We started assessing the outlook for 2020 a few weeks ago. The truth of the matter is that we are facing two almost equally probable scenarios: The first one (adopted by the great majority of analysts) says that growth will continue next year and that the equity markets’ returns will be decent (implying a total return of 6-8%) but not as good as 2019. After all, the argument is that in 2019 economic growth stayed around 2.5% and earnings were lower than 2018, but the equity markets’ performance was simply impressive. Of course, someone could argue that possibly up to 50% of the gains this year could be credited to correcting the bloodbath at the end of 2018.

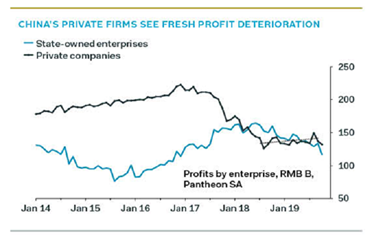

The second scenario is more skeptical of the 2020 outlook. The above-normal returns of 2019 may signal a reversion to the mean. In addition, signs of a global economic slowdown are still plentiful, the trade disputes may be inflamed again, Brexit issues are unresolved, Chinese slowdown (let alone private defaults) is evident almost everywhere, margins are being squeezed, a US Presidential election is looming, and long-term rates may continue rising, to name just a few concerns, all of which may put downward pressures on equity valuations.

As far as the debt markets are concerned, we are also facing two camps: The first one, claims that long-term rates (which are controlled by the bond markets and not the Fed) are going higher, implying possible capital losses for fixed income investments. The second camp, sees long-term rates going down, implying capital gains for fixed income holdings.

Both camps (for equities and bonds) seem to agree that non-US developed markets (mainly EU markets) as well as emerging markets will perform better than US markets, and they also seem to agree that the dollar will lose ground in 2020.

Let’s start then, with the latter. We tend to agree that non-US markets may perform a bit better than US markets in 2020, if not for anything else but for the flow of funds destined in the EU and emerging markets, but also as a reversal/balancing act to the 2019 performance.

Regarding the dollar, we also tend to subscribe to the view of slight (between 5-7%) downward pressure to the greenback due to the following reasons: (i) The Fed has declared that it is staying put in 2020 and the interest rate differentials have already been priced into the estimates, (ii) the flow of funds into non-US markets should uplift non-US currencies, and (iii) political upheaval in the US including the realization that deficit spending is undermining long-term growth.

Before endeavoring into the outlook for equities and fixed income, allow me please to add two things that may change the market dynamics after Q1 in 2020 and especially in Q4, and also touch on precious metals and commodities.

The two things that may change the dynamics in the second half of 2020 are higher volatility (mainly due to unmet expectations but also political turmoil), and unanticipated above-normal inflationary pressures by the end of 2020 which may force the Fed to raise rates in September and/or December 2020. Regarding the former, please see the graph below:

Regarding the potential inflationary pressures in the second half of 2020 (especially in Q4), we are of the humble opinion that the spending patterns (private and public) along with the trade disputes and the Fed’s dovish approach (with the last cut and the change in their watchfulness attitude) will finally put pressure on prices. If that were to happen, then the Fed will be forced to raise rates which will put downward pressure on equities and bond prices (Q4).

Our views about commodities, especially gold and oil, are as follows: Commodities in general should benefit from the combination of lower dollar and capital inflows into commodity-producing regions. Assuming that growth continues at least in Q1, oil prices will trade around current levels with a slight upward trend in Q1 and possibly into Q2.

Assuming a positive outlook at least for Q1, we expect gold to be range-bound between $1460-1515 (where trades will fluctuate between these support and resistance levels). However, as problems start appearing in Q2 and are built up in the second half of 2020, we expect gold and silver prices to rise, and would not be surprised if gold exceeds $1630 by year’s end, especially if unanticipated inflationary signals appear in the horizon.

