First a quick reminder about statistical errors: Type I error implies the rejection of a hypothesis that is true. Example: Nowadays, Google is a cheap stock. If the hypothesis is true and we reject it, then the loss is the opportunity to profit from a cheap valuation, however, no capital is jeopardized.

Type II error, however, is a much more serious error, as it involves the failure to reject a hypothesis that is false. Example: Nowadays, Google is a cheap stock. If the hypothesis is false and we fail to reject it, we may be induced to deploy capital, in which case not only do we miss the opportunity to deploy it elsewhere, but most importantly we jeopardize the capital we deploy.

Could we be in a stage of the geoeconomic cycle where an interloper (Putin and his madness in Ukraine along with the obvious implications on energy and food prices, as well as the rising demand fed by deficit spending and central banks’ irresponsible policies, and also supply constraints) is becoming entrenched so that the financial immune system nurtures bacteria while at the same time committing a Type II error? If that is the case, then the markets may be misdirected, and the bacterium may be inducing the financial immune system to release compounds on which it can then feed. If that is the case, then we may be committing a Type II error.

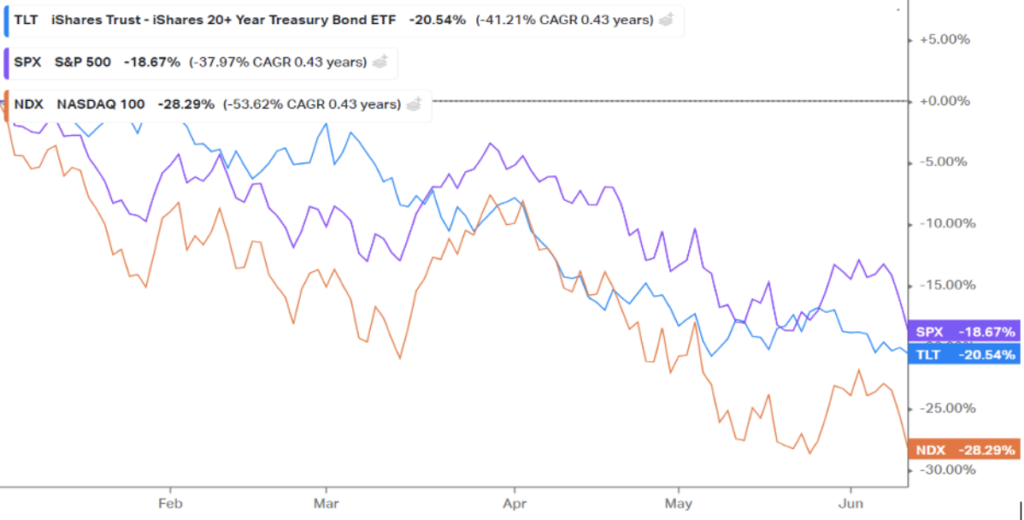

The latest episode in the market turmoil is about inflation. Between Thursday and Friday, the markets, on average, lost almost 5.5% while – as the graph below shows – the losses since the beginning of the year, including the losses on long-term government bonds, exceed 20%.

Searching for villains might be an exercise that some enjoy, but the bottom line is – as we previously have stated – that the Fed and the ECB missed the boat a long time ago. The problem is not only that they missed the boat, but also that they failed to get tickets for the next boat by not raising rates last year or at least by raising them decisively 2-3 months ago. The bacterium then started sending deceptive signals which, in turn, undermined the economic immune system. The result has been that the misery indexes (sum of inflation and unemployment, as well as the sum of the mortgage rate and gas prices) are now in double-digit territory which, in turn, threatens to undermine spending and profitability, and could lead us into recession.

The higher inflation and the failure to reject the delusional hypothesis of soft landing are now threatening growth, sentiment, and earnings. Where is the leadership to raise rates by 75 bps before the next FOMC meeting and send a message that inflation will be defeated even if it is necessary to go through a short recession? The message that Machiavelli wanted to send through his writings was that the ruler’s mission is not to be loved but to acquire the moral virtue of doing the right thing.

And because we cannot live by bread alone:

“Who will teach courage, justice, loyalty, self-control, simplicity, and the acceptance of grief and pain better than men like Fabricius, Curius, Regulus, Mucius, and countless others? For if the Greeks bear away the palm for moral precepts, Rome can produce more striking examples of moral performance, which is a far greater thing.”

Machiavelli, Institutio Oratoria, XIII.II