We all know it by now. The Nasdaq lost 13% just in the month of April and is down more than 21% since the start of the year. As for the S&P 500, it lost almost 9% in April alone. Darlings like Nvidia and PayPal are down 32% and 24% respectively since the beginning of the year. Even the “anchors” of Google and Amazon are down between 21% and 27% since the year started. As we wrote last Monday, where can we hide and park cash, especially when inflation eats away between 8-10% of purchasing power? In an environment where rate differentials push the dollar higher, gold not only loses some of its shine but also declines in value as its greatest enemy (paper money) strengthens.

Looking over the market’s shoulder we see six factors whose combination has brought this decisive blow to the desired market tranquility. Here are the six factors and our assessment going forward:

- Inflation: Expansionary policies (monetary and fiscal), in combination with supply constraints, higher energy and food prices, and the ability to raise prices are the main culprits. We expect the combined effect of those efforts to lose power and, from that perspective, inflation as a factor that drives down valuations should lose a good chunk of its power too in the near future.

- Higher interest rates: While we question the ability of the Fed to accomplish a “smooth landing”, we also believe that the impact of higher rates has already been priced in. Thus, the power of this factor should weaken in the months ahead.

- Earnings recession and an economic recession: The baggage is mixed. On average, earnings seem to be growing at a healthy pace, and the declines observed could be classified mostly as an aberration. Consumer spending also seems to be growing, which signifies that, at least for the US, a recession should be avoided for the next 8-10 months. However, we cannot say the same for the EU, and especially for Germany.

- Algorithmic trading: Computer-generated trades where human discernment is absent amplify volatility and become a self-defeating mechanism. However, usually when multiples are being pressed down significantly, a reversal soon follows. So, from that perspective, this important factor loses some steam too.

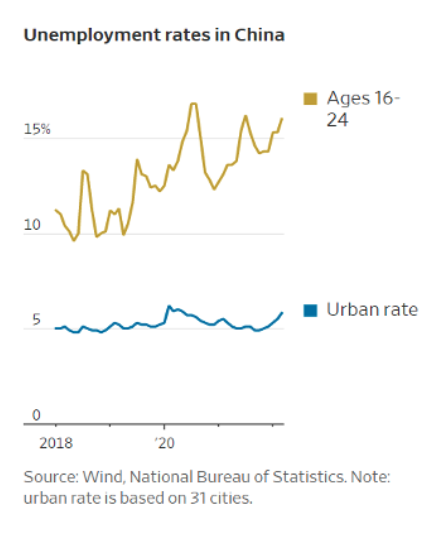

- China: The lockdowns are problematic. Chinese growth is slowing down, and unemployment is rising (see graph below). Someone needs to be blamed, and who could be a better scapegoat than the US? Harsh ideology prevails, and this is dangerous. The lockdowns and the Chinese pronouncements against the US (calling the US the devil), make the geopolitical environment bitter. However, the Chinese cannot afford to lose the US and EU markets (if they do, then they will have a hard landing which, in turn, will reduce incomes and threaten social stability). Therefore, I believe that this risk will be reduced too, in the course of the next few months.

- Our biggest and growing concern is Putin, his belligerent and malevolent policies, and the possibility of a broader war that we only hope will be conventional. As the clouds get darker, we prepare for a plan B and possibly for a plan C if needed, as we have been telling our clients in weekly calls.

And because we cannot be sustained by bread alone: