John E. Charalambakis

&

Mohamed Ramzi Roshdi

We all remember, not with the fondest memories, the market performance in 2022. The S&P 500 lost 19.4%, and even long-term government bonds performed badly (losing 31.2%) as interest rates kept rising. The environment of rising interest rates was the main cause for the bad performance in 2022. This year started with significant skepticism given the high interest rates and the expectations for a recession. Early this year, the fascination around Artificial Intelligence (AI) energized tech-oriented companies like Nvidia and uplifted the prospects of the Magnificent 7 (see brief discussion about this below). However, and as our commentaries last summer indicated, unrealistic expectations were created and eventually the S&P 500 went into correction-territory after losing more than 10% between August and October.

The market experience this year has certainly been better than last year’s performance, even though fixed income markets are down almost 7% (long-term government bonds), while the investment-grade corporate bond market has gained 2.8%. On the other hand, equities seem to be performing better, at least when judging by the S&P 500.

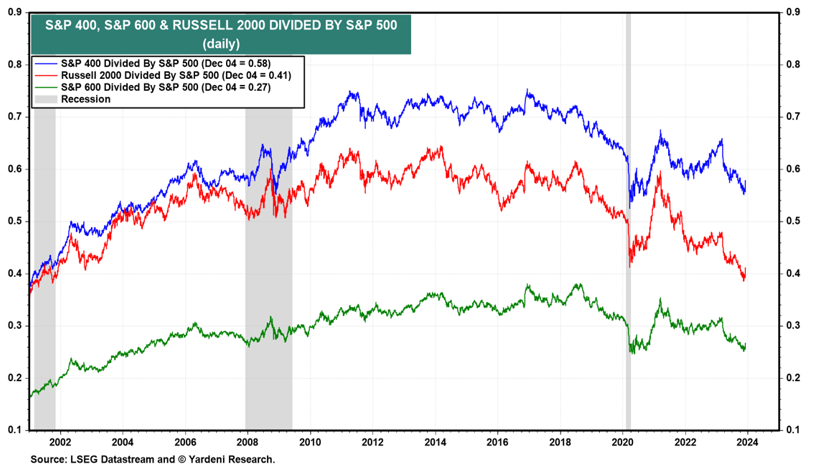

However, as we have stated in a previous commentary, it is well-known that this year’s good S&P 500 performance hides some bias, given that it’s just seven stocks (a.k.a. the Magnificent 7 – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) that have made all the difference in the index’s upswing this year due to AI enthusiasm. So, while the Magnificent 7 erased all the losses of 2022 (averaging 35%), the other 493 stocks in the S&P 500 have barely gained 2% this year. This, of course, creates a dualism and a significant conundrum for both investors and managers alike.

The above paragraphs represent the rear-view mirror. Looking forward, things look better.

If we had to choose any metric to correlate with the prospects of an economy, it would be the productivity growth rate. There is a good chance that the remainder of this decade will exhibit an upward trend in productivity gains (see figure below) which, in turn, can fuel a rally in equities, reduce costs – and consequently contribute to lower inflationary pressures and lower interest rates – while boosting fixed income securities as well. Having said that, the next couple of years might represent a transition towards that realization, and therefore, 2024 may turn out to be a bit challenging especially in its second half, as discussed below.

Having this background knowledge, the economic, financial, and geopolitical risks, the question at the heart of our preparations for 2024 is none other than: How do we then invest in such an environment?

