June 14, 2024 | Volume 1, Issue 8 | The BlackSummit Team

Welcome to our monthly newsletter, Carbon Market News Roundup, the goal of which is to introduce our audience to a new asset class market in the making: the carbon market. Our previous issues, along with the rest of our commentaries, may be read here

In the last issue we looked at the nearly $9 trillion financing gap toward the global green transition, the G7’s agreement to phase out coal use, and we began our series on the electric vehicle market, giving an industry overview and market analysis This issue, we will explore the recent guidelines for carbon markets handed down by the US federal government, signs of a turnaround in carbon markets, and we will continue our series on the electric vehicle market, focusing on emerging technologies that will be crucial in the future of the market.

Carbon Markets Given Credibility Boost by US Government

The End of Greenwashing Is Now Within Sight

Michael Bloomberg, Bloomberg

Carbon Offsets, a Much-Criticized Climate Tool, Get Federal Guidelines

Brad Plumer, The New York Times

The US government recently released a Joint Statement of Policy and Principles for Responsible Participation in Voluntary Carbon Markets. The guidelines emphasize transparency and accountability, and require that credits be quantifiable, represent actual reductions in emissions, and keep emissions out of the atmosphere for a specified period of time.

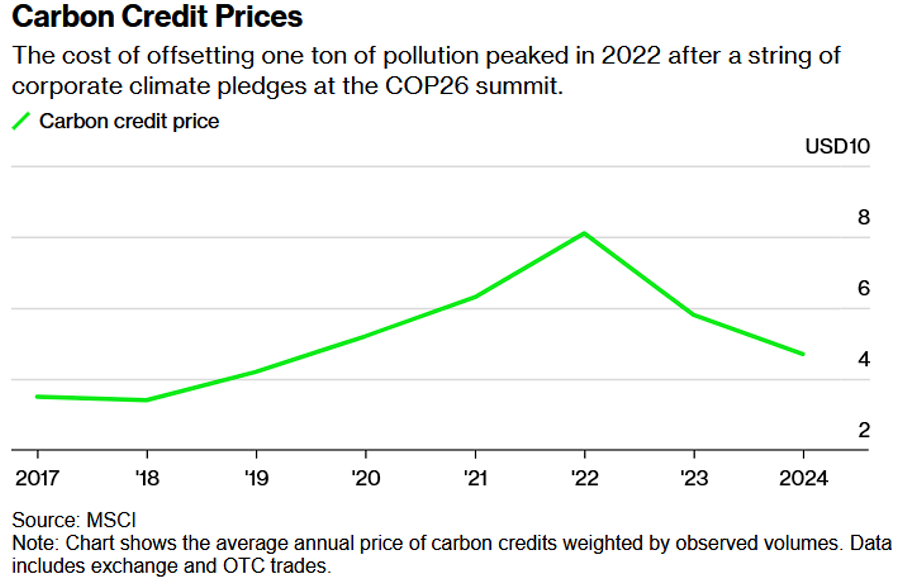

This move aims to bolster the credibility of the voluntary carbon market (VCM), which plays a crucial role in channeling private capital toward decarbonization efforts. This market mechanism can move faster and move more capital than government regulations. Washington’s principles address the issue of integrity, which carbon markets have struggled with after a series of scandals and buyer pullback, leading to the market value dropping by over 60% according to some reports.

