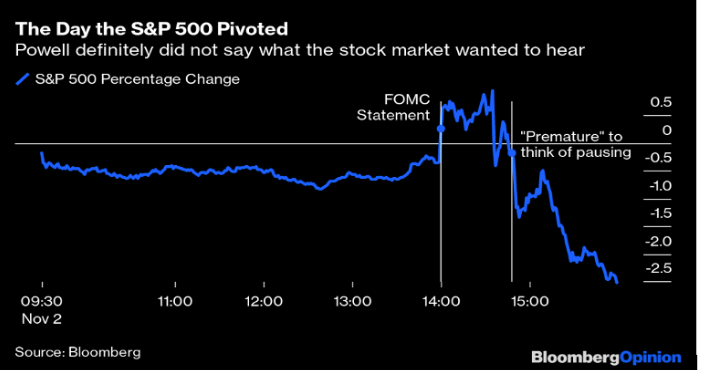

Wednesday evening, I was reading an editorial praising Chairman’s Powell performance following the Fed’s decision to raise rates by another 75 bps. “One for the hawks, one for the doves,” it said. Marvelous I pronounced! Having one foot in one boat and the other in another. That’s the secret to transitory balance! Of course, the market disagreed with my transitory balance idea and is still searching for a bottom, as gains close to 1% not only disappeared but actually turned to losses of 2.5%, as shown below.

During that press conference, we were assured that the Fed has the tools to fight the inflationary upswing, the bond market turmoil, and lack of liquidity, and at the same time secure a soft landing. However, I am still skeptical. How in the world are we going to accomplish all that with negative real interest rates, at a time when money supply is still plentiful, when the business and consumer confidence are declining, and when geopolitical turmoil seems to be nudging higher given elections results overseas (who could exclude the possibility of seeing Israel, Iran, and S. Arabia getting into a war that could see oil and gas prices going through the roof, while the madman is contemplating options for his war in Ukraine)?

In my humble opinion and understanding of things, nowadays a portfolio needs a beta of no more than 0.40. The downside risks overwhelm the upside risks, and we cannot exclude the possibility of seeing the Fed raising rates to 5.5% (maybe even higher). The nature of this inflationary spiral has a peculiar twist where power and conflict seem to be at the epicenter. Who can refuse the reality that it is fueled by the war in Ukraine? Who can refuse the fact that basic items in the households’ basket are impacted by that conflict? How about the workers’ demands for higher pay? Can we say that distributional claims on income are not part of that spiral? Those distributional claims are accommodated by the extraordinary money supply that the Fed allowed to be circulated. Moreover, as the spiral progresses, claims rise ex post the announcement of numbers, and thus inflation becomes a self-fulfilling prophecy. In addition, at a time of supply constraints (from workforce to materials and components), shipments can be diverted to higher bidders (another source of conflict), and of course, prices rise even more. Furthermore, a power play seems to be at work where corporations keep raising their profit margins. We read reports where the share of profits to the inflation rate has increased fourfold between 2019 and 2022. And in our humble understanding of things, we simply ask: Does the Fed really have the tools to fight this kind of inflation? Is the Fed’s policy of higher rates a panacea at a time when financial conditions are loose relative to where they need to be?

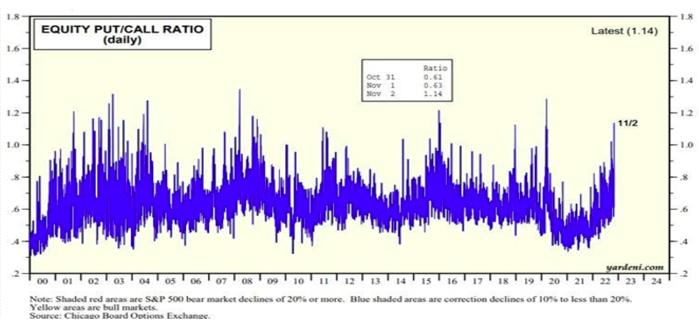

Investors’ sentiment remains bearish, as seen below. We should also add that in a geopolitical game of conflict where the balance of power is in question, we cannot ignore the role of the international reserve currency and the need to enhance its appeal and value.

And because we cannot be sustained by bread alone:

“Power is part of human existence. It cannot be wished away by the priority of love. But the exercise of power can be conditioned by love so that it becomes true servanthood.” – Jacques Ellul