US Equity Markets

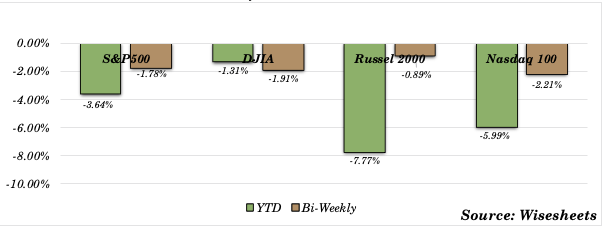

- The S&P 500 temporarily entered correction territory as investors assessed economic risks and the Fed’s response to potential inflation and slowing growth.

- Growth concerns and increasing recession fears were amplified by comments from President Donald Trump regarding a “period of transition” for the US economy, weighing on market sentiment.

- Adding to the uncertainty, President Trump ramped up pressure on the Fed to cut rates, fueling expectations of market volatility.

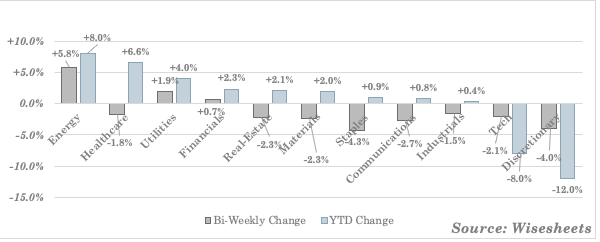

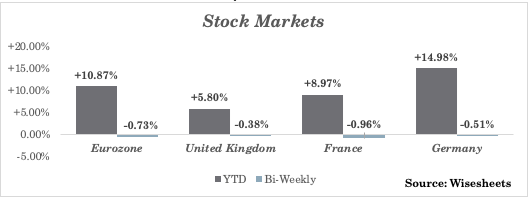

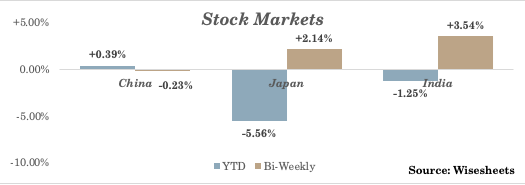

- Value and cyclical sectors have outperformed tech and AI stocks within US equities, as have some international stock markets, including European and Chinese markets.

- Given the latest comments on tariffs, we may experience a few days of optimism in the markets, however the trajectory would depend (to a large extent) on specific policy to be announced on April 2, 2025.

S&P 500 Sectors Bi-Weekly / YTD Performance

US Equities Indices

US Equity Markets: March 7, 2025 – March 21, 2025

| Index | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| S&P 500 | 5,668 | -1.78% | -3.64% |

| DJIA | 41,985 | -1.91% | -1.31% |

| Russel 2000 | 2,057 | -0.89% | -7.77% |

| Nasdaq 100 | 19,754 | -2.21% | -5.99% |

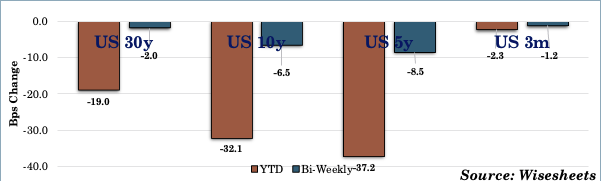

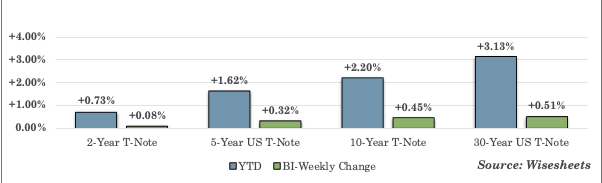

Bond Markets

- US T-Notes generated positive returns as yields across most maturities declined (and prices rose) following the Fed’s policy meeting.

- Since the beginning of the year, investors have poured over $20 billion into short-term Treasuries as money managers ride out market volatility.

- The yield on the 10-year US Treasury note fell to 4.25%, approaching the lowest point in over two weeks as markets continued to assess the risks of an economic slowdown and how the Federal Reserve would react.

