The headlines of this past weekend edition of the European edition of the Wall Street Journal read: “Debt Targets for Greece Questioned”. In the article Klaus Regling, the managing director of the European Stability Mechanism states that the targets for Greek debt after the almost $400 billion worth of bailouts were “meaningless”. The implications of the article are three: Greece should not expect any further reductions/haircuts of its debt level; the IMF may withdraw its support and leave the troika because its bylaws does not allow the institution to be part of a rescue mechanism in a country whose debt level is unsustainable; and what was perceived last November as a promise for further debt haircuts cannot materialize.

The above along with the Italian political crisis – which the IMF warned just a few days ago that it could turn ugly in terms of financial stability – and the unraveling Greek political turmoil could become the beginning of another round in the never-ending tale called “stabilizing a fundamentally dysfunctional currency union”.

Over the course of the last few months economists have been arguing regarding the recovery in Latvia. Specifically, they are those who argue that it was the extreme austerity applied in Latvia along with its persistence to a fixed exchange rate in relation to the Euro (i.e. no ability to devalue in anticipation of joining the Euro zone next year) that led Latvia being the fastest growing economy in the EU. According to those who support that position, and if that were true, then the prescriptions and remedies insisted by Germany would pay off in Greece too which should start seeing significant growth rates soon.

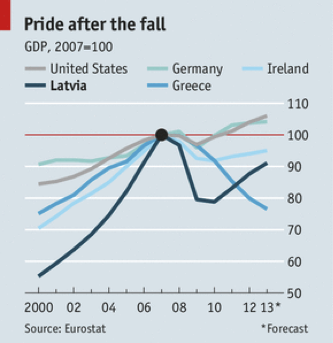

Before we start analyzing the situation, let’s see where both countries (as well as others) stood in 2007, at the dawn of the crisis. As the following graph shows (originally published by The Economist), both countries have experienced a significant drop in their GDP. However, the similarities stop there.

The Latvian economy started its recovery more than two years ago, while Greek GDP is still dropping. In addition, Greek debt due to the bailouts – that saved the EU creditors but sank Greece into deeper holes – is much worse now than it was in 2010. Moreover, the unemployment in Latvia barely crossed the dangerous threshold rate of 20% while in Greece it is almost 30%. In addition, while internal devaluations took place in Latvia (like in Greece) through lower labor costs, Latvia’s total factor productivity rate increased significantly, while in Greece it is still struggling. Of course, in Latvia a good chunk of the GDP is made up of fixed capital investments (23%) while in Greece the percentage is about half of that.

My fear is that Greece resembles Cadmus in search of his sister Europa. As the Cadmus story unfolds we may recall that in his search for Europa, Cadmus – following the oracle – founded Thebes and from his family lineage the most important Theban families descended. While Cadmus and Harmonia ended up ruling their city well, the unfortunate thing is that in his efforts to succeed all sorts of misfortunes struck his descendants. We may just recall that Actaeon was transformed into a deer which was ripped to pieces, Ino was driven insane, Agave ripped her son to pieces in a state of ecstasy, while Polydorus’ grandson Laius was murdered by his son Edipus who in turn married his own mother Jocasta.

Returning now to the comparison between Greece and Latvia, we should also point out that as the Brookings Institution states in its report, the austerity measures in Latvia were implemented after the main drop in the GDP, while in Greece were implemented well before the main drop in GDP, and thus became the vehicles for a deeper recession. Moreover, as the IMF pointed out in its admission last June regarding the mistakes it made in the Greek program, fiscal consolidation when timed inappropriately could become a source of greater unemployment and drop in income which feed the recession.

Furthermore, we cannot compare a country of 2 million people with a GDP $30 billion to a country of 12 million people whose GDP is $250 billion. In addition, emigration from Latvia reduced its labor force by almost 10%, which in turn has mitigated unemployment pressures. However, losing human capital and especially the younger generations is not an answer to the questions of jobs, incomes, and growth. Finally, the reasons for the bust in Latvia are almost completely antithetical to the reasons for the Greek collapse.

Of course, Greece now starts from a very low point and through the accounting chemistry of a primary surplus (i.e. taxes minus expenditures net of interest on the debt) may win the public perception image, which would be a very good step. However, perception and reality is a different thing. As I pointed out, above Greece needs to increase the percentage of the GDP that is coming from fixed capital investments i.e. needs to create capital and wealth, and needs to focus on productivity gains. The relative success of Latvia is no vindication for policies that try to add through subtractions.

Let’s hope that Greece is condemned to succeed (and not like Cadmus to suffer), and hopefully within six-eight months period we will see significant inflows that can uplift its prospects.