Welcome to our monthly newsletter, Carbon Market News Roundup, the goal of which is to introduce our audience to a new asset class market in the making: the carbon market. Our previous issues, along with the rest of our commentaries, may be read here.

In the last issue we looked at recent efforts to bolster confidence in voluntary carbon markets, as well as highlighting the development of carbon markets in Africa, which holds enormous implications for climate finance. In this issue, we examine the nearly $9 trillion financing gap toward the global green transition, the G7’s agreement to phase out coal use, and we begin our series on the electric vehicle market, a sector with rapid growth and great significance in the fight against climate change.

The Tremendous Investment Gap to Reach Net Zero

The $9tn question: how to pay for the green transition

Attracta Mooney, Financial Times

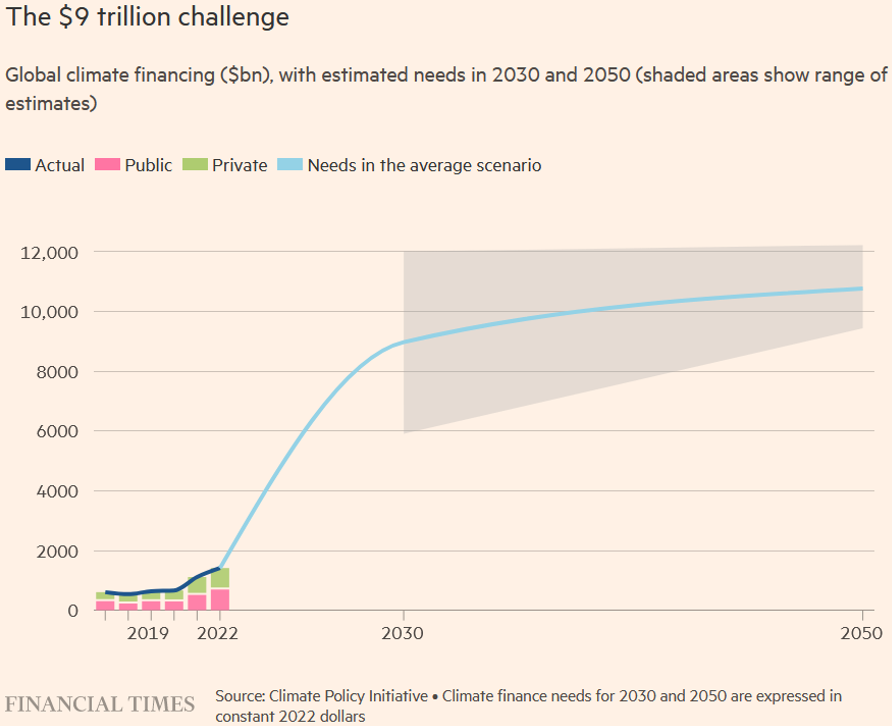

Globally, governments are struggling to figure out how to finance the transition to a green economy to meet climate goals. The International Renewable Energy Agency estimates that around 1,000 gigawatts of renewable power capacity must be built annually until 2030, alongside other green initiatives, necessitating substantial investment. The Climate Policy Initiative suggests that climate finance needs to reach $9 trillion per year by 2030, a titanic increase from previous levels. Europe requires €800 billion for energy infrastructure by 2030 and €2.5 trillion for a complete green transition by 2050. Former US climate envoy John Kerry emphasized the challenge of funding this transition, stating, “We don’t have the money.” Governments are exploring various funding mechanisms, including wealth taxes, tourism taxes (Hawaii’s governor proposed a $25 check-in tax), shipping levies, and corporate taxes, to raise funds. The importance of this financing has been underscored by global agreements to transition away from fossil fuels. COP29 has already been designated as the finance COP, focusing on reaching a global agreement on climate finance to aid poorer nations.

Both public and private sectors are expected to contribute to climate finance, with the International Energy Agency estimating a 30% contribution from the public sector and the rest from the private sector. Governments are urged to implement intelligent regulation and pricing structures to attract private sector investment in renewable energy and other green initiatives, while the private sector must utilize its industrial capital, of which there is plenty but is not effectively deployed, per the article. Over the next seven years capital expenditure on fossil fuels will halve while for renewables it will double, according to Kingsmill Bond of the Rocky Mountain Institute.

Developing countries face even more daunting challenges, given their limited access to capital and overstretched budgets. Some of those countries—India, Fiji, and Egypt to name a few- are issuing sovereign green bonds aimed at financing green projects. The Climate Leadership Finance Initiative is also aimed at how to better mobilize private sector finance in both the global north and global south, while the global climate finance framework at COP28 argued that concessional resources needed to be made available to unlock needed private finance. Efforts are underway to mobilize private sector finance and redirect subsidies away from fossil fuels. Overall, concerted global efforts (from both the public and private sectors), innovative funding mechanisms, and effective policy frameworks are deemed necessary to finance the transition to a green economy and combat climate change effectively, but for now, the goals set in Paris in 2015 are looking unlikely to be met unless an extraordinary shift occurs in climate financing trends.

