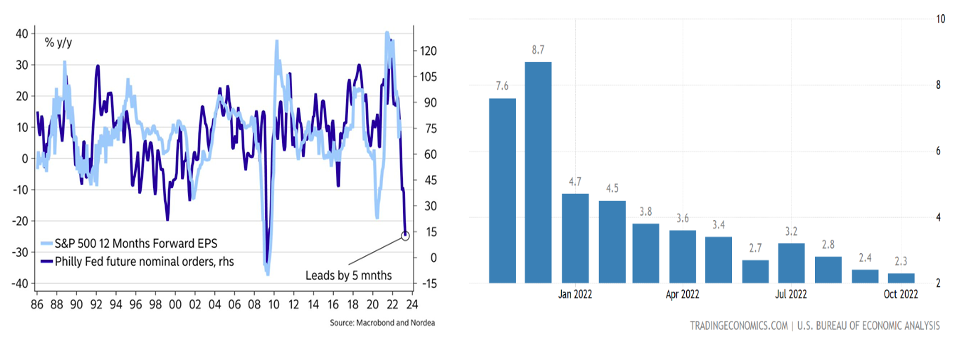

What kind of conclusions could we draw by looking at the two images below? The first one relates the economy’s orders to the S&P 500. Orders could be considered a leading indicator regarding forward earnings for S&P 500 companies. The downward trend of 2022 seems to be extending into 2023. Usually, forward earnings follow this trend and that is not a good omen for equities. The second image shows the personal savings rate in the US. It reached a high of 33.80% during C-19’s peak in 2020. Accumulated savings fired up spending in 2021 and sustained spending in 2022. However, the current savings level of 2.3% is almost as low as the record low rate recorded in July 2005. A low savings rate (despite the fact that excess savings are still around) is also a bad omen for the equity market.

We fully understand the optimism for a soft landing (which in most cases is illusionary), especially if from a technical analysis we start rejoicing at the fact that the S&P 500 broke above the 200 days moving average, and that the market’s breadth (advancing vs. declining stocks) is expanding. However, prices tend to outrun fundamentals and caution is recommended, especially given the widely accepted assumption of “immaculate disinflation” where lower job vacancies do not increase the unemployment rate.

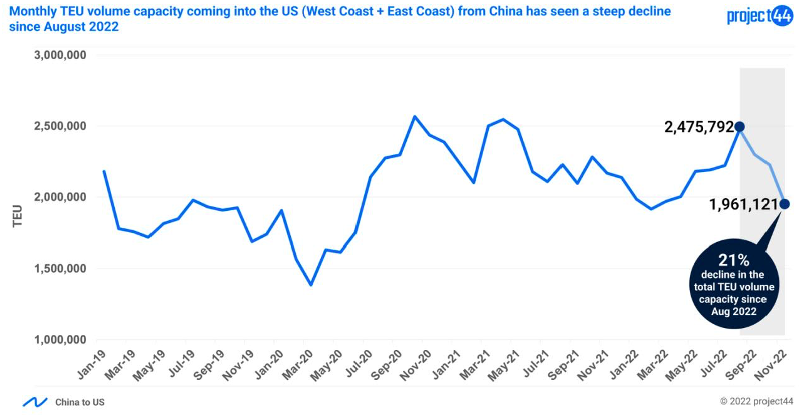

As we contemplate the rising chances of a recession in the US (we take as a given an EU recession which might be a deep one), we should also assess energy prices’ gyrations in relation to oil fundamentals given the potential limited opening of China and the refusal of Russia to supply any oil given the cap imposed a few days ago. We should also assess the impact of a US real estate slowdown, while reminding ourselves that China’s real estate market is still on a crash trajectory with wide financial consequences (including additional funding needs of over $1 trillion) within China. Another red flag on the horizon is a major decline in US manufacturing orders in China which are down 40%. Between August and November alone, container volumes from China to the US fell 21%, as demonstrated by the chart below. The fall is due to a collapse in demand while at the same time overcapacity is becoming an issue in the shipping industry.

Within the global order, there is a rising crisis of legitimacy which points to a rising probability where power rivalry moves beyond proxy wars. This is no longer a black swan, but certainly it has not been incorporated into the pricing of securities and the margin of safety that investors need to consider in order to estimate the required equity premium. Hence, the global markets – irrespectively of the risks associated with currency misalignments – run the risk of a disorderly repricing which naturally could lead to a liquidity and a possible financial crisis.

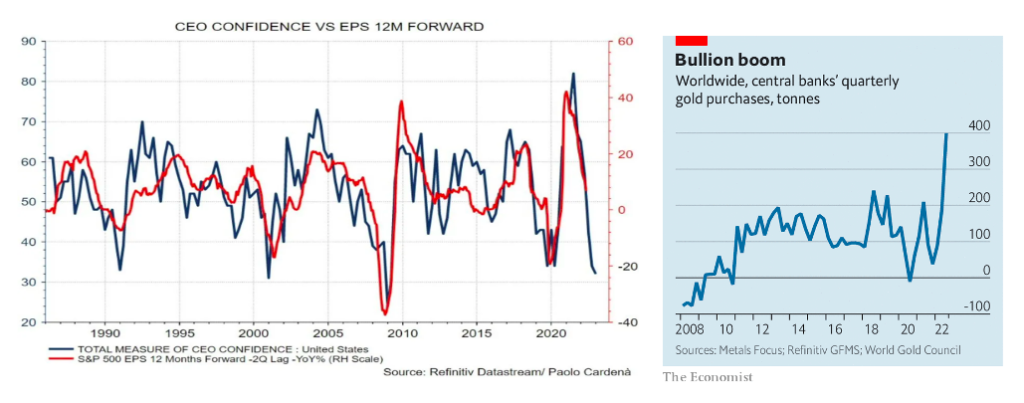

All of the above are taking place when CEOs’ confidence has declined steadily throughout 2022, as shown below, and at a time when total debt (public and private) as a fraction of GDP has jumped from 350% in 2021 to 420% in 2022.

A recession will reveal corporate nakedness and zombie entities will shake up the markets as debt downgrades and liquidations/exodus may create cascades of fear, leading investors in the safety of Treasuries and possibly gold. And speaking of gold, why are central banks accumulating gold reserves in record number since 1967, as shown above? Last time such a rush took place in the last 1960s, it served as the prolegomenon to the death of Bretton Woods.

And because we cannot be sustained by bread alone:

“Living in an age of flux, Machiavelli understood the transience of political orders, and it is this which in one way makes his appeal to the permanence of human nature so striking.”

Alasdair MacIntyre, A Short History of Ethics