We are at the hinge of a new era where we are supposed to choose between a reality of tyranny and illiberalism dominated by kleptocrats, and an age of democratic institutional renewal that was the cornerstone of growth and prosperity in the last seventy years.

Hannah Arendt wrote in 1963 that “No cause is left but the most ancient of all…the cause of freedom versus tyranny.” To that we could add that truth still matters, and manufactured reality through lies and deceptions simply undermines the moral fabric of a civilization. The fact is that Buzz Windrip (the authoritarian ruler in Sinclair Lewis novel “It Can’t Happen Here”) is alive and well nowadays in a number of countries. The modern Windrip is aiming for one thing: to make Marx’s ideal into reality (i.e. melt into air anything that is solid). While the EU is trying to advance and hold on to the traditional values of classical liberalism, the US is retreating from such values; this bifurcation cannot last long before it erupts. Its spillover will usher economic and financial troubles.

The economic foundation of the 21st century is still shaky given that debt is at its core. The financial crisis ten years ago was the outcome of such a shaky foundation. Since then, while some measures in the right direction were taken, we kept expanding on debt-fueled growth rather than productivity gains. Thus, while we have reduced the amount of toxic assets and strengthened to some extent – but certainly not as much as we should – rules and the balance sheets of financial institutions, the unprecedented amounts of debt, and unfunded liabilities keep undermining long-term prospects.

In the markets nowadays we observe a bifurcated reality, as shown below:

The equity markets are at record highs while the riskier part of the bond market keeps losing ground since September. The lowest-rated bonds have spreads between 700 and 1000 basis points over safer bonds. Rising spreads spell trouble down the road. Moreover, more corporates are being downgraded than upgraded these days. In addition, cracks are emerging in the leveraged debt markets. The latter will create refinancing problems. Lack of access to capital, will result in more downgrades in the BBB market which may force liquidations. We are of the opinion that this bifurcation is not sustainable.

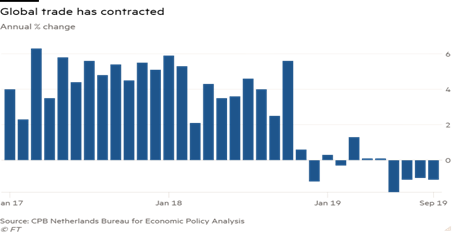

The trade deal front/hope (between the US and China) seems to be the main driver of equity gains. However, in the international trade markets we also observe a bifurcated reality, as shown below.

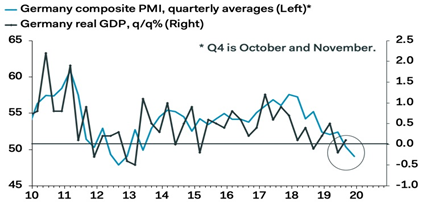

The latest data show that world trade contracted sharply. This is the fourth consecutive month of global trade decline and represents the worst record since the 2009 crisis. Bilateral trade between the US and China has been contracting at double digits since last year. The loss of trade momentum introduces an element of policy uncertainty and bifurcation for business investments and the global supply chain. Industrial production indices in Asia show marginal/negligible increases, while developed nations’ indices point to either stagnation or decline. Such industrial bifurcation could be seen in the EU’s locomotive i.e. in Germany’s data. While Germany barely avoided a recession by recording a marginal GDP growth, its manufacturing index remains depressed as shown below.

As I am looking into these bifurcations at a time when analysts are preparing their 2020 assessments, I am wondering if Virgil’s vision in the “Aeneid” of an eternal city (Rome) dominating all others simply met its demise in Milton’s “Paradise Lost”.

As I am looking into these bifurcations at a time when analysts are preparing their 2020 assessments, I am wondering if Virgil’s vision in the “Aeneid” of an eternal city (Rome) dominating all others simply met its demise in Milton’s “Paradise Lost”.

Happy Thanksgiving!