G7 to Phase Out Coal Use, Use Natural Gas as Temporary Fix

G7 agree to end use of unabated coal power plants by 2035

Jillian Ambrose, The Guardian

G7 pact to stop using coal by 2035 sets up next battle over gas supplies

Attracta Mooney, Financial Times

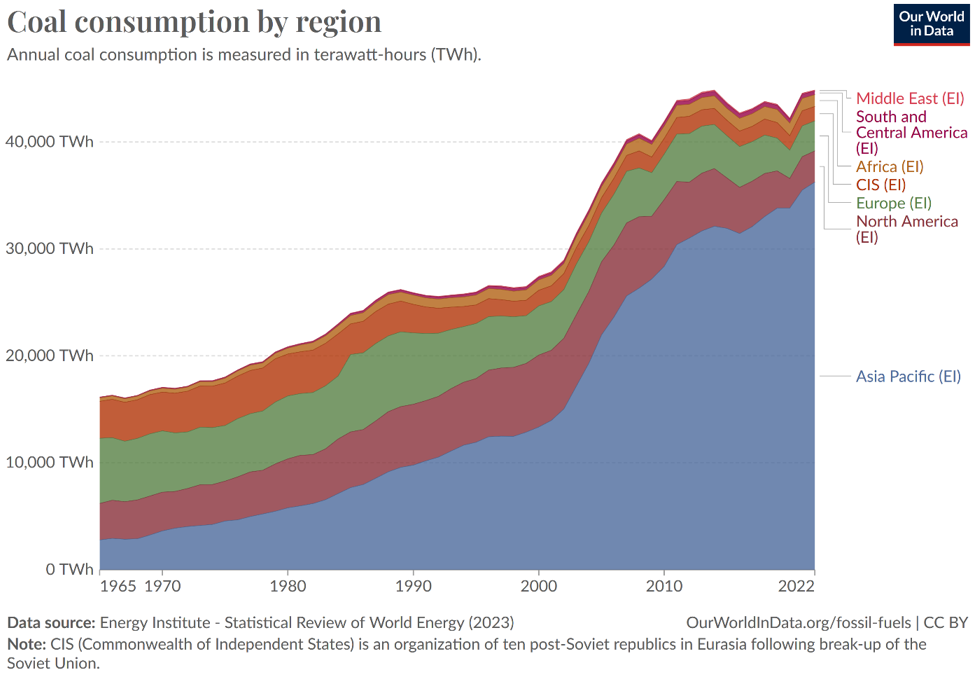

The G7 have announced their agreement to phase out the use of unabated coal power plants, which are major producers of greenhouse gas emissions, by 2035. The development is significant, as the bloc – including the US, the UK, Canada, France, Italy, Germany, and Japan – have struggled to come to agreement about quitting coal over several years of discussions.

The agreement also sets a goal for the G7 to significantly increase their global electricity storage capacity sixfold by 2030, which would help integrate more renewable energy sources into the grid.

There are, however, caveats. Ending “unabated” coal use means that countries may still continue using the fossil fuel as long as those power plants have carbon-capture technology installed. The agreement also allows for coal-reliant countries (like Germany [27% of electricity mix] and Japan [32%]) a timeline to phase out coal use where they can delay the deadline as long as they have a plan to limit global warming to 1.5 degrees Celsius.

Meanwhile, China and India – the world’s two biggest coal-burning countries – are still building new coal plants. Experts say that 6% of existing coal plants must shut down every year by 2040 to avoid a climate catastrophe.

Critics of the move say that the loopholes weaken the overall impact of the agreement, and that by leaving the text open to the possibility of continued natural gas investment the urgency of climate action is undermined. G7 representatives argue that Russia’s war on Ukraine has disrupted energy supplies and necessitated greater investment in the gas sector as a temporary fix. Critics also say that the agreement fails to detail how the clean energy transition may be financed in developing countries.

EV Market Report, Part I: Industry Overview & Market Analysis

2023 was the hottest year on record, according to the NOAA’s National Centers for Environmental Information. The average land and ocean surface temperate last year was 1.18 degrees Celsius above last century’s average and beat 2016’s previous record by 0.15 degrees C. Scientists say that there is a one-in-three chance that this year will be even hotter.

The fight against climate demands a global shift away from fossil fuels, and the transportation sector is a crucial battleground. Electric vehicles (EVs) are a rapidly growing sector with the potential to dramatically reduce greenhouse gas emissions that we believe deserves more attention, given the confluence of factors, including economic, geopolitical, and technological, that drive the sector. What follows is part one of a three-part series on the EV market, its drivers, and its future prospects.

