I did not expect the last commentary to start becoming a reality so soon. In that last commentary I explained that the emerging markets look like prime territory for a crisis. In the last few days we have witnessed significant emerging market turmoil. It started with currency devaluations (the Argentinean peso lost more than 20%, the Turkish Lira close to 10% to name just two currencies), to be followed by central banks’ abrupt interest rates increases (Turkey, India, S. Africa). We certainly cannot ignore the fact that during that same period the Chinese data portrayed contraction in the manufacturing sector, while rumors circulated that we may soon be facing bankrupt Chinese funds unable to return the investors’ capital. In addition, while the central bank of Japan decided to continue its expansionary policy, it warned about price pressures! Our own Fed declared that it is committed to further tapering and decided to reduce its “asset” purchase program by an additional $10 billion a month. Welcome to the era that may become known as the epoch of beautiful losers where useful idiots are in high demand.

And while all these things were taking place, no one seems to have paid any attention to the announcement by the New York Fed last Tuesday in which it explicitly states that the prelude of reverse repos that it started on September 23rd last year, not only will it be continued but also it will be expanded in scope, magnitude (each trade will jump from $1 billion cap to $3 billion a piece), and perspective. Under this reverse repo program – see previous commentaries on the subject – the Fed effectively lends its balance sheet to its primary dealers, hedge funds, money markets funds and other capital markets participants. The effects of this program are fourfold: First, it expands the collateral base (which as I have stated before is the alpha and omega in obtaining an escape velocity from the crisis); second, it expands liquidity and money supply (and thus its adds fuel to the expansion); thirdly, it puts an effective control over short term interest rates (and thus it can control better the tapering as well as the rate increases forthcoming next year); and finally it serves as “window dressing” for those market participants that need quality collateral for reporting purposes. I will not be surprised if eventually the Fed drops its existing target of the federal funds rate (the rate that banks charge each other for short-term loans) and adopts reverse repos as one of its primary monetary tools.

At the same time it seems that everyone is concerned about deflationary pressures and inability to ignite inflation. I shall return to this point in a future commentary, but I will only say at this point that if we continued measuring inflation like we did in the Paul Volcker days, then the inflation numbers would be much higher. In plain words my concern is that it has taken the Fed too long to start removing the punch bowl from the ongoing monetary party, that it may have started losing control, and therefore planted the seeds of the next crisis, especially when it is expanding the scope and magnitude of the reverse repo program.

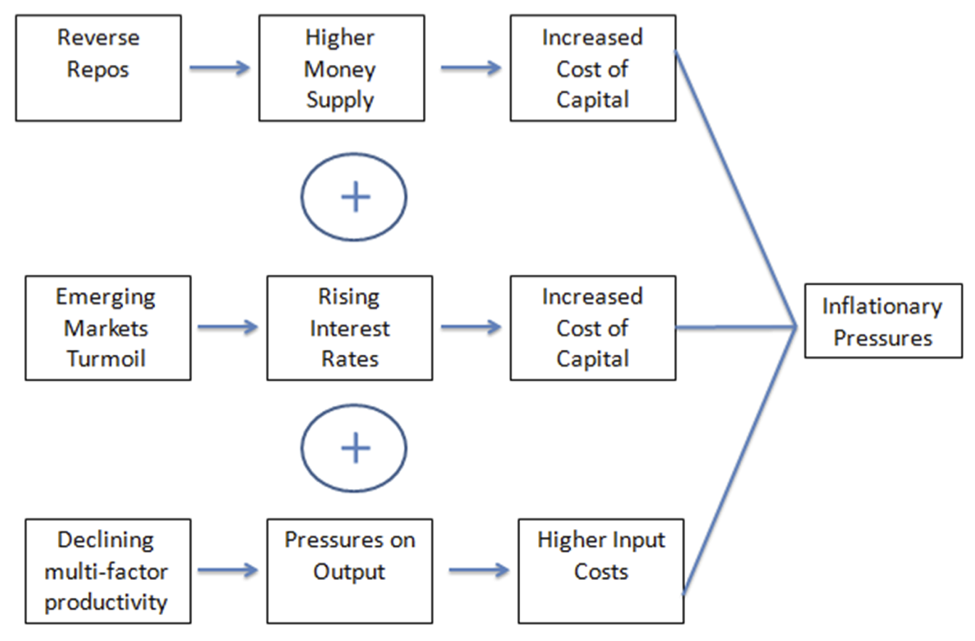

As central banks around the globe are cracking up the printing presses, the declining multi-factor productivity around the world has the potential of undermining price stability and eating away capital. The following schematic serves as a preliminary discussion platform of the dangers that lie in ambush and which if unleashed could shake pretty badly the inverted credit pyramid that the derivatives and the collateralization of dubious assets have created using the mechanism of credit over-extension.

Let me clarify that I still expect a good and decent year, especially for the equities markets. The concerns expressed above serve the purpose of a prolegomenon to a potential fire that can caught investors by surprise making them the useful idiots (a.k.a. the propagandists) of a cause they do not fully comprehend. If that turns out to be the case, then investors would resemble the beautiful losers in Bob Seger’s song by the same title:

He wants to dream like a young man

With the wisdom of an old man

He wants his home and security

He wants to live like a sailor at sea

Beautiful loser

Where you gonna fall?

When you realize, you just can’t have it allBeautiful loser

Never take it all

‘Cause it’s easier

And faster when you fall

You just don’t need it all