One of my favorite authors is Isaiah Berlin. I consider his anthology of essays by the title “The Proper Study of Mankind” as one of the finest books published in the 20th century. Isaiah Berlin had a notorious ideological conflict with Isaac Deutscher. Their public disagreements were rancorous, each one defending his position with passion (Berlin the classical Anglo-American liberalism, and Deutscher the Marxist interpretation of history). I believe that the bond market a.k.a. as the largest liabilities market on planet earth is facing a similar conflicting situation over the course of the next one-two years.

Here are a few reasons why this may be the case:

- As the Fed tapers, the expectation was that bond prices will decline (due to lack of demand by the Fed) and thus yields will rise.

- As the economy improves, funds are directed more towards equities rather than bonds, which in turn put upward pressures on yields.

- As institutional investors face those pressures, they may revert to bond sales, which also pressures yields to higher levels.

I believe however that the situation may not turn out to be as expected, i.e. experience an environment of constantly rising yields. Rather, I believe that yields will be going sideways for the foreseeable future, and may even decline just a little bit. Let’s review some of the reasons why this may be the case:

- As the Fed tapers, funds are repatriated, and some are directed toward the bond market, which in turn push bond prices higher and yields lower.

- The reverse repos by the Fed, increase the amount of “good collateral” (e.g. government bonds) which starts the cycle of re-hypothecation. As the cycle expands, the demand for bonds increase, and thus yields would drop.

- The expanded collateral base (see point above) becomes the basis for higher and bigger credit facilities, which translate to higher money supply. As money supply expands, rates drops.

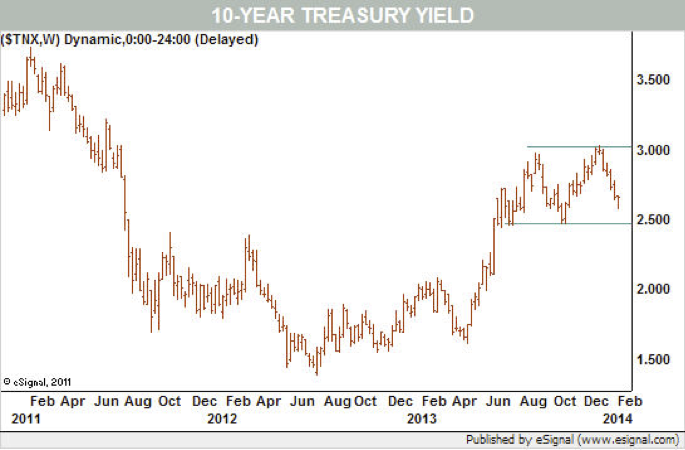

Empirically speaking, we saw that yields and interest rates dropped in the last two weeks. It seems then, that we are positioned for counter-balancing forces in the bond/liabilities market. As technical analysts would tell us (e.g. Michael Kahn’s article in Barron’s this week), signs are that a triangle (double-top) pattern is being formed in the 30-Year, 10-Year, and even 2-Year Treasury Bonds/Notes. As the triangle develops (see graph below), yields tend to be pushed lower.

It is my anticipation then that the bond market may exhibit signs of going sideways which would allow the Treasury to keep financing the debt at low rates. That in turn will feed the demand for loans, and therefore will keep bumping fuel to the economy. One more reason then, to start wondering if inflationary signs start making their appearance by year’s end.