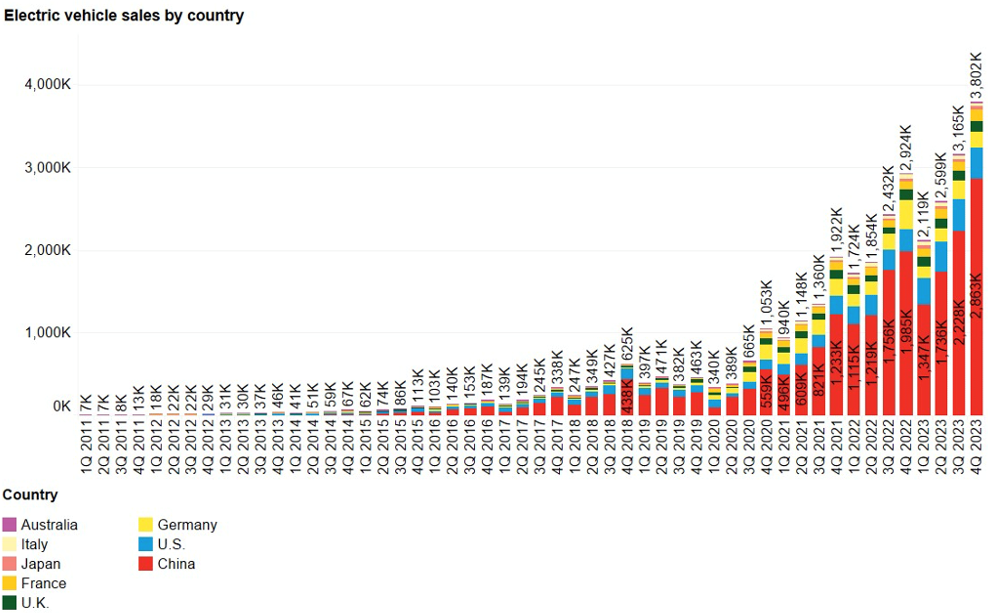

The EV market has seen rapid growth in recent years, with unit sales in 2022 exceeding 10 million cars and the sector realizing a total revenue of over $538 billion. That year, around 65% of global revenue came from China and the US (with China being the biggest).

EV Sales by Country

Source: Bloomberg

In 2023, EV sales neared 14 million, with 95% of sales coming from China, Europe, and the US. The sales remain concentrated in these three major markets; more than one in three new car registrations in China were electric in 2023, compared to over one in five in Europe and one in ten in the US. EVs accounted for 18% of all cars sold in 2023, up from 14% in 2022 (both of which are a drastic increase from just 2% in 2018). These trends indicate that growth remains robust as the EV sector matures.

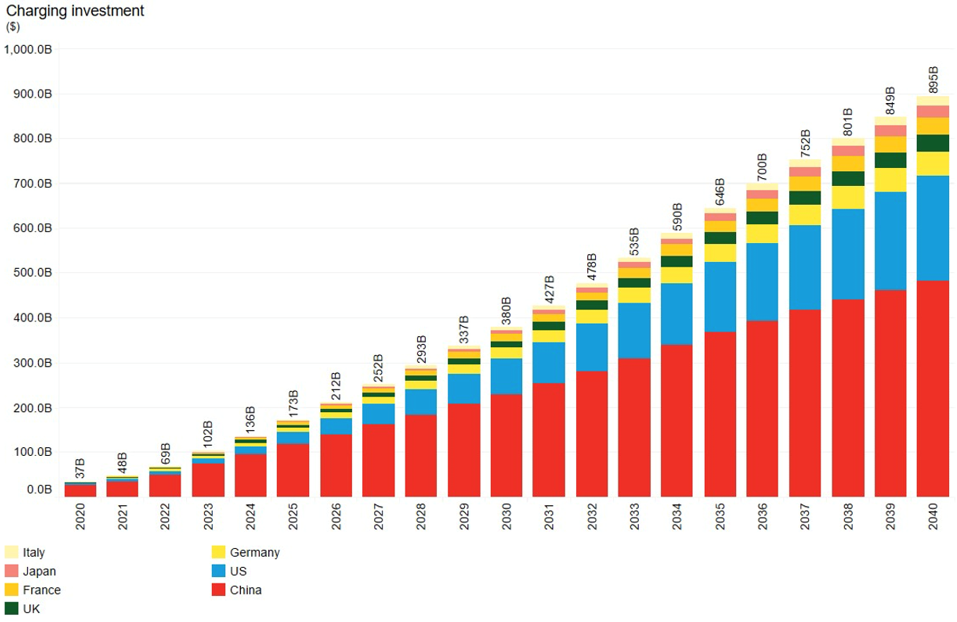

Total Investment in EV Charging Stations per Country

Source: Bloomberg

The expansion of units sales is not the only important metric in this sector; the vehicles must have infrastructure in place in order to charge. The accelerated growth in global investment in charging stations (see chart above) is being driven by a number of favorable tailwinds, including supportive government regulation, subsidies, and incentives across major car markets worldwide; ambitious corporate environmental goals; and shifting consumer preferences. Increased demand for EVs also drives greater investment in charging stations and related technologies. Conversely, continued growth in consumer demand for EVs may depend on the rapid deployment and wide availability of reliable, high-speed EV charging infrastructure, particularly in geographically large markets such as the US and China.

Next issue, we will cover technological advancements in battery technology with consequences that heavily intersect with the EV sector.