We are of the opinion that the output gap in the US by the end of the year will range between 2.5-3.5%. However, for the European Union (EU), we expect the output gap to be higher than that. Such an assessment implies elevated unemployment rates for both the U3 and the U6 rate, at a time when relative prices will continue experiencing major dislocations and wages will continue being pressured downwards.

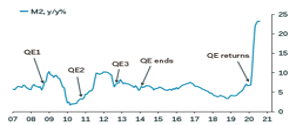

The growth in money supply (see first figure below) around the world has introduced a shock in the market which, along with fiscal measures, has allowed the economies to cushion the pandemic’s damage. However, the second figure below signifies that the slowdown in lending may be a prelude to the recovery’s slowdown which, in turn, may push the brakes in anticipated growth both in the fourth quarter as well as in the first quarter of 2021.

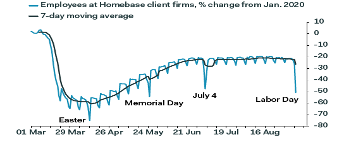

Moreover, when we review payroll data from small businesses, we discover that the data indicate declining payroll numbers which in turn support the thesis of a slower than expected Q4 growth. Keeping in mind that the only certainty about a forecast is that it will be wrong, we would dare to say that the Q4 growth rate may be less than half of the Q3 expected growth rate.

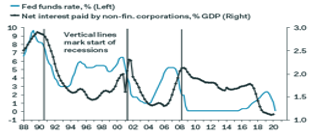

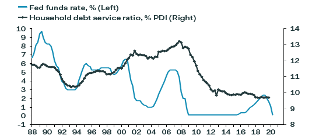

Having said that, and while acknowledging a runup in corporate debt and the suppression of wages (which discourages spending), we should also emphasize that the corporate debt service load for corporations is at historical low levels (which permits expansion), and that the same thing is happening with households’ debt service ratio, as shown below.

Based on the above assessment, and assuming that the central banks will continue capitulating, we would not be surprised if equity prices experience another upswing by year’s end.