Welcome to our monthly newsletter, Carbon Market News Roundup, the goal of which is to introduce our audience to a new asset class market in the making: the carbon market. Our previous issues, along with the rest of our commentaries, may be read here.

In the last issue, we explored the race to net zero, the impact of AI power demand on climate change, and the escalating consequences of climate change. This issue, we focus on the hurdles and wild cards of the green transition, the effect of climate change on American home values, and a recent sign that the EU may be scaling back climate accounting rules.

Challenges to the Green Transition

The World’s Best Hope to Beat Climate Change Is Vanishing

Hayley Warren, David Stringer, Julia Janicki, & Aaron Clark, Bloomberg

Wild Cards for the Green Transition

Aaron Clark, Bloomberg

By 2030, the world must meet a series of green targets to avoid the most severe impacts of global warming. Despite the ambitious goals set by governments and major companies, carbon dioxide emissions hit a new record last year. This makes the journey to net zero by 2050 steeper and costlier. Many 2030 targets are already in jeopardy, and dramatic acceleration is needed to hit these milestones. Each year of delay increases the risk of extreme weather and significant economic impacts, such as a 12% hit to global GDP with a 1°C temperature rise.

Source: Bloomberg

More than 130 nations agreed to triple renewable energy deployment by 2030, with significant growth in solar and wind power. However, this pace is still insufficient to meet targets. Clean energy growth must keep up with rising electricity demand, especially from emerging economies. Emissions from tech giants are rising due to energy-intensive data processing for artificial intelligence, delaying their net-zero goals. Companies like Google and Meta are increasing their use of clean power, including nuclear energy. Despite these efforts, the challenge remains immense, requiring substantial investments and rapid expansion of renewable energy.

Forests play a vital role in absorbing carbon dioxide, but they are being lost at alarming rates. Leaders have committed to halting deforestation by 2030, but 2023 saw significant forest cover loss. Efforts in Brazil, such as increased surveillance and penalties, have reduced deforestation, but more financial mechanisms are needed to incentivize forest protection. The European Union’s stricter anti-deforestation standards have faced delays due to objections from trading partners. Overall, greater international pressure and funding are required to close the gap between pledges and action.

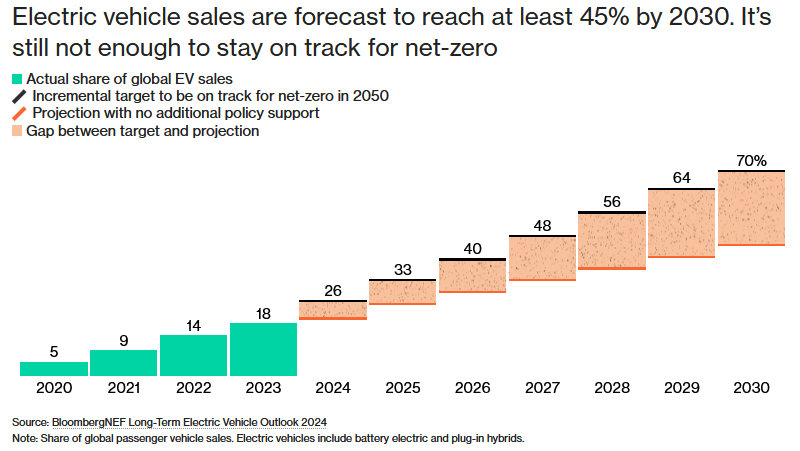

Electric vehicle (EV) sales must rise sharply to reduce road transport emissions. Electric models need to make up 70% of new car purchases by 2030 to stay on track for net zero.

Source: Bloomberg

While the growth of emissions-free vehicles has been positive, further government support is required to achieve this target. Decarbonization in other vehicle categories, such as municipal buses and two-wheelers, is also progressing. However, recent slowdowns in sales growth and lowered sales targets by major automakers pose challenges. Even Tesla has adjusted its goals, highlighting the non-linear transition to electrification.

