Fact 1: In the early 1990s, if it were not for Europeans and the US, Germany would have had a pretty rough and bumpy ride towards its reunification. The direct and indirect funding provided by both sources made the difference for Germany.

Fact 2: To keep attracting the necessary funds for the reuninification, Germany kept interest rates high, caused significant tremors in the then European Monetary System, forced Europeans to tolerate high interest rates and a major recession, all for the sake of a dream (a.k.a. the United States of Europe) .

Fact 3: To keep the dream going, the rest of Europe accepted the measures that Germany pushed which to a large extent, contributed negatively to their competitiveness.

Fact 4: The German industrial machine – admirable by any measure – found good customers in the rest of Europe. German exports skyrocketed and to this day if it were not for the European markets, Germany could not enjoy the trade surpluses and the economic strength it enjoys nowadays.

Fact 5: In several cases German multinational companies succeeded in securing major government contracts outside Germany, by not the most admirable means– a.k.a. bribes and corruption (see e.g. the infamous Siemens case).

Fact 6: Profligate EU states enjoyed artificial prosperity bought on credit, forgetting the basic law of economics whish says that prosperity depends on the ability to produce rather than on the ability to consume.

Fact 7: German banks advanced the over-extension of credit and the game of musical chairs that was being played through the collateralization of paper “assets” and via the securitization of toxic assets. Some of them may not be able to meet strict capital criteria that are needed in order to avoid a banking meltdown.

Fact 8: While structural deficits (deficits that are not due to the downturn of the business cycle) constitute major source of concern, the Eurozone crisis is not caused only by those deficits. Actually, in its most recent manifestation in Ireland, it was the banking sector and the guarantees for the sake of rescuing the banking sector that brought the troika (International Monetary Fund, European Central Bank, and the European Commission) supervision/mandates into the picture. In the case of Portugal – whom the markets expect to be next shoe to fall – again, it is primarily an unhealthy banking sector that is the main cause of the tremors. As for Spain (whose need for a bailout – if it arises – would require a commitment of at least twice the combined bailout of Greece, Ireland, and Portugal). The main problem is again a banking sector that fed a housing frenzy. Moreover, Spain’s banks would face significant problems due to the loans they have provided to property owners who are under the water (their loans are higher than the value of the underlying assets) and who face unemployment rates of over 20%.

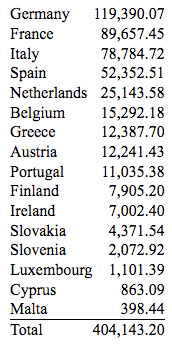

Fact 9: The EFSF (European Financial Stability Fund) would not be sufficient to face an escalating crisis. Its bylaws exclude from the provided guarantees the nations that have tapped into the fund. Assuming that Greece, Ireland, Portugal and Spain refrain from contributing due to the bailouts they will receive, the fund will shrink and would not be able to face possible crises in Italy, Belgium, and France.

The table above shows the sources of the funds (in millions of Euros). As it can be seen, Spain is a major contributor. However, if Italy and France were to start feeling pressure, then the EFSF would fall apart. Hence, the talk on Thanksgiving day, was that the European Commission suggested the doubling of the fund and of the implied guarantees. The problem is that the burden would fall on reluctant partners such as Germany, whose constitutional court is already examining the constitutionality of the German commitments/guarantees to the fund. If the court decides that the guarantees provided were unconstitutional, then the disintegration could take place within a few days. But even without such a challenge from Germany’s constitutional court, the markets could call the fund a bluff (to use the EU leaders terminology, they would consider the EFSF a water pistol rather than a real gun) when they analyze the insufficient numbers, and thus such disintegration of the Eurozone may become unavoidable.

Fact 10: At this stage we consider that three elements are missing: First, true EU leadership. A true leader is needed who will re-inspire confidence about the dream, will speak the truth about the commitments and the sacrifices needed, and will lead the efforts of restructuring the Eurozone. Second, the illusion that you can have a monetary union without a common fiscal policy needs to be abandoned and the fantasy/utopia of a union without proper federal tax structures needs to be addressed and solved. Third, due to over-extension of credit via debt/bond instruments, proper haircuts are needed if survival is desired.

In the 1940s there was a German pastor by the name of Dietrich Bonhoeffer. He was one of the very few pastors who opposed Hitler openly (actually participated in the plans to assassinate Hitler). If the Protestant churches and their congregations had listened to him, the bloody war would have been avoided, because the masses would have abandoned Hitler. Bonhoeffer wrote a book titled The Cost of Discipleship, where he exposed and challenged the believers to avoid the cheap grace, the cheap preaching, the cheap baptismal and the cheap faith. He called them to a costly commitment. The Eurozone needs a Bonhoeffer.

The Romans used to say Alea Iacta Est, and the Greeks ? ????? ???????. We are afraid that unless costly commitments are taken, the die will soon be cast.