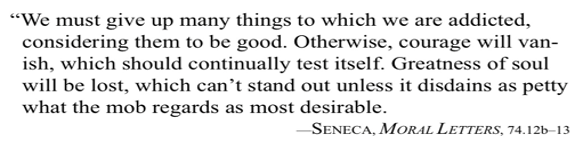

What can we conclude from a week marked by a delusional war and high volatility, and what should we be preparing for? The first graph below portrays the YTD market performance. More volatility should be expected. The level of cash in accounts should increase, hedges are needed.

The possibility that things could get out of control is not insignificant. Russia’s economy is in shock. The damage to its economy is estimated, as of today, at about 40% of its GDP, on an annualized basis. The Russian stock market is illiquid, and the tradable shares such as Gazprom or Sberbank on the London Exchange have lost close to 98% of their value. When a delusional Putin is pressed hard, the possibility of using some form of nuclear annihilation (he has already hinted of that possibility) is not negligible. If that were to happen, European security and state of affairs will also experience a shock. At the very least, we should be alarmed at the deployment of cyberweapons that could affect our everyday lives.

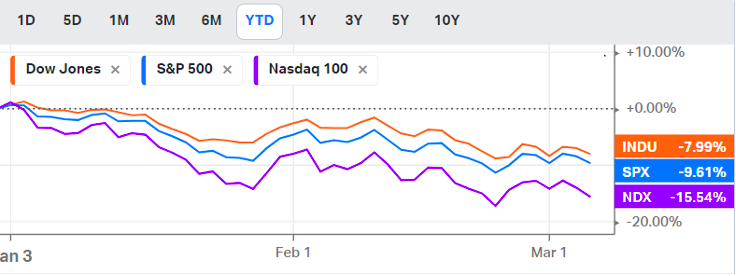

It is not just energy prices (oil and natural gas) that have been rising. Grains, and especially wheat prices, have increased more than 50% in the last ten business days (see below).

It might be prudent to develop a food security strategy, as we may see in the future countries refraining from exporting staples such as wheat and/or other grains. We reiterate our previous statement: When we discuss security issues we should include national, energy, food, and trade issues.

We also reiterate that a situation of delusional madness requires Machiavellian, disproportional measures with no exemptions (such as the energy-related exemptions permitted when the SWIFT measures were applied). To that extent, a total ban on all Russian imports and exports (no matter the temporary pain, especially for Germany) may be needed. Exempting Russian energy from the sanctions empowers the delusional madness since it is financing it.

When on February 1st we posted our commentary about being ambushed by the future, the world was facing the return of a rising rivalry between three superpowers (US, China, and Russia). We have reasons to believe that, soon, we will be talking about the rivalry of two where the #2 (after the conclusion of this madness) will concede to the hyperpower. The markets, in that case, will have reasons to celebrate the dawn of the Day After.

And because we don’t live by bread alone, let’s remember the wise words of Seneca: