In the summer of 2011 we published some commentaries about the development of financial black holes. The argument of this commentary goes as follows: Central banks and governments around the world adopted the Powell doctrine of overwhelming force to defeat the enemy which in the 2008 crisis was the imminent collapse of banks, capital and credit markets as well as of the economy (resembling a black hole where everything goes in but nothing comes out). That overwhelming financial power created buffer zones for the markets and the economy. The problem at this stage is how to exit from a strategy that has overblown deficits, debts and central banks’ balance sheets, while toxic assets are still around. Under normal circumstances the options for the exit would have been: default, restructuring of debt via haircuts, austerity measures where additions to the GDP are sough via subtraction, and inflation that devalues the debt.

It seems that the measures taken and those threaten to be taken (in the form of Mario Draghi’s pronouncement “whatever it takes”) has had an effect in the form of calming the fears down and returning the markets to some normalcy. The fact however remains that the economies around the world are growing below their potential while unemployment is still high, and in some countries has touched depressionary levels. Given the above experience, one lesson that we can learn from the facts is that we need to assess investment strategies using a limited time-horizon allowed by the buffer zones that governmental and central banks actions have created.

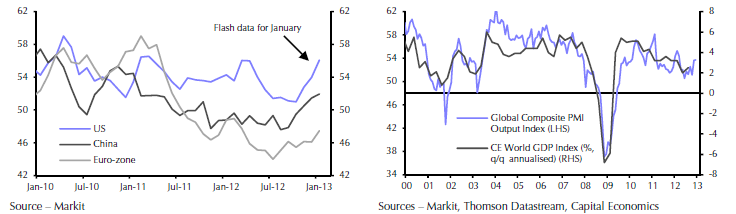

Having that time framework in mind, the most recent economic developments point to an easing of pressures and to a monetized recovery that allows capital markets to breathe with more confidence. Recently released PMI (Purchasing Managers Index) data show the uptick in economic activity in the US, the EU, in China, as well as globally (see figures below).

We anticipate that the easing of pressures will increase money velocity for the time being, and thus the monetized recovery is anticipated to continue for at least a few months (if not for the remaining of the year). We base that argument on the fact that spreads are being narrowed, credit markers are widening, equity markets are boosted, banks’ CDS spreads are narrowing, and some limited political convergence is taking place. Of course, by no means do we imply that financial improvements lead to economic improvements, and thus we expect that this phenomenon to be temporary, unless the causes of the crisis are addressed.

Globally, we anticipate that the Japanese monetization-driven policy and the Chinese investment-driven recovery to continue for the time being, which may lead to good results for Asian markets in general.

The announcement we saw from the Fed yesterday (Jan. 30, 2013) point to continuous QE activity, and the interpretation we could give in the context of this commentary is that they are trying to reduce the uncertainty produced by the product of two forces, namely the cumulative QE position and the momentum they are trying to create. However, we should never forget that such a product will always be greater than the Planck contast which in this case is reflected by the total market credit debt accumulated, and hence Heisenberg’s principle will always haunt such activity.