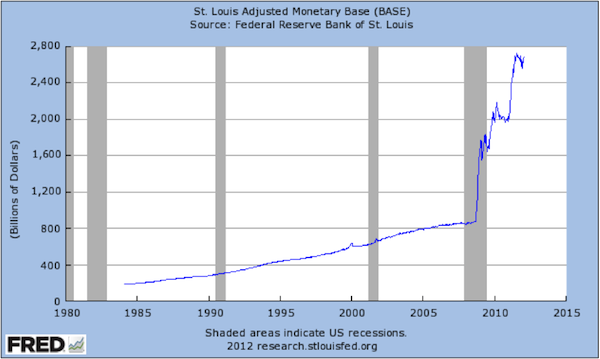

The argument of this commentary is as follows: The market experiences an upswing (which we anticipated and started commenting on December 21, 2011) due to two basic facts: First, the policies’ implemented needed time to work and hence the lag in growth, employment, and incomes. Second, the money multiplier is reversing course and has started moving higher, probably due to the fact that monetary reserves have started circulating and becoming credit extensions in the real economy. (We have published commentaries before stating that unless the latter happens, growth cannot be sustainable). Moreover, we are of the opinion that the Fed is undershooting its targets. Actually, it could not do anything else but undershoot the targets, otherwise it should have been on a course of raising rates, and hence contradict herself.

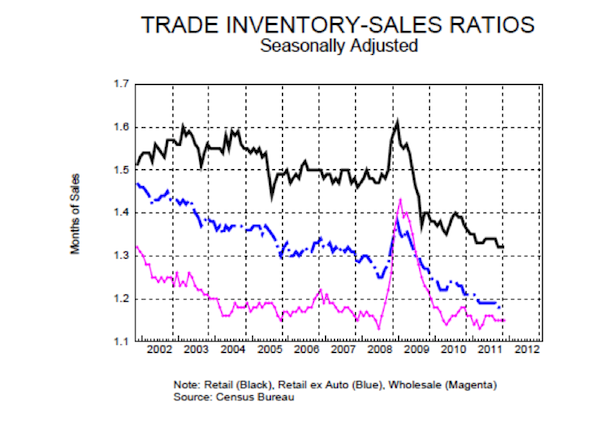

Let’s review some basic figures, starting with inventories-to-sales ratio. A time lag of one year is pretty normal given the abnormal financial shock of 2007-‘08. Given the downward trend presented below, the market is obtaining confidence which translates into higher production levels.

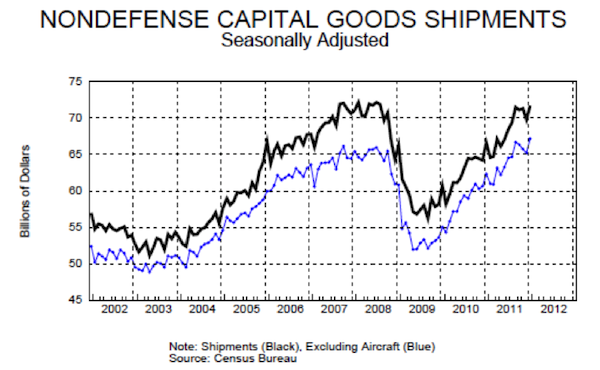

As production increases, shipments increase too (the two can be thought as mirror-images of each other), as the following figure shows.

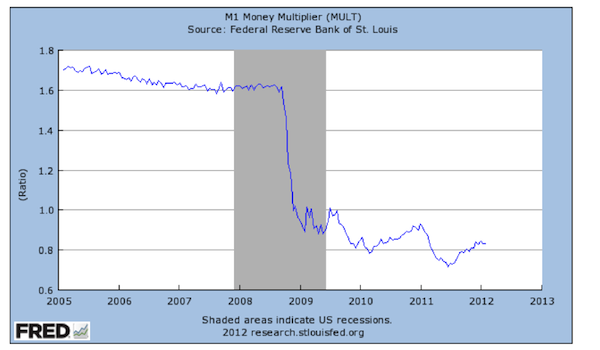

The higher levels of shipments create a feedback loop for production managers who in turn initially utilize overtime labor and later on hire workers, hence the lower unemployment rate. At the same time the confidence levels (purchasing managers, consumers, loan officers) rise, which allow the reversal in the money multiplier, translating into higher money supply from bank reserves. The figure below portrays this reversal of the money multiplier.

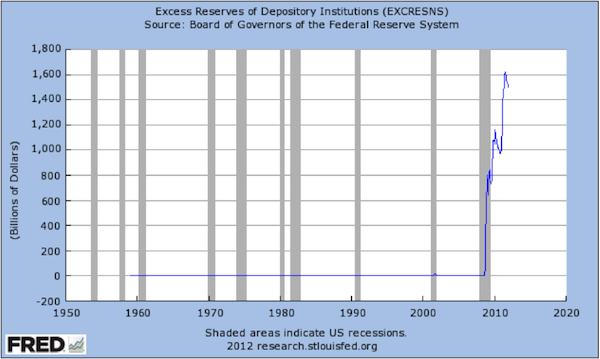

It is very crucial to emphasize this reversal. We have been stating for months now, that the Fed’s policy of quantitative easing and the various credit facilities had as main objective the recapitalization of the banks and the creation of a firewall for the possibility of another financial tsunami. The first graph below shows the accommodative policies of the Fed.