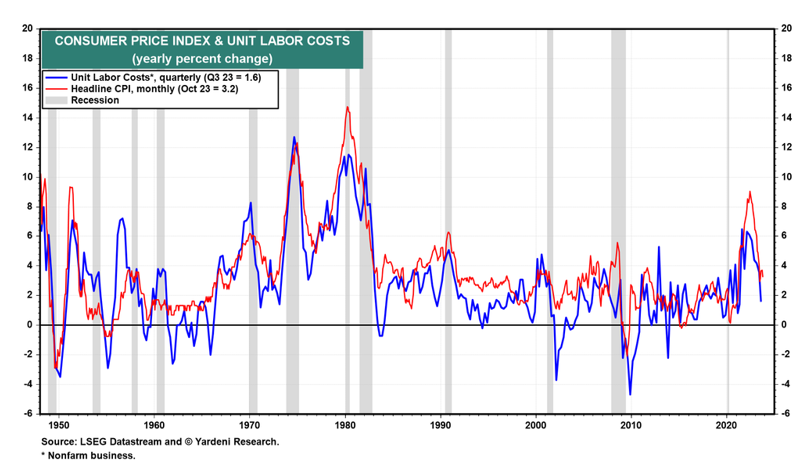

On the inflationary front (see figure below), the news is encouraging. Inflation has been cut by more 60% since the summer of 2022. However, elevated spending (above average given the stage of the business cycle) could make the efforts to lower the rate of inflation to around 2-2.5% a bit more difficult.

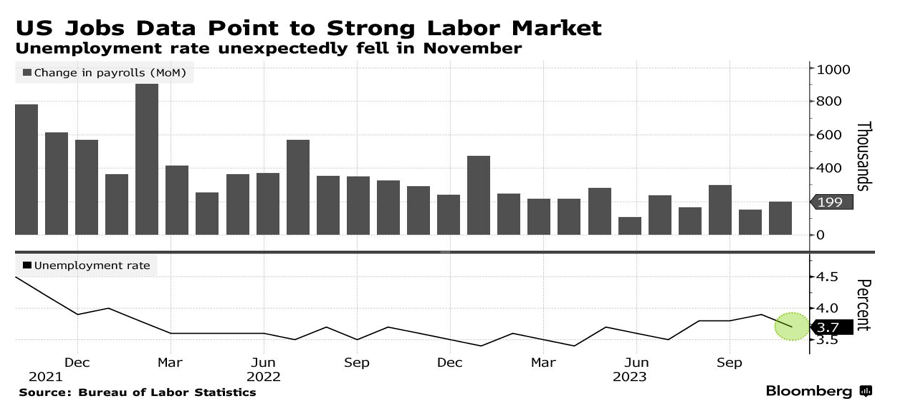

The employment front remains strong given the growth that the US economy is experiencing. As the figure below shows, the employment gains remain healthy, and as was reported last week, the wage gains also remain strong, both of which signify good economic prospects.

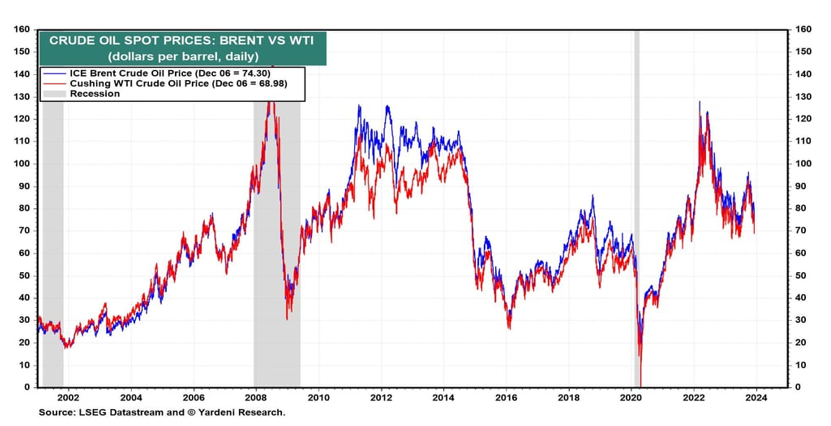

We expect US Treasuries to continue exhibiting good gains, therefore exposure to them should be considered as long-term rates are trending downward. The recent drop in oil prices will certainly provide price pressure relief but we are not certain that this will be lasting given demand and geopolitical/OPEC+ conditions. The energy sector may be hiding some unpleasant surprises for 2024.

