We are at an economic, financial, and political crossroad. That crossroad extends from the East and reaches out to the West. From fear of an economic slowdown in China and its effects on the economies and the markets around the globe, to the fear of Brexit and its repercussions on the EU, and from the fear of the dividing politics of the wall to the fears of a shaky Latin America.

I am a firm believer that hope, while not being a strategy, is a vital ingredient in formulating alternative strategies that can inspire action and tactics which in turn can overcome the effects of a possibly badly unfolding reality. Since late November – when we began presenting our initial assessment for 2019 – we expressed a cautious optimism that 2019 will be a better year for the markets than 2018. During the first few weeks of this year, the markets indeed have erased a good chunk of the losses of 2018. We retain that cautious optimism for the immediate future, and while we hear the respected voices who say that recession is knocking at our doors, we cannot see it coming yet.

We see an economic slowdown in both earnings growth and economic growth, but we consider that healthy. We have entered into the late stage of an economic expansion. While the fear is that the natural slowdown will be followed by a recession, we express optimism that other asset cycles can replace the potential losses of the equities once recession starts knocking at our doors (still not happening).

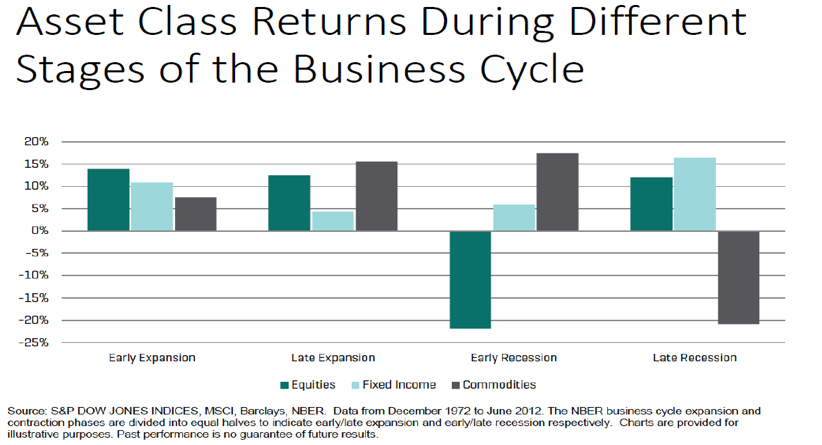

As the following graph shows, during the late stages of an expansion cycle commodities start to become attractive. Moreover, when recession starts equity losses could be compensated by commodity gains.

One of the key ingredients, then, is proper asset allocation and hedging based on low correlation among asset classes, especially at a time like this. Hence, while we believe that equities and possibly fixed income securities will do better this year, we also encourage greater exposure to precious metals. In the midst of chaotic Brexit negotiations, we hear about delayed Brexit — i.e., exit after the deadline of March 29 — however, we cannot imagine UK voting for the European Parliament elections this May and hence electing representatives on the eve of their exit! Moreover, at a time when lunacy reigns supreme, we do not live with the fear of a bear market and a recession that will dawn upon us, but we rather choose the hope that an uncorrelated anchor can stabilize portfolios and even produce some alpha for the portfolios.

In the midst of the slowdown in China (a.k.a. the Great Wall of Steroids/debt) we can identify beams of hope and opportunities in companies that have been beaten down and are positioned to gain from the expansionary fiscal and monetary policy that is unfolding in China. Moreover, while the health of Chinese banks might be questionable, a meltdown would not be allowed. Therefore we do not expect that a crisis and/or a Lehman moment will be unfolding in China.

Our fear is that the degradation of politics – especially in the West given that democracy is not exactly the preferred method of governance elsewhere – empowers the forces that undermine stability to the point that uninformed divisions become flags that weaponize brainless fanaticism where the incompetents reign supreme.