market turbulence.

The report also finds a dramatic buyer preference for removals and new vintages: removals credits (e.g. reforestation) traded at roughly 4× the price of reduction credits, and very recent vintages commanded large premiums. The Integrity Council’s Core Carbon Principles are beginning to shift demand towards certain project types, yielding higher prices and volumes where CCP-approved credits exist.

Supply-side, several infrastructure and tech developments emerged. Standards bodies are digitizing. Notably, Verra announced a partnership with blockchain platform Hedera to modernize project data management. This “digital MRV” initiative will let projects submit documents and proofs on a secure registry, reducing paperwork and enabling audits. Verra plans to digitize dozens of methodologies by end-2025, paving the way for faster issuance and transparency. Such moves aim to rebuild trust and scale up the VCM after a period of integrity scandals.

Finally, voluntary credit prices saw a slight seasonal bump. Carbon Pulse noted in late April that VCM indices edged up as traders returned from holidays, although the overall market remained weak after recent oversupply. Investors are nonetheless preparing new vehicles: for example, two firms launched a new $200 million US forest carbon fund in April to finance high-integrity projects. And registries announced minor updates to methodologies (e.g. adding nature-based project types) to attract buyers. In summary, the voluntary market appears to be in a consolidation phase: turnover is down from its 2021–22 peak, but a focus on quality and new digital infrastructure could set the stage for a steadier, more credible market ahead.

Recommended Reads

Global warming reaches 1.58C over 12 months

Corporate America Owes the Rest of Us $87 Trillion

Scientists Tally Oil Majors’ Climate Damage With Eye to Legal Liability

Carbon to Clean Tracker: Repurposing Fossil Fuel Power Stations into Clean Energy Hubs