Almost 200 nations have committed to protecting 30% of the world’s land and water by 2030 through the Kunming-Montreal Global Biodiversity Framework. This effort aims to preserve carbon-rich ecosystems and limit species extinction. However, only 17.6% of land and 8.4% of oceans are currently protected, and progress has been slow. Funding issues and a lack of binding commitments have hindered advancements. Some countries, like Germany, are leading in protection efforts, but the gap between pledges and action remains vast, reflecting the need for greater international pressure and funding.

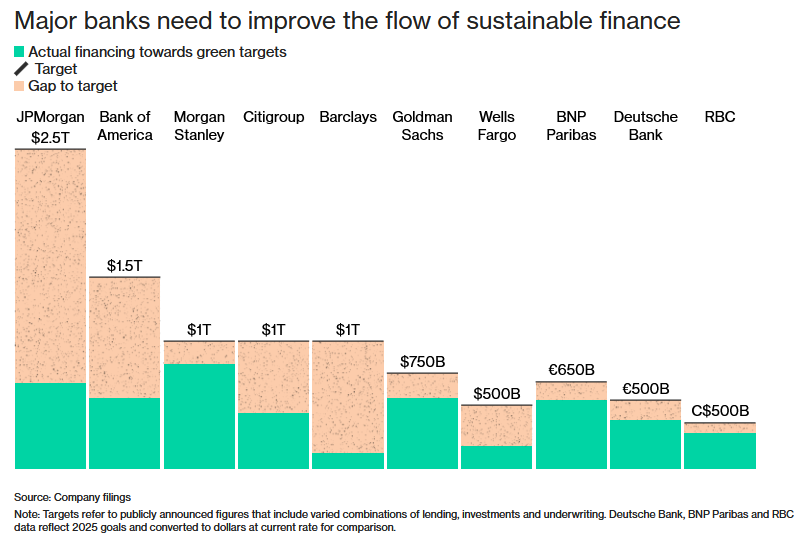

Wall Street has committed to boosting green financing, aiming to contribute to the $215 trillion required for the green transition by 2050. Ten major lenders have pledged over $9 trillion toward clean energy and sustainability, with over $4 trillion already deployed. Despite this progress, the industry’s lending ratio to clean energy versus fossil fuels remains far below the necessary 4 to 1 rate to limit temperature rise to 1.5°C by 2030.

Source: Bloomberg

While some banks have surpassed their green finance targets, climate campaigners emphasize the need for increased investments in green activities and reduced fossil fuel funding to achieve climate goals.

