There are four issues that we would like to address in the current edition of this special series that we started on February 14th.

- Where should we park cash to offset the market’s downturn and the inflationary pressures?

- Could bonds be the answer? How about TIPS (inflation-protected securities)? Would commodities help?

- Where is Putin’s war on Ukraine headed?

- Where do Chinese developments fit into the picture?

Let’s start by examining the blue line below which represents a 20+ Year Treasury Bond ETF. As it can be seen, as of last Friday, the particular (default-risk) market had lost more than 16% since the beginning of the year. In the same graph, we included a couple of well-known companies (which last year had made impressive gains) such as Netflix (orange line) and FaceBook/Meta Platforms (purple line), both of which have lost between 45 and 65% since the beginning of the year. Other companies (also well-known) such as Shopify and Roblox have lost more than 65% of their values, also since the beginning of the year.

Before we continue, we should state that we are not making recommendations, as past performance cannot guarantee future results. We are merely raising questions that readers could discuss with professional advisors. Having said that, we should note that since the beginning of the year – but especially since Putin invaded Ukraine – allocating capital to commodities (energy, grains, metals) has paid off, as it can be seen in the next figure (yellow line).

In our humble opinion, and given the inflationary environment, buying 2-year Treasuries might be better than simply staying only in cash. An even better solution might be buying TIPS (but with a maturity of less than five years) given that you can find such securities which yield more than 5%.

So, how about Putin’s war in Ukraine? We have been writing for two years now that Putin’s ultimate goal is to change the global balance of power. If that is his goal – along with his “best and most intimate friend” Xi of China – then, objective #1 in this phase is to control the Black Sea for Russia, while China may be pursuing control of the South China Sea. If we are right in that assessment, then we cannot preclude the possibility that we are in for a long fight that will eventually draw in US and NATO forces. If this turns out to be true, then portfolios should start planning for such a scenario. In calls with our clients, we have been discussing this possibility.

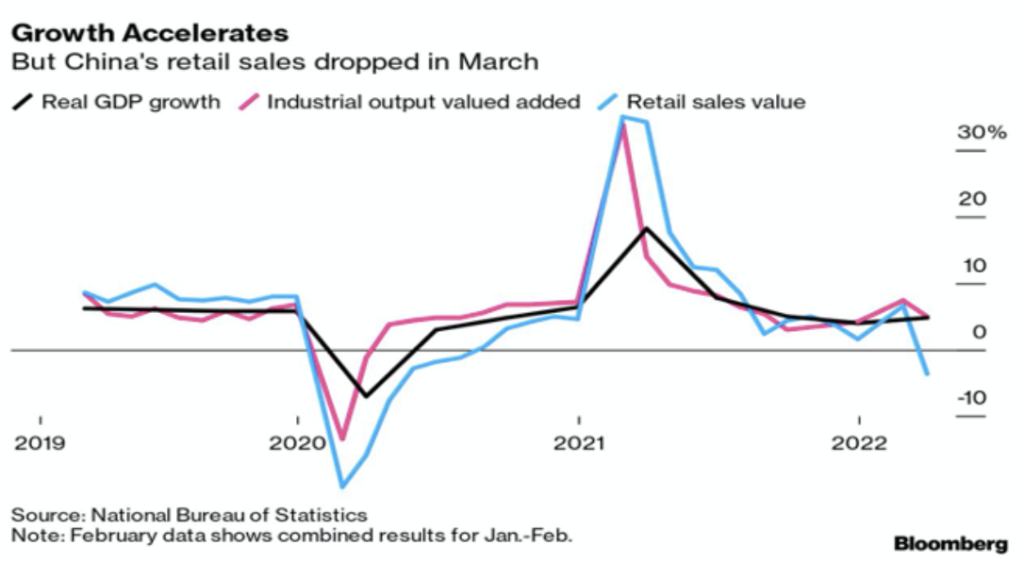

And what about China? The following picture describes (at least partially) the story:

Growth might be up (however this is backward-looking), but sales and, consequently, production are headed down. Covid-related infections and the rise in the number of severe cases along with the numerous deaths among the elderly, the lockdowns, and the supply-chain constraints (to name a few factors) negatively affect the economy. The result is that all the goodwill bought by the measures announced by Vice Premier Liu in mid-March has almost evaporated. Even the stock rally that followed those announcements has been erased. This past week, the authorities announced twenty-three (!) measures to stimulate the market, including incentives for government-controlled entities to buy stocks! The Great Wall of Steroids has serious problems besides its illiberalism and oppression of human rights. And in the distance, they dream of controlling the South China Sea in order to emulate Russia and its efforts to control the Black Sea.

And because we cannot be sustained by bread alone:

“I will not sit unconcerned while my liberty is invaded, nor look in silence upon public robbery.”

“I see no reason to believe that the present usurpation will be more permanent than any other despotism…”

-William Pitt, British Prime Minister