- Bonds were also supported by the Fed slowing its balance sheet shrinkage to address signs of lower underlying liquidity.

- The Treasury has made it clear that wants to see the 10-year Treasury yield decline and stay down. However, the latter requires first and foremost fiscal discipline which is still absent. Restricting the supply of the bonds can temporarily achieve that objective, but it’s a treatment of symptoms rather than of causes.

US Treasuries

US T-Notes

US Treasuries: March 7, 2025 – March 21, 2025

| Maturity | Close | Bi-Weekly Change in Yield (in bps) | YTD Change in Yield |

|---|---|---|---|

| US 30y | 4.596% | -2.0 | -19.0 |

| US 10y | 4.252% | -6.5 | -32.1 |

| US 5y | 4.008% | -8.5 | -37.2 |

| US 3m | 4.185% | -1.2 | -2.3 |

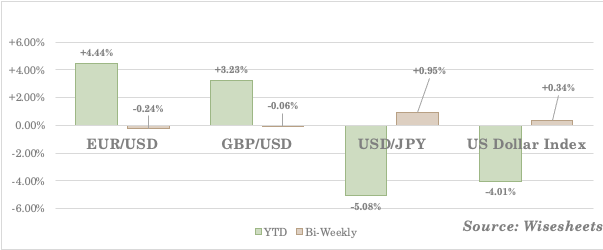

FX Currency Markets

- The US dollar index climbed toward 104, rising for the third consecutive session as investors continued to assess the Fed’s monetary policy stance.

- The euro fell below $1.082, retreating from a near five-month high touched mid-month, after ECB President Lagarde warned of weaker growth but downplayed inflation risks if the EU retaliated against US tariffs.

- The Japanese yen slipped to around 149.3 per dollar, as investors reacted to the latest inflation figures. Japan’s core inflation rate slowed to 3% in February from 3.2% in January but still exceeded forecasts of 2.9%. This marked the second consecutive month that inflation surpassed expectations, highlighting persistent price pressures and reinforcing the case for further interest rate hikes.

- The dollar may temporarily strengthen, however, its medium-term trajectory is problematic.

Foreign Exchange Currencies

FX Currency Markets: March 7, 2025 – March 21, 2025

| Currency Pair | Close | Bi-Weekly Change | YTD Change |

|---|---|---|---|

| EUR/USD | 1.0815 | -0.24% | +4.44% |

| GBP/USD | 1.2916 | -0.06% | +3.23% |

| USD/JPY | 149.3180 | +0.95% | -5.08% |

| US Dollar Index | 104.1400 | +0.34% | -4.01% |

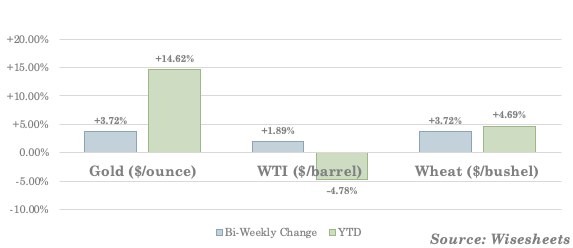

Commodities (Energy, Grain, Metals)

- WTI crude futures traded at $68.3, marking their second consecutive weekly gain with a 1.89% increase, driven by new U.S. sanctions on Iran and a fresh OPEC+ plan to cut output among seven members.

- Gold hovered around $3,030 per ounce, a fresh record, supported by rising US rate cut expectations and strong safe-haven demand.

- Wheat futures climbed above $580 per bushel, reaching their highest level since late February, as investors welcomed signs of strong international demand. The USDA’s latest weekly Export Sales report showed U.S. wheat sales surged 84% above the prior four-week average and exceeded expectations.

- In the immediate future (2-4 weeks) commodity prices may not move significantly, however, in the medium term, the strengthening of commodity prices seems to be at play.