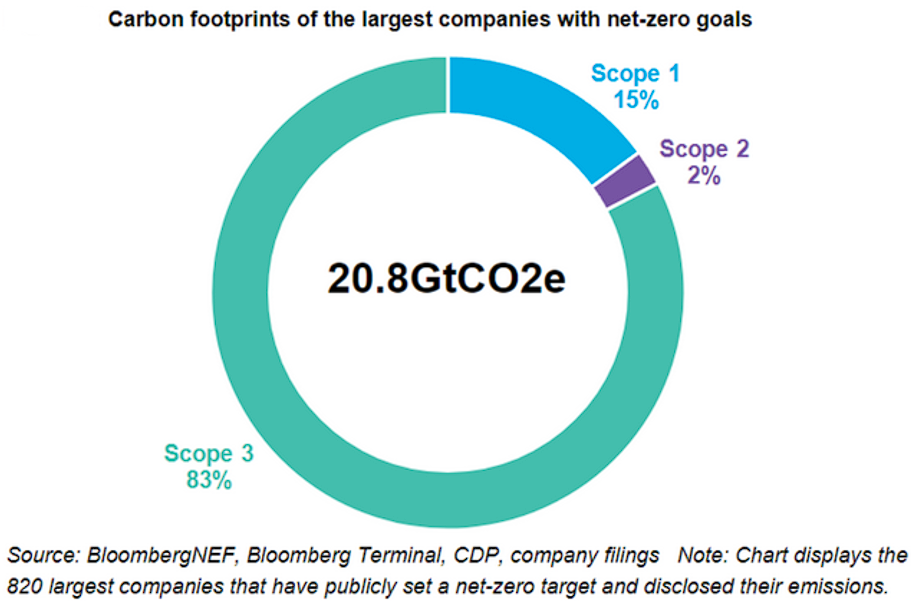

Businesses are increasingly setting ambitious goals to reduce emissions, particularly difficult-to-reduce Scope 3 emissions that come from their supply chains and customers. Carbon credits offer a way to address these indirect emissions, and ensuring a transparent and credible market reassures corporations, their shareholders, and the public that there are real emission reductions that are taking place.

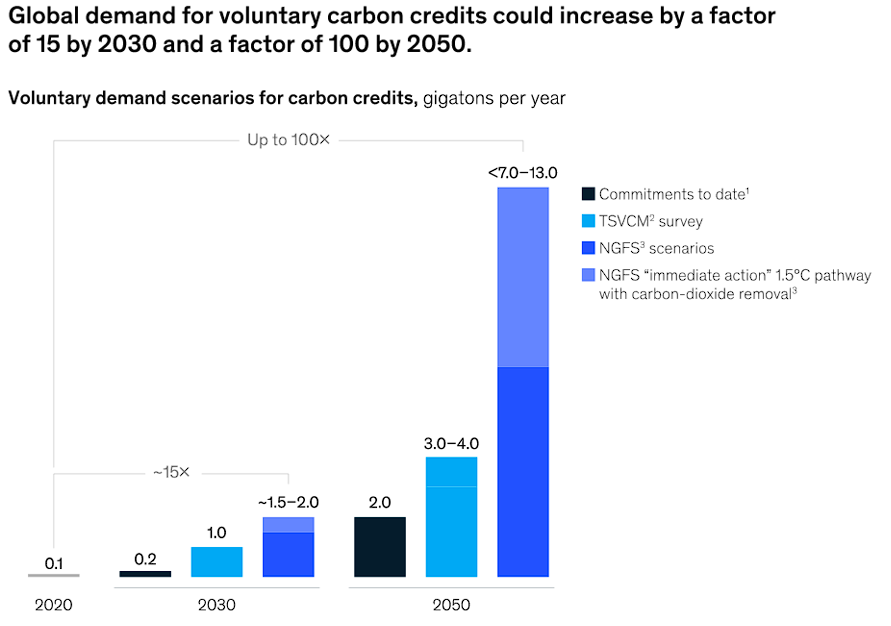

Treasury Secretary Janet Yellen believes that this enhanced market could help achieve carbon neutrality by 2050, aligning with the Biden administration’s climate goals and international efforts to mitigate global warming. In the past year, businesses and individuals spent a combined $1.7 billion voluntarily buying carbon offsets.

The guidelines will have a global impact. A more trustworthy and standardized carbon credit market has the potential to become a powerful tool in the fight against climate change, attracting significant private sector investment and accelerating emissions reductions.

Carbon Markets See Upcoming Turnaround

Wall Street Backers See Breakthrough Moment for Carbon Offsets

Natasha White & Alastair Marsh, Bloomberg

Recent scandals over the past year and a half have sent shockwaves through carbon markets, from the collapse of major offset projects to high-profile lawsuits challenging companies over false climate claims tied to purchased credits. As the dust settles, analysts are closely watching how the landscape evolves.

The recent US government announcement of VCM guidelines is an invitation for other countries and private firms to jump back in. JPMorgan, Bank of America, and Barclays have built carbon trading and finance desks, while other large firms such as Citigroup and Goldman Sachs are exploring financial opportunities in offsets and green financing for developing countries, which will bear the worst of the effects of climate change. BloombergNEF predicts a market rising as high as $1 trillion within the next 30 years. This would encompass tremendous upcoming investment into the supply side of the market and trading infrastructure to allow for the necessary liquidity.

Some experts believe the nascent market is similar to the history of the derivatives market, which faces a deep mistrust and needed structural reforms after the 2008 financial crisis. Establishing trust can do for carbon credits what it did for derivatives, creating the space and credibility for a multi-trillion-dollar market.

Compliance markets, which require companies to buy emission permits or pay carbon taxes, make up a market that is already worth almost $100 billion. Some countries are allowing outside credits to be used in these compliance regimes, such as Colombia and Australia. China, which has recently revamped its compliance market, is exploring the use of international offsets, and debate is rising over whether the EU should do the same. As governments, Wall Street, and international bodies begin to express renewed confidence in the integrity and need for carbon markets, the future of these critical instruments in the fight against climate change looks promising.