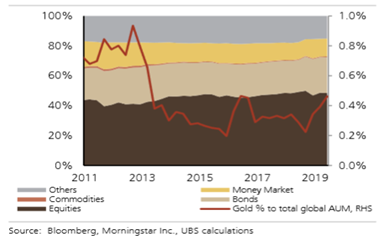

The trade-bound range prediction is supported by the Fed’s dovish approach and the expectation that a comprehensive trade deal with China won’t be reached. On the contrary, as trade tensions escalate in Q2 and the rest of 2020, and given that global positioning in gold is miniscule (see graph below where gold is less than 0.5% of AUM, representing mainly positions held by hedge funds and the public sector), we expect gold prices to start heading higher in Q3/Q4. Our position is that when asset managers, private banks, and retail investors start seeing problems in the second half of 2020, precious metals’ prices will experience an upswing.

Turning now to the equity markets, our views are as follows:

Overall, growth will be muted in 2020. Earnings expectations also will be muted in Q3. Growth in the first half will be sustained by spending, increased manufacturing/industrial activity, and higher lending. Equity markets (in both the US and the EU) are expected to perform decently in the first two-three months of 2020 (where consumer-oriented companies with strong brands and pricing power are expected to do better than others, along with some financial and industrial names; while EU companies with exposure to emerging markets are expected to outperform others), but problems will start knocking at the door by the end of Q2, mainly due to clear signs that a comprehensive deal with China cannot be accomplished in 2020.

Furthermore, rising political uncertainty in combination with downbeat earnings and expectations will force optimists to re-evaluate their assessments by the end of Q2 if not sooner. That leaves us cautious and pretty conservative for the second half of 2020, especially if our fears for lower earnings guidance along with higher volatility (Q3) and especially unanticipated inflationary pressures (Q4) materialize.

Under this scenario, we expect a widening of credit spreads in the second half of 2020 which will elevate risks. However, if central banks go on a round of QEs – expanding their balance sheets when problems start knocking at the door – our fear is that the enhanced monetary base will convert and become higher money supply at which point our fears for inflationary pressures by the end of Q4 may escalate. Finally, we expect that profit deterioration in China may exacerbate in the second half of 2020, which in turn will have global negative consequences (see graph below).

If the above assessment is close to be accurate, then (given that cuts in rates – which breed higher multiples – are not expected) our bias for 2020 is towards solid and value-oriented names that pay good dividends, and furthermore our preference will be for preferred stocks, especially if long-term rates remain below 2.15%. Needless to state that if rates take a turn below 1.60%, preferred stocks may turn out to be very attractive. Furthermore, our preference would be for low-beta holdings with strong fundamentals.

Let me close with our views regarding fixed income securities for 2020: As stated at the start of this extended commentary we are facing two distinct possibilities in 2020, namely rising rates (enforced by above-expectations economic performance in Q1/Q2) which may inflict some damage to fixed income securities; or lower rates (enforced by economic weakness greater than expected), which in turn may give rise to demand for yield as well as safe and quality assets. To that let me add that some exposure to the green bond index and/or high yield ESG (environmental, social & governance) high yield securities may be worthwhile.

Given the yields around the world (see graph below) and the fact that more than $12 trillion in bonds carry negative rates, higher-risk investors may seek some returns in senior loans, emerging markets sovereigns (at least for the first half of 2020) and/or in Asian high yield markets. Those returns could be enhanced if the greenback moves lower too.

Looking beyond the first half of 2020 the risks of a downturn may be felt especially by the more than half of investment-grade securities currently rated BBB. A good number of them may face downgrades and rising spreads in an environment of economic deterioration. If that were to happen credit markets may experience a shock that will force capital losses on fixed income securities.

Given our view of a decent Q1 with some problems rising in Q2 but deterioration of economic conditions in the second half of 2020, our position is that duration should be below 4.5, while our bias is for higher quality securities, shifting mainly to US Treasuries (again with bias to short and medium term Notes) by mid Q3.

Happy journey!