A general perception that the global economy is slowing down seems to prevail. At the same time the Euro zone crisis – in spite of the measures taken – will be exacerbated by the known and unknown liabilities that exist in the financial and public sectors. We wrote last week that the monster of financial capital demands that have been created cannot be satisfied, unless a deus ex machina appears.

The volume of unsecured bank bonds that mature over the course of the next 18-30 months is such that it creates significant dollar shortages, especially in the EU. It is not just the Spanish banks with the real estate problematic portfolios. It is all the French, British, German, and the Benelux banks who are short in funding their dollar exposure/liabilities.

The central banks around the globe are increasing their holdings of the greenback, and given the limited money supply of the greenback that actually flows and is available for the private sector, we would not be surprised if we observe a significant increase in the value of the USD vs. at least the Euro and the sterling pound. Ten years ago the USD was in a surplus position globally, which in turn contributed to its downward trend. These days the estimates show that the private sector is in a shortage position by at least 1.6 trillion. Hence, companies have started paying a premium if they wish to borrow in US dollars.

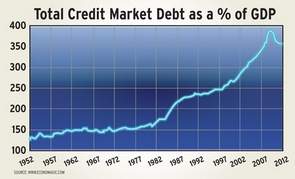

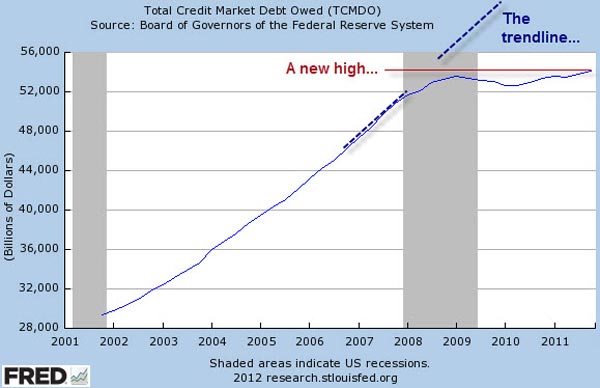

The global imbalances run amok due to institutionalized changes (especially in the late 1990s and the beginning of this century) that inflated demands by the public and private sectors and gave an excuse to central banks (hence money does not fall from a helicopter but rather is credit-demand driven) to extend credit based on dubious collateral, and then to sterilize foreign reserves flowing into the country by printing real money (goodbye savings glut hypothesis) that was in turn invested in “AAA” securities which in turn inflated bubbles around the world and induced consumption based on inflated assets. The graph below portrays this credit overextension, while the one below it shows the yearly percentage increase of total credit market debt (TCMD) relative to the economy’s ability to handle it.

The graph above clearly shows that credit collapsed in 2007-’09 and the efforts made have barely brought it back from the dead (i.e. above zero). Let’s not forget that the locomotive for global credit creation is the US. If this locomotive stops, EU’s ability to sustain the Euro will be gone.

The balance sheets of banks are as good as their assets. In the potential silent depression we might be undergoing their assets are sustained due to governments’ and central banks’ benevolence. The socialization of costs via higher public sector deficits and central banks’ cost absorption mechanism through their own balance sheets have an upper limit that we will be approaching pretty soon (if not already there). In the current period characterized by the tragedy of the commons, credit (the ultimate engine of the misconceived prosperity) may freeze due to the inability of the public and private sectors to meet their interest rate obligations. Hence the potential of massive defaults is present and the probability for such an event seems to be increasing. If that is the case, then bank capital will decline significantly, and in some case may even evaporate, especially in the EU.

If we have reached the plateau of TCMD as the graph below suggests, then the capital structure of banks and of the economy may alter within a short period of time. The plateau also will signify that the dollar shortages may be unable to be met, which will translate into stronger dollar and capital inflows into the US which may allow the latter – due to such inflows and new energy policy – to experience a lesser shock relative to the EU.

The rate of return to leverage has been diminishing rapidly –due to lack of true savings, credit overextension, bubbles, and capital misallocation – and it is becoming more and more expensive every year (in terms of debt accumulation) to produce a dollar of GDP. This diminishing trend represents the ultimate malinvestment practice.

Our limited understanding of things suggests that exposure to Euro-denominated assets – including cash – may not be the wisest things in the foreseeable future.