EV Market Report, Part II: Emerging Technologies

Fundamental Analytics Carbon Services EV Market Report

The Fundamental Analytics Carbon Services Team

Why China Could Dominate the Next Big Advance in Batteries

Keith Bradsher, The New York Times

The rapid evolution of battery technology is pivotal for the electric vehicle (EV) industry. As battery innovations continue to enhance energy density, charging speed, and safety, they directly impact the feasibility and adoption of EVs, enhancing range, affordability, and environmental impact. Experts believe that the future of EVs hinges on the ongoing progress in battery technology.

EVs emit far fewer greenhouse gas emissions compared to traditional internal combustion engine vehicles, and widespread adoption of EVs will be crucial in mitigating air pollution and combating climate change. Additionally, because current batteries rely heavily on mining and process raw materials such as lithium, cobalt, and nickel, developing alternatives (such as sodium-ion batteries) and sustainable recycling methods for batteries is essential to minimizing waste and environmental harm.

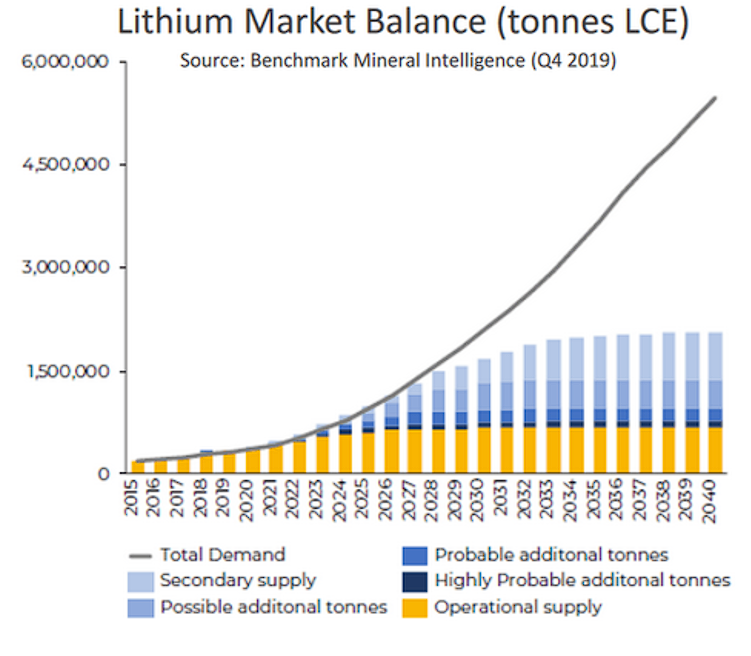

Lithium-ion batteries, which are used in most portable consumer electronic, offer many advantages. They have a high energy pet unit mass and volume relative to other electrical energy storage systems, as well as a high power-to-weight ratio, energy efficiency, good high-temperature performance, a long life, and low self-discharge. However, lithium batteries lose a significant amount of their charge when temperatures fall below freezing. Additionally, lithium can be expensive, and China does most of the world’s lithium processing, which risks a supply crunch for countries needing the mineral in a time of heightening geopolitical tensions.

However, a new innovation may dethrone lithium; sodium-ion batteries. Sodium sells for 1-3% of the price of lithium and is abundant across the world, and, luckily, is very chemically similar. Recent breakthroughs in sodium-ion batteries mean that they may now be recharged daily for years and have an expanded energy capacity. They also keep most of their charge in freezing temperatures.

Many executives and analysts believe that these breakthroughs may begin to shave off lithium demand, which has been projected to reach new heights due to the need for the mineral in the green energy transition. They believe that sodium may begin to replace lithium in a number of industrial applications, not just the manufacturing of EV batteries.

Source: Benchmark Mineral Intelligence

However, there is another issue: out of 20 sodium battery factories that are planned or under construction currently, 16 are in China. Chinese researchers led the innovations that may allow sodium to replace lithium, and in 2 years it’s estimated that the country will have 95% of the world’s sodium battery-making capacity. Another wrinkle is that despite China’s massive lead in sodium-ion battery manufacturing capabilities, over 90% of the world’s main industrial source for sodium comes from the US. A reluctance to rely on the US means that China produces a synthetic material, an industry which has a record of severe water pollution.

Sodium technology still needs to be massively scaled up to significantly compete with lithium, and large-scale rollout may bring new downsides of the technology to light. However, if the technology is able to prove itself and become economically viable at scale, it will hold significant consequences for not only the EV market, but also for the green energy transition as a whole.