The recession that almost everyone expected in 2023 never materialized. This is mainly due to government spending and excess savings that consumers and businesses accumulated during the Covid years. Thus, spending by all three (businesses, consumers, and government) has engineered strong growth so far this year. However, we believe that this may not be sustainable, and we won’t be surprised if the economy falls into recession in the second half of 2024. Having said that, we don’t expect the recession to be long-lasting or very deep.

We are of the opinion that there are four factors that may slow down the economy in 2024 (especially by the end of the second quarter of 2024), namely:

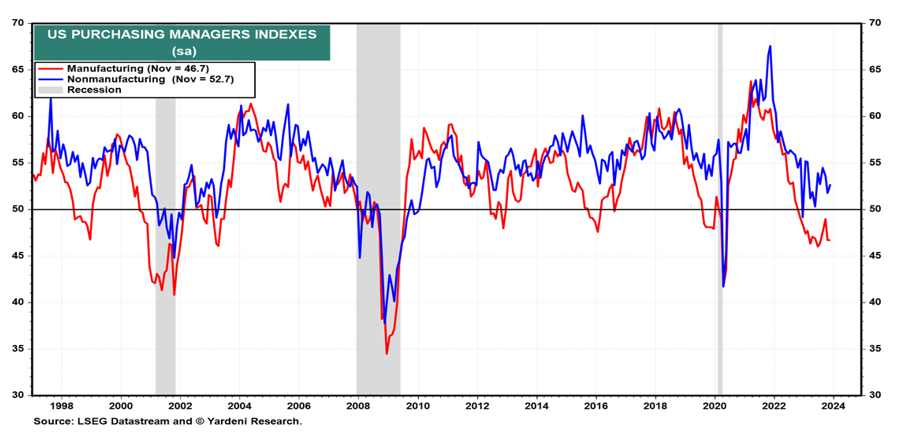

1. Reduced consumer spending and lower consumer confidence (softening of consumer demand is already happening) which, in turn, contribute to the slowdown in manufacturing and service activity, as shown below.

2. Reduced corporate spending due to lower business expectations, the first signs of which are already here.

3. Lower corporate earnings due to lower spending and an overall environment that points to restrained economic activity.

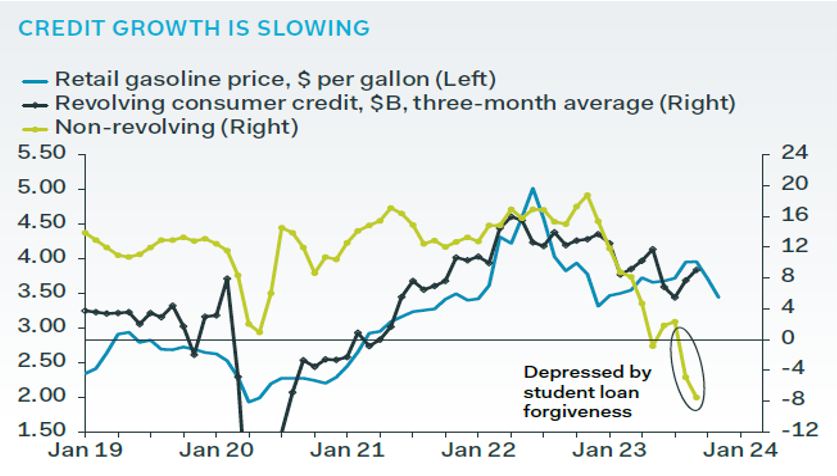

4. Credit and refinancing risks due to high interest rates. The signs are clear that credit growth is slowing down (see figure below) which should also contribute to an economic slowdown and a possible recession in the second half of 2024.

In the last few weeks, we have been observing that equities – those outside the group of the Magnificent 7 – have joined the upswing trend. The S&P 400 Mid Caps, the S&P 600 Small Caps, and the Russell 2000 Small Caps have been performing well (in some cases better than the S&P 500), as shown below. Expectations that the Fed may cut rates in 2024 have contributed to that upswing trend, and speaking of rate cuts, we believe that the ECB will start cutting rates by April and the Fed by June.

