Numbers reveal conceptual relationships. Price movements become powerful sources of inferential knowledge regarding changing historical conditions. The rhythms of price movements signify an historical inevitability as has been shown over the course of the millennia. In the dust of old civilizations archeologists have discovered large numbers of clay tablets and cylinders that reveal the price-series as early as the reign of Hammurabi (circa 1793-1750 B.C.). Price-series in general reveal four levels of abstraction.

First, they show us the cost of commodities. Secondly, they reveal the value of money. Thirdly, they become the source of study of historical movements (e.g. the effects of the Jacksonian movement, the social impact of the Civil War) and of the structures of exchanges (e.g. the effects of the industrial revolution). Lastly, price-series numbers contain the hints to the nature of changes to come. Inflation numbers are not merely seismographs. Inflation numbers do not simply record price movements. They are times when they become the cause of the symptom called reduced purchasing power and cheapening of the currency at a time of economic structural changes. The “change price-regimes” are dynamic in their nature, in the sense that they seem stable on the surface but abrupt structural changes signify a kink in their trend and trajectory. When those changes take place history alters course.

When one “price-change regime” yields to another (e.g. form the inflationary environment of the 1970s, to the disinflationary one of the 1980s and the 1990s, and from the latter to what some call today a deflationary period) the boundaries of our economic understanding need to expand and encompass demographic, social, geopolitical, collateral-assets, and technological forces. For example the disinflationary era of the 1980s and of the 1990s saw fertility rates going down, the collapse of communism, the end of apartheid, the emergency of the computer age, the re-emergence of globalization, and the development of paper assets whose re-hypothecation became the powerful engine of debt accumulation (among others). The combination of all these forces planted the seeds of asset-price inflation in the equities markets which evolved into the tech bubble, the real estate bubble, and the overall credit boom.

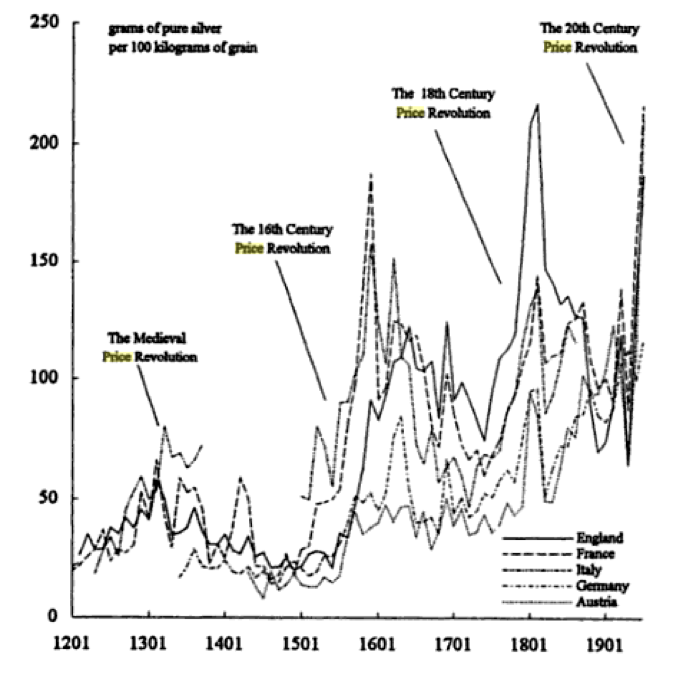

Failing to understand the underlying price waves could be fatal. In a nirvana state (where we may be entering) the wave-riders begin thinking that they are wave-makers. The Japanese call such convoluted thinking shoribyo, the Israelis היבריס (chutzpah), and the Greeks call it hubris. Most inflationary episodes over the last eight centuries have taken place in four waves. The first wave is known as the medieval price revolution. It lasted from the end of the 12th century to the early beginnings of the 14th century. The second started in the mid 15th century and lasted till mid 17th century. The third wave reached its climax during the French Revolution and the Napoleonic Wars (18th century). The last wave was the price-change regime of the 20th century.

During those price waves an equilibrium seem to be achieved on the surface which is followed by fluctuations on a fixed plane. Such equilibrium took place during the climax of the medieval civilization. Another one took place during the Renaissance period (1400-1480). The third wave coincides with the Enlightenment period (1660-1730). The fourth coincided with the reign of Queen Victoria. Complex price fluctuations took place during those periods; however none observed a long-term inflation. Those price waves have been studied and documented in many studies (Simiand, Abel, Griziotti, Phelps-Brown-Hopkins, etc.). The Abel price wave series (1201-1960 A.D.) can be seen below.

Price waves cannot be understood outside their historical context. While explanations could range from Malthusian, to monetarists, to Marxists, to Austrians, and from agrarians, to neoclassical and Keynesian, the “price-change regime” has a historical ad hoc element in it that cannot be captured by models. Let’s call it the fulfillment of time element of historical inevitability given structural changes in the economy and the society.

As hinted earlier “price-change regimes” are linked to profound events in human history (the renaissance, the reformation era, and the enlightenment period). It is my belief that we are entering such a profound period again when a new wave is being formed (waves are variable while cycles are closed predictable events). The signs for that could become evident by the end of 2014. However, the causes again can be found in a variety of factors from lack of political vision and leadership especially in the west, to the Middle East new wave of fragmentation, to new technologies and energy sources, to the emergence of frontier markets, and from new trade deals to the repos of collateral as well as the introduction of new collateral, markets, and ideas that could advance the devolution of what we think is normal. The current state of affairs is either the prelude to a new birth of a “price-change regime” necessitated by the fulfillment of time, or the requiem for an era that will end with a chimera monstrous crisis that will be the mother of all crises.

Speaking of the fulfillment of time and in the spirit of the days, allow me to close with some thoughts that came to my mind as I was drafting the above and listening to Handel’s Messiah. Handel was commissioned on August 22nd, 1741 to compose an oratorio. On September 14th of that same year he completed his composition. At some point during that period, in just 24 hours he wrote 260 pages of music. In those three weeks he never left his home. He described his inspiration by quoting St. Paul “Whether I was in the body or out of it when I wrote it, I know not”. The premier performance was on April 13th, 1742 and the proceeds were used to free 142 persons from debtor’s prison. Handel’s last performance of the Messiah was on April 6th, 1759. During that he fainted at the organ and died eight days later.

Handel’s inspiration came from the fact that there is always a chance for a rebirth as long as the yoke of oppression is abolished and broken. In Handel’s Messiah we have the shattering of the long-standing categories of weak victims and strong heroes, for here and in the forming wave the victim emerges as the hero. That’s the magic of a humble manger.

Merry Christmas!