Commodities

Commodities: March 7, 2025 – March 21, 2025

| Commodity | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| Gold($/ounce) | $3,027.2 | +3.72% | +14.62% |

| WTI($/barrel) | $68.3 | +1.89% | -4.78% |

| Soybeans($/bushel) | $585.5 | +3.72% | +4.69% |

International Markets Data

European Markets

European Equity Markets: March 7, 2025 – March 21, 2025

| Index | Close | Bi-Weekly Change | 2025 YTD Performance |

|---|---|---|---|

| Eurozone | 5,428 | -0.73% | +10.87% |

| United Kingdom | 8,647 | -0.38% | +5.80% |

| France | 8,043 | -0.96% | +8.97% |

| Germany | 22,892 | -0.51% | +14.98% |

Government Yields: March 7, 2025 – March 21, 2025

| Yield | Close | Bi-Weekly Change (in bps) | 2025 YTD Change |

|---|---|---|---|

| German 1yr | 2.05% | -6.1 | -17.9 |

| French 1yr | 2.25% | -9.5 | -9.7 |

| UK 1yr | 4.16% | +16.9 | -45.9 |

| German 10 yr | 2.76% | -7.3 | +40.0 |

| UK 10yr | 4.72% | +11.9 | +15.4 |

| French 10yr | 3.47% | -8.6 | +27.2 |

Asian Markets

Emerging Economies Equity Markets: March 7, 2025 – March 21, 2025

| Index | Close | Bi-Weekly Change | 2025 YTD Performance |

| China | 3,365 | -0.23% | +0.39% |

| Japan | 37,677 | +2.14% | -5.56% |

| India | 23,350 | +3.54% | -1.25% |

Government Yields: March 7, 2025 – March 21, 2025

| Yield | Close | Bi-Weekly Change (in bps) | 2025 YTD Change |

| China 1Y | 1.56% | +2.5 | +53.5 |

| India 1Y | 6.60% | +8.2 | -6.5 |

| Japan 1Y | 0.61% | -0.9 | +17.9 |

| China 10Y | 1.90% | +6.5 | +29.0 |

| Japan 10Y | 1.52% | -0.6 | +42.5 |

| India 10Y | 6.63% | -12.5 | -19.0 |

Interconnections Across Markets

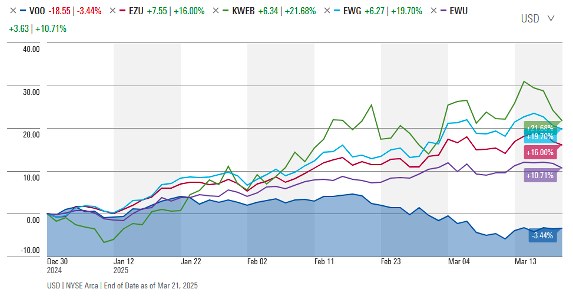

Year-to-date, international stock markets have demonstrated remarkable resilience and significantly outpaced the S&P 500, marking shifting investor sentiment around US equities. The chart above illustrates the S&P 500’s performance (bottom blue line) compared to major markets like the UK (purple line), Eurozone (red line), Germany (light blue line), and China (green line). Among the top performers, China and Germany stand out, each boasting gains of around +20% YTD, in stark contrast to the S&P 500’s decline of -3.44%. Fear of a new round of tariffs to be announced on April 2, which would hit major trading partners with reciprocal tariffs, has contributed to investor nervousness regarding US equities.

Source: Morningstar

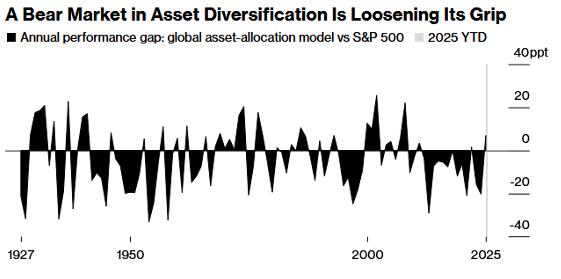

After a decade of dominance by US equities, more diversified portfolios are finally seeing their moment. So far in 2025, cross-asset strategies are outperforming the S&P500, with diversified portfolios benefiting from investors seeking stability amid ongoing economic uncertainty. According to Bank of America’s latest survey, money managers reduced their US equity allocations at a record pace this month, while increasing their holdings in Europe and emerging markets.

Source: Cambria, Bloomberg