The expected rate cuts should boost the equity markets, however the headwinds of lower spending, lower GDP growth, and especially lower earnings growth (which should remain within the 9-12% margin) most probably will offset the potential gains from the rates’ cuts. It goes without saying that if recessionary clouds start gathering by the end of Q1, then equity exposure (especially to small caps) should be reduced, and greater allocation to bonds should take place (including greater duration). We expect commodities to fare better in 2024 due to higher demand and possibly due to a slightly weaker dollar.

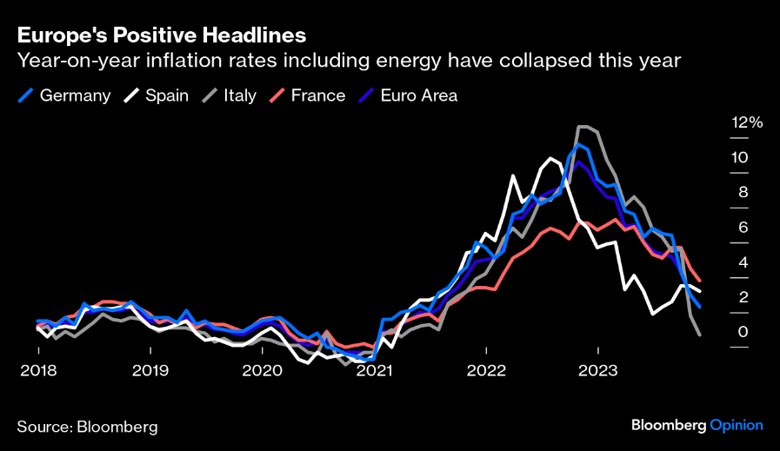

If we switch to view the picture outside the US, we can state a couple of definitive facts: The European economy is not in as good of shape as the US economy. Germany’s economy has stagnated (the EU’s locomotive), while several other EU economies are suffering from a growth deficit while inflationary pressures are subsiding, as seen below.