The Impact of Climate Change on American Homes

The New Evidence Climate Change Will Upend American Homeownership

Abrahm Lustgarten, The New York Times

Climate Change to Wipe Away $1.5 Trillion in U.S. Home Values, Study Says

Nicole Friedman & Deborah Acosta, The Wall Street Journal

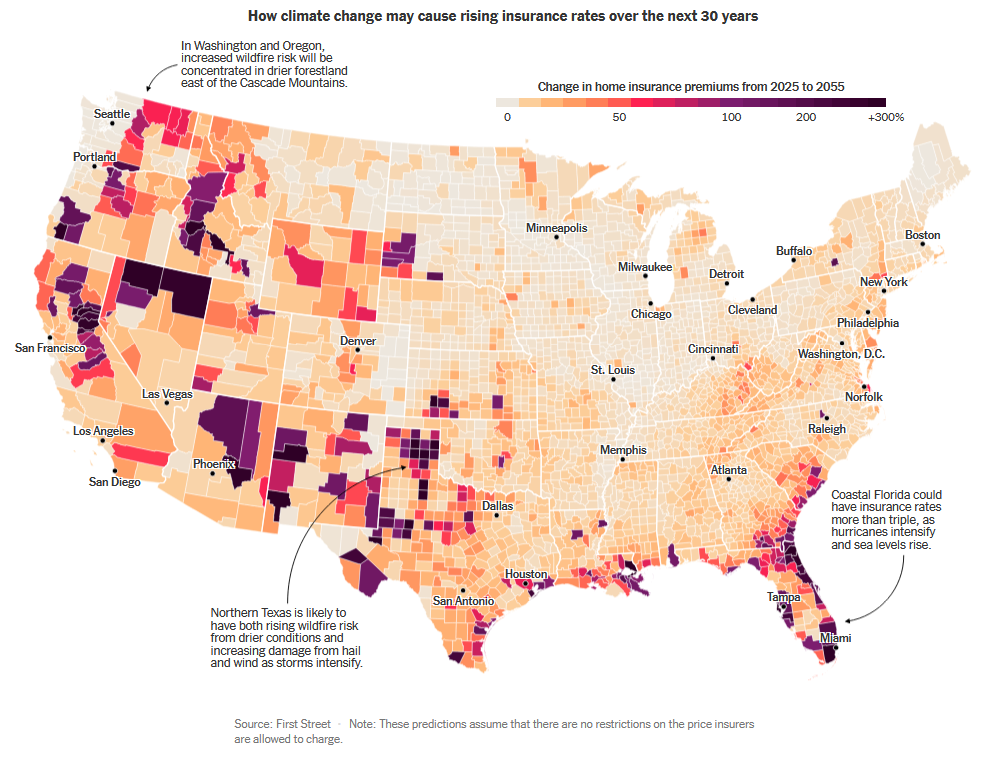

The recent Los Angeles firestorms, adding to the year’s extreme weather events, may result in over $250 billion in damages and economic losses. These climate-driven disasters are causing home insurance prices to spike nationwide, pushing up homeownership costs and leading some insurance companies to pull out of high-risk areas. According to a new analysis by First Street, the U.S. may experience nearly $1.5 trillion in asset losses over the next 30 years due to climate pressures, significantly altering housing fortunes and challenging the long-held assumption that owning a home is a reliable path to wealth.

Homeownership is a cornerstone of the American economy, with residential real estate valued at nearly $50 trillion. However, climate pressures are driving up insurance costs, with average premiums rising 31% since 2019 and expected to increase another 29% over the next 30 years. As insurance costs grow, owning property may become a less attractive investment, with projected declines in home values. This shift could result in a significant paradigm change in how Americans save and define economic security. The current system of underpricing climate risk for millions of properties is no longer sustainable, leading to higher costs and increased climate migration.

Source: The New York Times

The rise in insurance rates and dropping property values are expected to drive widespread climate migration, with more than 55 million Americans potentially relocating within the next three decades. This migration could make climate risk as important as factors like schools and waterfront views when purchasing a home. While some regions, like Pacific Palisades, may rebuild and maintain their value, others, like Altadena, might face gentrification and unaffordability. The future may see a divide between the rich, who can afford insurance and homeownership, and renters paying higher costs to private equity landowners better equipped to manage climate risks.

Europe Reconsiders Climate Accounting Rules

Europe Is Looking to Roll Back Climate Accounting Rules

Yusuf Khan & Kim Mackrael, The Wall Street Journal

The European Commission is reviewing its Green Deal environmental policy due to concerns over rising costs and competitiveness with China and the U.S. Meetings with businesses and industry groups discussed changes to sustainability legislation, aiming to cut red tape while promoting decarbonization to boost economic growth. The Competitiveness Compass document outlines plans to reduce regulatory burdens, lower trade barriers, and improve worker training. Key policies under review include the Corporate Sustainability Reporting Directive and the Corporate Sustainability Due Diligence Directive, with changes expected to streamline reporting requirements.

The EU plans to release an “omnibus” package to address regulatory burdens and simplify sustainability laws. The Corporate Sustainability Reporting Directive and the Corporate Sustainability Due Diligence Directive, which require companies to report on social and environmental impacts, are being reviewed. Industry groups have raised concerns about the impact on smaller businesses and foreign companies with significant European operations. Pushback from within and outside the continent has led to calls for delaying or relaxing certain rules, with France and Germany advocating for changes. Rightwing political parties have also opposed the measures, citing inflation and competitiveness issues.

Despite opposition, some companies and investor groups support maintaining higher reporting requirements, arguing they help manage risks and promote a competitive, net-zero economy. The European Green Deal, a key achievement of Ursula von der Leyen’s first term, is now under scrutiny as she begins her second term. Von der Leyen emphasized the need for flexibility and pragmatism in the green transition, stating that Europe remains committed to its sustainability goals. The upcoming “omnibus” initiative will be a critical test of the EU’s ability to balance regulatory burdens with economic growth and environmental objectives.