In the first part of this two-part series, we outlined four possible scenarios that make up Mr. Uncertainty. Antigone stood up to Creon which represented the epitome of self-destruction not just for him and his family but for the whole kingdom of Thebes. Antigone’s story was used as the basis for discussing investment safe havens in the midst of uncertainties. Antigone represents traditional values and norms whose defiance is the crown jewel of delusions.

When delusion prevails (especially by the reproduction of illusions through fiscal and monetary profligacy and via projects’ collateralization which, in turn, will be rehypothecated), a spirit of radical greed (Homer’s pleonexia) permeates the workings of the economy. At such critical junctures, Nemesis should be expected. Nemesis was the gods’ inescapable answer to hubris, to restore equilibrium. The debates about artificial intelligence (AI) could be considered an extension of the same issue. AI enables anyone to become Prometheus and steal the fire from the gods. If that were the case, Nemesis could become an endemic threat, and we could end up forming realities that provoke doom.

In this commentary, we will discuss the historical record of the last 50+ years (i.e. in the post-Bretton Woods era) of hard assets (gold) vs. paper assets (equities and bonds). So, before we endeavor further, let’s review the historical record of the ratio between gold prices and the S&P 500 index. We consider the ratio a barometer of uncertainty, and a good guide to asset allocation.

A rising gold-to-S&P 500 ratio signifies rising uncertainty. On the contrary, a declining ratio portrays confidence in the companies’ trajectory of profits. The inverse of the ratio could also point out bubbles in paper assets (like the dot com bubble in the late 1990s/early 2000s), which in our framework of analysis symbolizes pleonexia/hubris, an environment of delusions, and the coming of the Nemesis (see graph below).

The bursting of the dot com bubble brought back gold whose price peaked in the early 2010s. Quantitative easing and the reproduction of illusions (Creon’s policies as described in the previous commentary) throughout the 2010s lowered the gold/S&P 500 ratio and provided a liftoff to the ratio, as shown above. The rising uncertainties that the global economy is facing have pushed gold prices higher this year while, at the same time, paper assets are gaining ground. Someone may claim that the current level is a mirror image of the mid-to-late 1990s. This may be deceiving for two main reasons (without downgrading other important differences):

- First, the market concentration and oligopolization of the economy (along with its twin sister, rising inequalities), was not as high as it is now. Never in our timeframe were we facing a situation where the top 10 companies’ share in the S&P 500 index had reached the current record of 35%. Even worse is the fact that 54% of the S&P 500’s gains this year are concentrated in just four stocks (NVDA, MSFT, AMZN, META)!