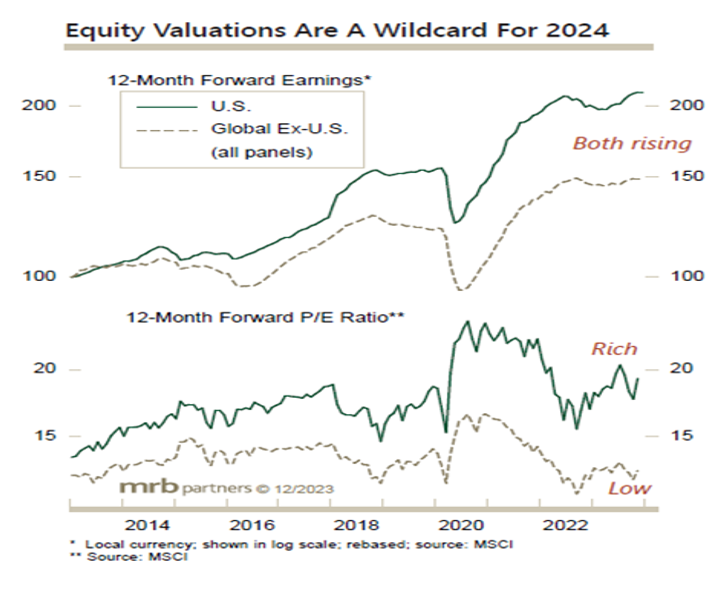

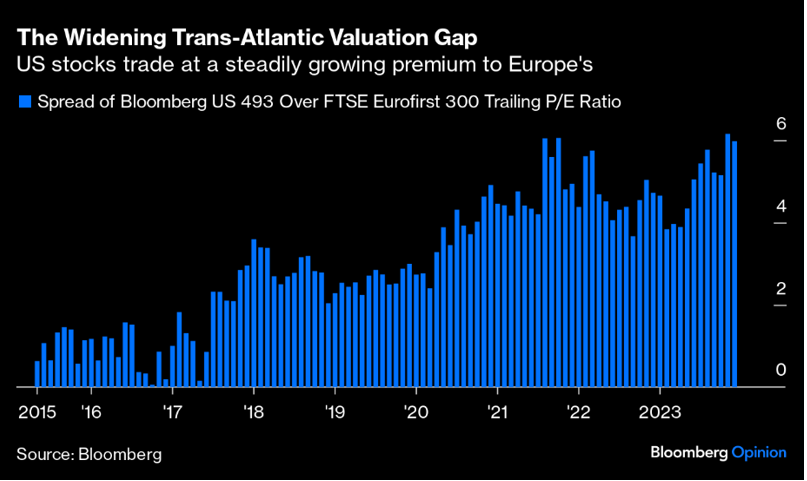

Having said that, we also understand that EU equity markets, from a valuation perspective, are more attractive than US markets. As we can see below, the EU equity indexes trade at about the same multiple as 5-6 years ago, making them relatively attractive to the US indexes.

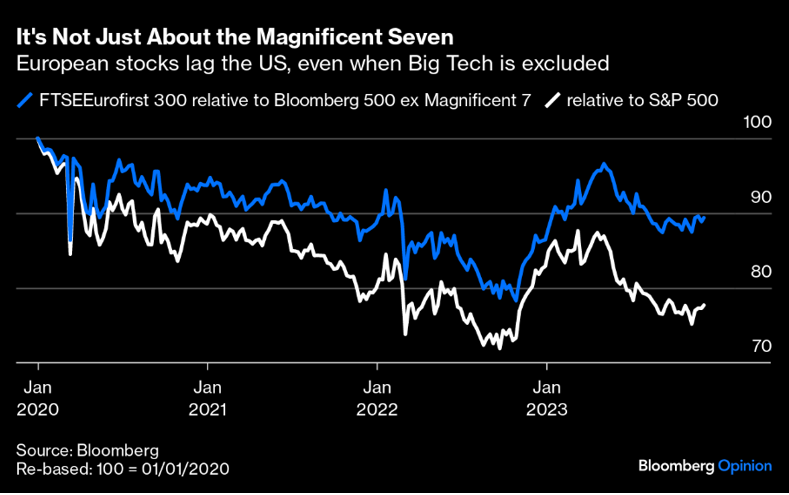

Even when we exclude tech stocks, European equities are cheaper as shown below.

The case for European exposure makes stronger sense when we take into account that the ECB will cut rates by at least 100 bps in 2024 (according to estimates including our own).

Staying within the theme of non-US exposure, we estimate that the Japanese economy will experience decent growth (relative to its recent past), and its market is expected to continue enjoying good returns, therefore some Japanese exposure – besides European exposure – could be considered.

Finally, the developing markets from Latin America to Asia continue exhibiting divergent patterns: In Latin America, we observe countries where a sense of failure dominates (like in Argentina), or where growth expectations are higher (like in Brazil where inflation is dropping, and commodity exports are rising). In Asia, we expect countries like Indonesia, the Philippines, India, Vietnam, and Malaysia to continue exhibiting strong growth, while China is sending mixed signals of slower growth during efforts to restart its economy. Speaking of China, and as the following figure portrays, its economy faces significant headwinds. The real estate sector will continue suffering, and given its vitality for China, the whole economy will continue facing headwinds, while its shadow banking system will continue undermining people’s wealth and prospects.

In conclusion, we would say that the second half of 2024 could represent the marking of a crossroad, especially if a surprise candidate wins the US presidential election. It could be the year when productivity gains could point the way to significant growth gains, but it could also be the year that will mark returns below average, and therefore the exercise of caution will be required by taking a rather conservative approach to capital deployment and asset allocation. The graph below reflects, rather accurately, our views.