The market turmoil last week persuaded some that a major correction is at work that will deflate the financial bubble. We would humbly disagree with that prediction. In our opinion there are five main reasons why the market blinked last week, namely: Uncertainty about Fed’s forthcoming policy of raising rates; the technical default by Argentina; some conspicuous earnings report; some kind of a catch up with geopolitical unfolding; and a rising employment cost index (ECI) that indicates that inflation might not be dead as some thought. As expected, the “fear index” a.k.a. volatility index jumped 27% last Thursday. In the following few paragraphs we will focus on the ECI, the macro-trends, and we will close with a couple of thoughts about Argentina.

In the previous weeks, markets seemed to defy the voices that called for correction and they also seemed to ignore some important geopolitical events, as expected. We could possibly say that markets caught up with the news last week and decided to take a recess. Such recess took place despite the strong GDP growth numbers which were weighted against some other news that dominated the headlines. Therefore, the market put on a grim face and decided that taking a break from its upward trend is the right move for the moment, because it was looking for a catalyst that would initiate a mini-correction.

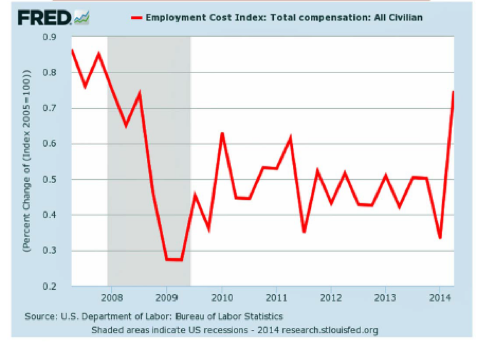

We view this temporary downtrend a moment of consolidation, breathing space, and recess that will be used to assess more accurately the positive news on GDP growth, employment report, and earnings capacity. One of the most positive signs for this assessment is the fact that the ECI – as shown below – has taken an upward turn (the strongest since 2008), which signifies that wage costs are rising. That turn of events may force the Fed to pause and rethink as to the timing of raising interest rates.

As we have pointed before from these commentaries, we are of the opinion that due to the fact that the monetary base has already start becoming money supply which in turn results in higher liquidity, the threat of deflation is exaggerated and we should not be surprised if inflation starts exceeding its 2% target next year (if not sooner), initiating a new upward trend for precious metals whose main competent would not be so much fear of inflation but rather investment demand and a security against paper promises.

We believe that the rising ECI is anything but noise, and along with the declining unemployment rate and the higher liquidity, it points to an unfolding reality where markets will be headed higher – even if Fed tightens sooner than expected – encouraged by higher economic activity, lending, confidence levels, and expectations. Therefore, we consider last week’s market turmoil noise that should not affect the general upward trend, because the forthcoming environment of rising rates will be accompanied by an environment of rising liquidity where the rate of return on capital and other investments will exceed the cost of capital by higher margins than today.

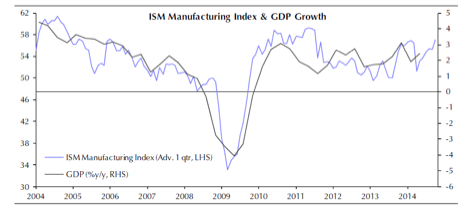

Our continuing positive view of the macro-trend that will support the markets’ upswing can also be seen in the ISM (Institute of Supply Management) Index below, which reached a three-year high in July.

Four out of five components in the ISM index rose which in turn signifies a widespread increase in manufacturing activity. Two of the components (forward-looking orders and employment) rose 7.6% and 10.22% respectively. All in all, such increases point to a GDP growth in the third quarter of over 3.3%, affirming the expectations outlined above.

Let’s close with two short thoughts regarding Argentina: First, we would rather focus on the fact that it triggered payment on CDSs (credit default swaps) which represent insurance against non-payment of bonds. In our opinion it is a prelude to what may be happening when the inverted credit pyramid – where the financial structure is based on paper derivatives – start shaking. The money is simply not there to support all debt claims and the notional amounts of the derivatives will become real claims that will undermine the whole financial world. As for Argentina and the rest of developing nations it points to an asymmetrical markets’ upswing where the fittest will become stronger.