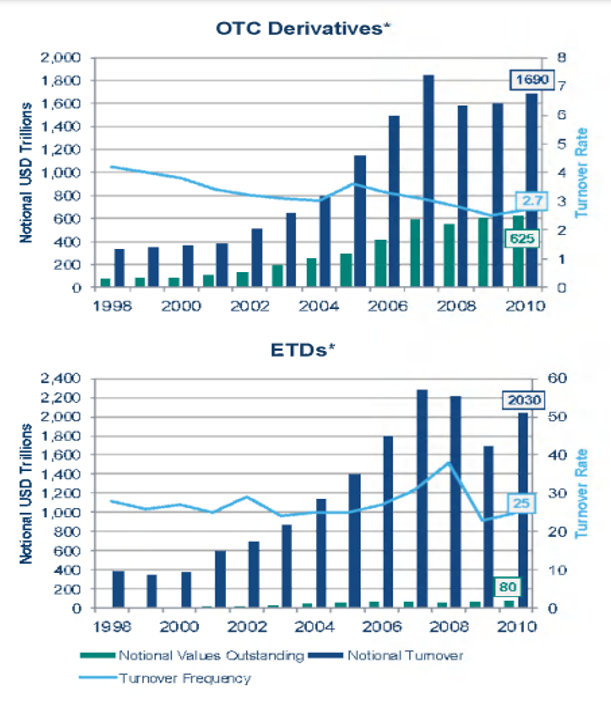

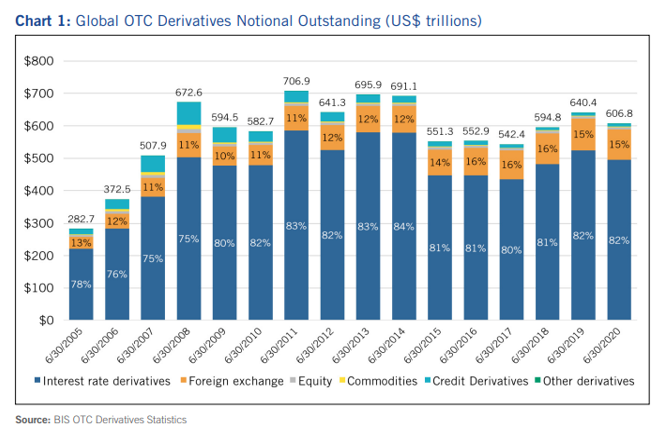

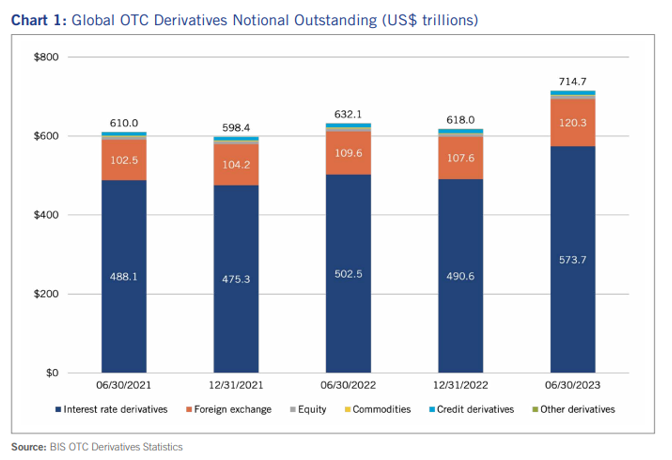

- The second difference is that the derivatives market (the cause and epicenter of the GFC in 2007-’09) was in its infancy, as shown below. However, as is also shown below, this market increased exponentially in the early 2000s, creating illusions of growth that ended up becoming national and global delusions.

The unwillingness to address such a serious and dangerous delusion endangers the whole system for a hard reset (see previous commentary) because, in a major crisis, those notional amounts become real liabilities that need to be paid or the system collapses. This unfortunate development reminds me of the Chilean poet Vicente Huidobro’s words about alternatives not chosen and which can be found in “those hours which have lost their clock.”

The bride of Acheron (Antigone) doesn’t want to see tears,

“No one to weep for me my friend, no wedding song”

because she knows that Nemesis will soon be visiting Creon. Indeed, soon thereafter, Creon cries out when faced with the suicide of his son (which he caused) whom he carries in his hands (his son Haemon was Antigone’s fiancé):

“Ohhh, so senseless, so insane…my crimes, my stubborn deadly—-

Look at us, the killer, the killed, father and son, the same blood—the misery!

My plans, my mad fanatic heart, my son cutoff so young!

Ai, dead, lost to the world, not through your stupidity, no, my own.”

And immediately after that, he is told:

“Master, what a hoard of grief you have, and you ‘ll have more.

The grief that lies to hand you ‘ve brought yourself…

The queen is dead…Oh no, another, a second loss to break the heart…

I just held my son in my arms and now, look,

A new corpse rising before my eyes…”

In our era, we live by the expectations of illusions hoping to become our delusionary saviors. Expectations are based on beliefs of instruments and tools (in our case derivatives) and the naïve acceptance of socially and economically constructed certitudes. However, when we are facing uncertainties, one should live by hope which, in turn, is based on historically rooted experiences. The nature of profligacy is such that it has even turned utilitarianism on its head. Instead of utilitarianism being pursued as an attempt to give the most good to the largest number of people, the crisis that reset the system in the 1970s transformed utilitarianism to mean the least pain for the largest number of people. With the advancement of derivatives, utilitarianism does not mean the greatest good or the least pain, but the greatest pain management for the species.

The pattern that gold is forming (see second graph above) may indicate market complacency due to high concentration (an unstainable aberration), which may further imply rising gold prices due to rising uncertainties.

The Continental Congress of 1774 and the American Revolution that followed in 1776 served as the inspiration and the precursors/stimulators of the age of revolutions that swept France (political revolution) and England (industrial revolution) between 1774 and 1849. In those seventy-five years, the world changed forever. Was it a smooth transition where power was fairly distributed? We cannot say so, as the world ended up being dominated by a few powers (especially the British). Age-old civilizations collapsed. India became a province administered by British pro-consuls, the Islamic states were convulsed by crises, Africa became a field of open conquest, and the Chinese Empire was forced to comply to western desires. Could the oligopolization of the market by just a handful of companies follow that historical pattern?

We better not forget Nemesis: Within 20 years of that super period between 1774 and 1849, the signs of reversal were evident and a few years later, the expansion will turn into contraction. The period that started with the radical American experiment and continued with the French Revolution of 1789, while it saw a few years later the construction of the first modern factory system in Lancashire and the construction of its first railway network, will give witness to the drafting of the Communist Manifesto in 1848 and within 70 years another reset will bring to the forefront another superpower via world and empires’ catastrophe.

While canoeing down the river of Acheron, I saw Antigone waving a flag that had the name of Nemesis written on it.