Homer taught us the contrasting qualities of leaders. Achilles was a man of action. Odysseus was a man of words. Both envisioned strategy from different perspectives. One represented strength. The other cunning. Later Machiavelli named those perspectives as force and guile. Strategic literature exemplified this polarity. Forceful subterfuge is vital in outsmarting tricky situations. Preference for force or guile is a temperamental disposition but is not strategy by itself.

The resourcefulness of Odysseus required an agile foresight capable of disorienting opposing forces (just recall the Trojan horse). The interesting thing is that Odysseus’s inscription also carried a warning sign to the Trojans: “Dedicate this thank-offering to Athena.” Athena after all was known for trickery, and that’s where Virgil and Dante failed in their harsh judgement of Odysseus (in their view heroes should be celebrated for their virtues and truth rather than opportunism and trickery; however Odysseus’ inscription confused and outwitted the Trojans because of its truthfulness).

When any strategy is deployed, it requires forceful subterfuge which is nothing but passionate strength as the expression of reason and perspicacity, which also carries sufficient pliability to accommodate the unexpected.

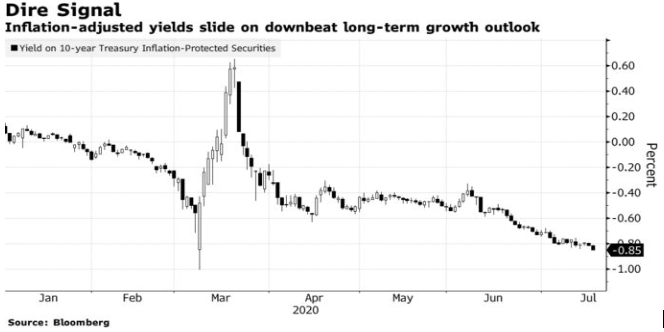

Nowadays, the bond market is sending us a different signal than the one received by the stock prices. The latter is holding well-above the lows we saw in March, while the former signifies trouble regarding the recovery. The real yield (that takes out inflation) on the 10-year Treasury is approaching negative 1%. Yields on TIPS could slide to negative 2%. The conclusion from such a trend is that growth will be sub-par.

In the meantime, inflationary expectations (a.k.a. breakeven rate) rose from 0.47% in March to over 1.40% in the last few days. The surge in gold prices reflects a triple element: financial repression in the era of zero and negative real rate, concern/fear of financial and economic turmoil, and demand for diversification/speculation.

The complacency seen (Achilles force) in the markets also reflects an inability to be cunning as risks are rising (after all Achilles died in Troy). Positive catalysts seem to have run their course (rabbits could always show up out of centralized powers hats; however, relying on such rabbits might not be a prudent strategy). Catalysts have been discounted and already incorporated into market expectations. As the seasonality of surprises is overtaken by the seasonality of the danger zone known of the August-October period, the forceful subterfuge strategy requires an abundance of cash, in order to exploit potential opportunities.

As volatility may be rising during that danger zone period (please recall that the VIX index has dropped from about 80 to around 26 nowadays), guile measures of exploiting its potential rise could be deployed, while international (non-Chinese) equities may become even more attractive.

As equity valuations decouple from underlying company and economy-wide fundamentals, investors should be resourceful and cunning in terms of a strategy whose forefront is the recovery value of their assets, especially when we contrast the force of investors’ optimism to corporate circumspection. The weak prospects raise the risks of debt repayments, especially in situations with limited cushions. Job losses are moving now to larger corporations. Delays in commercial real estate payments are being extended. More households defer credit payments. Restructuring debts are coming and that would also include emerging economies. A snowball of bad news could disrupt capital markets. Liquidity could be infused from exogeneous centers such as central banks, but demand for credit is endogenous and banks may be unable to channel such liquidity. Is that a coincidence that a number of funds are raising cash in hopes of a dual investment strategy where in one the cash will be used to buy solid companies once prices decline, and the other to engage in debt restructuring, collateralized lending, and rescue operations?

The rally of the last three months was driven by the force of liquidity. When such a force is deployed it distorts reality and corrupts reason in the same way that Thucydides complains that the exhibition of force corrupts language. Thucydides describes the breakdown in Corcyra and the bloody civil war between the democrats and the oligarchs. He describes the breakdown of the social order and relates it to the corruption of language. Recklessness became courage. Prudence became cowardice. Moderation became unmanly. An ability to see all sides of an equation, became indecisiveness. Violence became self-defense. As restraint collapsed, so did the possibility of sensible discourse or the ability to execute a strategy.