However, the higher reserves did not translate into higher lending (where the money multiplier would have increased) but rather to excess reserves while the money multiplier kept dropping.

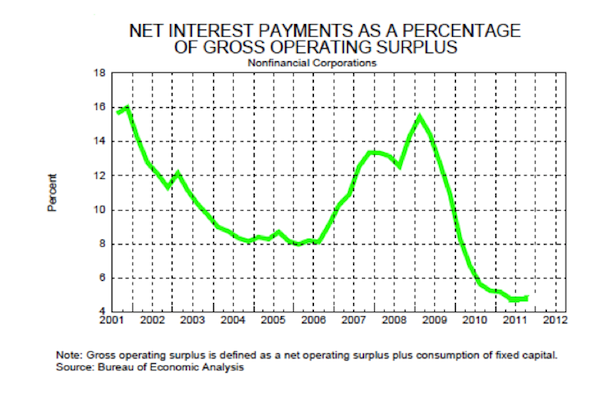

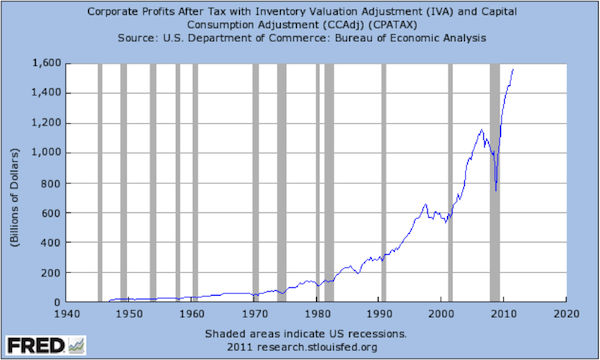

The reversal of the money multiplier coincides with the small decrease in excess reserves and with higher lending activity. If this trend continues –as anticipated – then, we are talking about a sustainable upswing in business activity that will take place at the same time as the net interest payments bottom out (see figure below), while profits continue their upswing trend boosting confidence and growth.

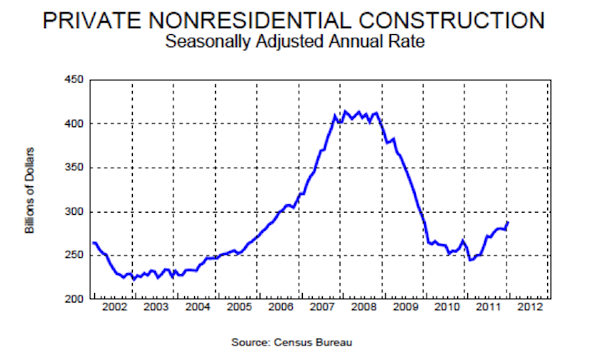

It should not then be a surprise that the private nonresidential construction starts picking up speed, which verifies the higher levels of business confidence, as the graph below demonstrates.

As the economy picks up speed, fixed capital investments accelerate which also promote growth, incomes, and jobs.

The pace of gross fixed capital formation (GFCF) – with its normal lag – is a fundamental difference of distinction between the US and the EU. In the latter, GFCF started again its declining trend, as the figure below shows.

We are of the opinion that the policy lags would not take place in Europe – and thus the EU will suffer from a recession – due to two facts: First, the ECB’s credit facilities are based on the swaps borrowed from the Fed, and hence while they temporarily boost EU-banks’ liquidity, those reserves won’t translate into money supply and credit extensions for the real EU economy. Second, the idiosyncratic risk in EU-banks balance sheets is such that do not allow re-capitalization through carry trade, and therefore part of their borrowings will seek safety in the US, which will further enhance the returns of US markets. (Let’s recall that the ECB did not extend those credit facilities to the EU banks until after the Fed agreed to extend swap lines with the ECB, so that the collapse – given the trillions of unsecured bonds they had circulated and which started maturing in the second half of 2011 – of the EU banks can be postponed).

The uncertainty of the Greek bond situation and of the new loan agreement may create additional shocks into the EU financial system that could have further negative effects in the real economies of the EU. Temporarily those uncertainties may shake US markets too, however these shocks should not last long and actually may become cornerstones of capital infusions.

The problem is that the banking system of major EU countries is shaky and is sustained by the cash infusion of ECB’s credit facilities which in turn is sustained by the Fed’s swaps lines.

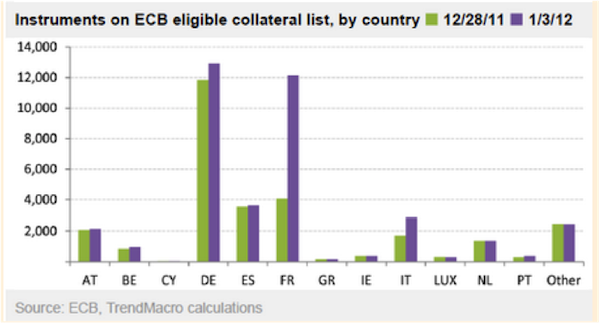

The figure above clearly shows the number of instruments pledged as collateral to the ECB for the life-saving liquidity provisions. French, German and Italian banks are the primary beneficiaries. The eyes might be on Greece and the risks of default there, but the problem may be elsewhere.

What is the real value of those instruments so recently pledged as collateral to the ECB?